Selling WYNN puts for income.

WYNN moved lower this week alongside other travel and leisure names. But the stock is trading right where it found support in September and has held well above Wednesday’s low.

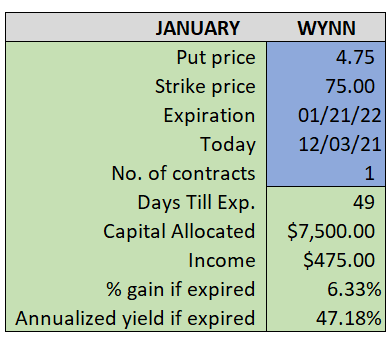

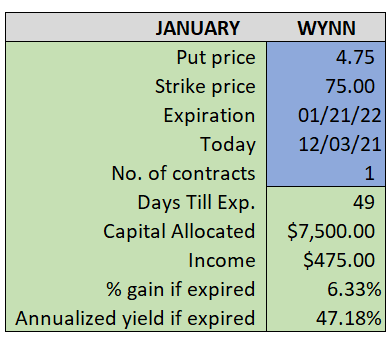

Thanks to higher levels of fear in the market, we’re able to collect income that gives us more than 45% of potential annualized yield, while still using a put contract that gives us roughly $5.00 per share of cushion between the current market price and our strike price.

- Sell (to open) 1 WYNN January 21st $75 put

- Limit: $4.75 or more

- The new position will represent roughly 8.1% of our model.

~~~~~~~~~~ - 15:47 Executed

- Sold 1 WYNN Jan 21st $75 Put @ $4.95