Cathie Wood’s ARK Innovation ETF (ARKK) has become a major barometer for growth stock investors. It’s also a great place to start for trading ideas (both long and short).

That’s because Wood’s popularity, along with a quickly expanding army of new retail traders, has led to a lot of activity around the stocks that ARKK is invested in.

Wood has a reputation for being able to pick out companies whose innovation will disrupt the way we do business, the way we travel, the way we digest entertainment, and really the way we live!

Her optimistic view of the future can be contagious. Which is why for a time, every stock she publicly added to her ARKK fund seemed to shoot higher right away.

Individual investors would enthusiastically jump into any stock that was added to the ARKK roster. If the stock was good enough for Cathie Wood, it was good enough for the average investor!

During last year’s coronavirus lockdowns, millions of people stuck at home opened brokerage accounts and started trying their hand at investing. Buying positions included in the ARKK ETF seemed like a great logical step for many of them.

And all of this retail buying pressure helped to push stock prices higher — ultimately leading ARKK to quadruple in price in less than a year!

This kind of excitement can turn into a self-fulfilling prophecy. New investors met with immediate success become even more confident. And confidence naturally leads these investors to contribute more capital, take bigger positions, and convince friends and family to come along for the ride!

Unfortunately, this type of enthusiasm typically doesn’t end well. And today, it looks like we’re in the early innings of unwinding some of the excesses from this ARKK excitement.

A Wave of Selling Could Sink ARKK

The enthusiasm of individual investors buying the same stocks included in the ARKK portfolio has led to high stock prices and some eye-popping valuations for some of the innovative companies.

Cathie Wood and her followers have been largely “price insensitive” when buying — meaning they’ll pay any price to get shares of these companies.

When I’ve voiced concern about companies with no profits — and no foreseeable profits — trading with market caps in the tens of billions, I get the same answer.

The ARKK fund is committed to these names long-term. And so they have no intention of selling no matter how high the stock prices go. (That argument is supposed to make us feel better because if ARKK isn’t selling maybe the stocks can continue to trade at sky-high valuations.)

The problem here is that Wood and her team at ARKK may not have a choice when it comes to selling these stocks. And if ARKK begins selling shares of stocks that currently trade for absurd prices (compared to their earnings), the decline for some shares could be severe.

Take a look at the daily chart for ARKK below. Notice how the ETF price is trending lower and ask yourself — “would I be comfortable holding this fund?“

As a former hedge fund manager, I can tell there are times when fund managers simply don’t have a choice. They have to sell shares of their favorite stocks because investors are pulling money out of the fund!

That’s exactly what appears to be happening… According to ETF.com, investors have pulled $1.9 billion out of the fund this quarter. With a couple of big distribution days in the past week!

When investors pull money out of a fund, managers are forced to sell. This is the only legitimate way to free up cash to pay the investors who are getting out of the fund.

And by selling shares to pay investors, ARKK is putting pressure on these stocks leading to lower performance, more investor concern, and additional waves of investors pulling money out.

It’s another self-fulfilling prophecy! And this time, fear is driving the ship instead of greed.

Digging Through ARKK For Potential Trades

As ARKK begins to take on water, I’ve started watching the top stocks held by the fund closely.

These names could come under significant pressure if forced selling at ARKK triggers a new wave of fear for retail investors.

Keep in mind, just because we’re concerned about a selloff doesn’t necessarily mean these are “bad stocks” — and it doesn’t even mean that the shares will necessarily trade lower.

But it’s important to understand that a selloff in ARKK — especially if combined with investors pulling capital out of the fund — will certainly add pressure to these names.

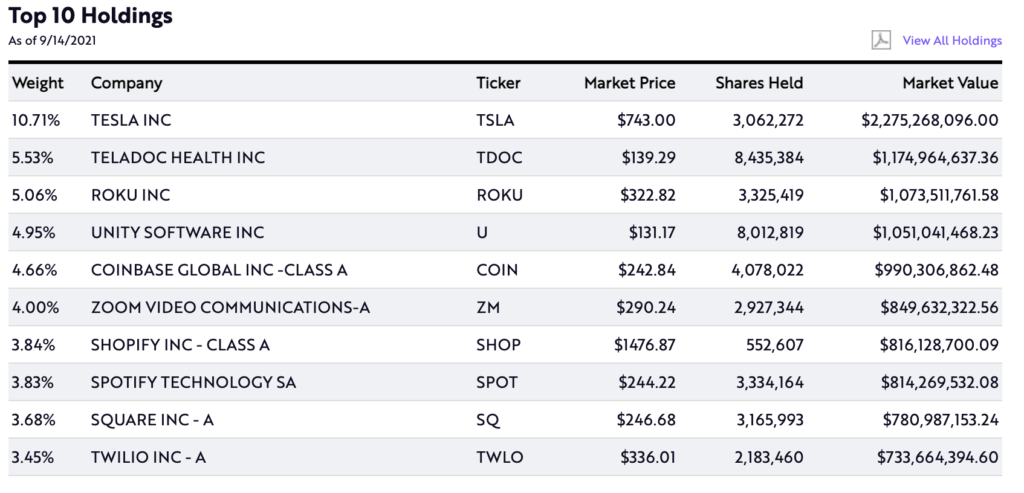

Here’s a quick snapshot of ARKK’s ten biggest positions.

You can view the fund’s entire portfolio here.

Over the next few days, we’ll take a closer look at each of these top-ten stocks to see what kind of opportunities we can find.

Some stock may be good candidates for buying put contracts. If the stocks trade sharply lower put contracts will naturally trade higher. This is one way to make a profit from stocks you expect to fall.

Other stocks may be good candidates to buy on a dip. After all, if Cathie Wood has a position, there’s probably a very good technology or innovation worth investing in at some point.

Finally, some stocks may be in the “too hard bucket.” It’s important to realize that you don’t need to have an opinion on every stock. Being selective with your trades and only entering situations where you have a high level of confidence is a great way to improve your overall results in the market.

I’ll be back with you soon to start picking through the ARKK holdings and building a plan for this developing situation.