Selling TTD puts for income.

The Trade Desk (TTD) provides a tech platform that helps businesses purchase ads and manage advertising campaigns. In the post-coronavirus environment with many new businesses looking for ways to grow their customer base, TTD is providing a valuable service.

The stock pulled back alongside the broad market weakness over the past few days. But this pullback brings TTD back to a key support are following the stock’s breakout last month.

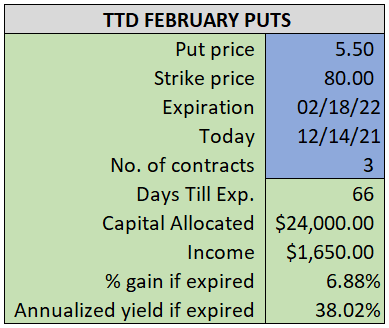

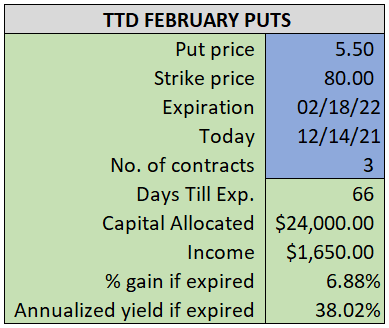

By selling the February $80 puts near $5.50, we’re able to collect an annualized yield near 38% while also giving us roughly $8.50 per share in cushion between the current market price for TTD and our strike price.

- Sell (to open) 1 TTD February 18th $80 put

- Limit: $5.50 or more

- The new position will represent roughly 8.6%% of our model.

~~~~~~~ - 15:33 Executed

- Sold 1 TTD Feb 18th $80 Put @ $5.50