The stock market ended the third quarter on a sour note. The Dow dropped 547 points, the S&P 500 fell 52 points and the Nasdaq was off 64.

Of course, one day does not a market make. And there are still plenty of reasons to be bullish (and plenty of areas of great stocks to choose from).

Still, the declines over the last few weeks have started to rattle investors.

And given the distance the most recent bull market has covered — and the months and months of peaceful action — we could be in for a turbulent fourth quarter!

Just take a look at the S&P 500 after Thursday’s selloff. With short-term support levels broken, the overall “market” could trade lower for some time! (I use quotation marks because as a market index trades lower, there are still plenty of stocks moving higher.)

Most amateur traders dislike a falling market. And volatility can frighten even seasoned veterans.

But volatile markets actually create better Income opportunities for investors. (And no, I’m not just talking about the chance to buy stocks at cheaper prices.)

There’s an option strategy I use in my own account to collect income from shares of my favorite stocks. I actually run a trading service for St. Paul Research showing people how to use this strategy… It’s called Income on Demand.

And while you can use this strategy any time to collect income from the market, volatile market periods actually give you more income.

The Advantage of Puts When Stocks Pull Back

The income strategy that I use is called “selling cash-secured puts.”

And while it may sound complicated at first, it’s very easy to do, and can be a very safe way to grow your wealth (especially in today’s market environment).

Here’s how it works.

We start with option contracts called “puts.”

A put is a contract that trades on an exchange just like a share of stock. When you buy a put contract, you’re buying the right to sell shares of stock at a specific price — and for a specific length of time.

There are different put contracts for most popular stocks. Each contract represent 100 shares. And for each stock, there are dozens of put contracts that can give you the right to sell shares at different prices — or for different time periods.

It’s easy to see how owning a put contract can help during a market pullback. If you have the right to sell shares of a stock at $100, and that stock drops to $80 — that right will be worth at least $20 per share.

Often traders will pay more than $20 for this contract, because there’s a possibility the stock will fall even farther.

Selling Put Contracts to Collect Income

Now, if you think about the other side of this trade you’ll see where the income can come into play.

My strategy is to sell a put contract for a stock that I would be willing to buy at a lower price. So for that $80 stock, I might sell a $75 put contract.

This would give someone else the right to sell me their shares at $75 (below where the stock is trading right now). And that other trader is paying me for their right to sell at $75.

It may sound weird to sell something that I don’t have…

But if you think about options as “contracts” — or agreements between traders — it makes more sense.

It’s more accurate to say that I’m “writing” a put contract, and another trader is paying me for my willingness to buy shares at a discount.

Writing put contracts is a great way to collect income right now for an agreement you enter… And then potentially buy shares later at a price that you’ve already agreed on.

And here’s where it gets exciting…

When markets pull back, put contracts get more expensive. And since our strategy is build around selling these contracts, we’re getting paid more for every transaction!

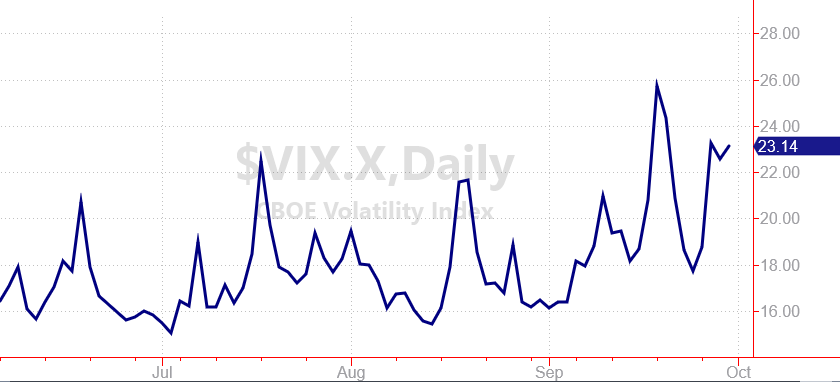

Take a look at the chart below… It’s called the CBOE Volatility Index — but it’s better known as Wall Street’s “fear index“

Traders also call it “The VIX” referring to the VIX ticker. (It’s pronounced “Vicks”)

Technically, the VIX measures how expensive option contracts are — which helps us know how much traders are willing to pay for the protection that put contracts offer.

See how the VIX has spiked higher this month as the market pulled back?

That spike is telling us that more income is available from this strategy right now because of the fear on Wall Street.

So if you’ve got your eye on a few stocks that have been going on sale recently, you might want to try selling put contracts instead of buying the shares outright. That way, you can collect income up front, and you might be able to buy shares a little cheaper if the stock falls below the agreed upon price!