Selling ZG puts for income.

Zillow Group has pulled back sharply after the company announced an exit from its home buying business.

On Friday while the rest of the market was under pressure, ZG actually rebounded. Investors were encouraged to hear the company’s exit would be less expensive than feared. Meanwhile the company’s overall web-information business should continue to grow in a hot residential real estate market.

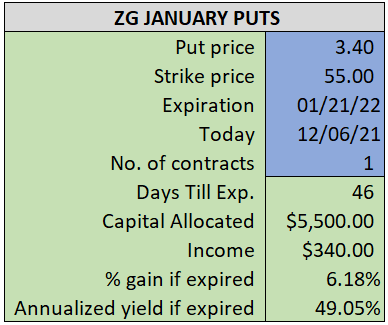

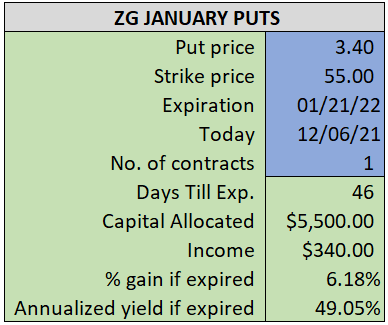

Thanks to higher volatility in the market, we’re able to collect income that gives us roughly 49% in potential annualized yield, while still using a put contract that gives us more than $4.00 per share of cushion between the current market price and our strike price.

- Sell (to open) 1 ZG January 21st $55 put

- Limit: $3.40 or more

- The new position will represent roughly 5.9% of our model.

~~~~~~~~~~ - 11:31 Executed

- Sold 1 ZG Jan 21st $55 put @ $3.40