Selling GOOS puts and COHU puts for income.

Canada Goose (GOOS) is a Canadian apparel company known for its goose down jackets. The stock moved lower in recent weeks following pressure from China’s version of the FTC. China claims GOOS is discriminating against Chinese customers with its return policy.

At this point, it looks like GOOS has addressed China’s concerns. Meanwhile, the company generates growing profits around the world and the global reopening should continue this trend.

COHU is an American tech company in the semiconductor space. The company makes computer chip testing equipment which will be in high demand as supply chain problems are fixed and the semiconductor industry ramps back up.

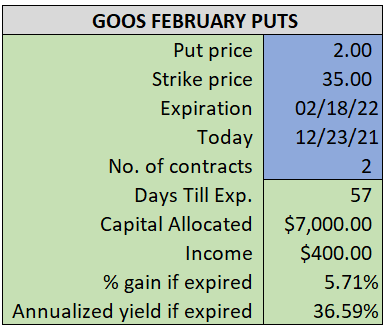

By selling the GOOS February $35 puts near $2.00, we’re able to collect an annualized yield near 36% while also giving us roughly $2.00 per share in cushion between the current market price for GOOS and our strike price.

- Sell (to open) 2 GOOS February 18th $35 puts

- Limit: $2.00 or more

- The new position will represent roughly 7.4% of our model.

~~~~~~~~~ - 14:02 Executed

- Sold 2 GOOS Feb 18th $35 puts @ $2.10

ALSO

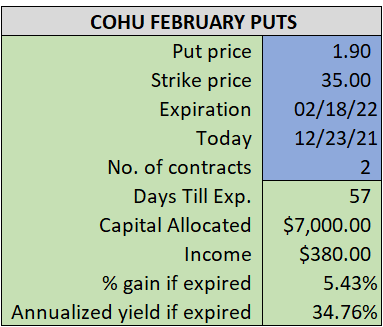

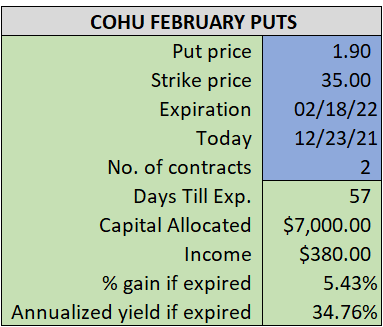

By selling the COHU February $35 puts near $1.90, we’re able to collect an annualized yield near 35% while also giving us roughly $3.00 per share in cushion between the current market price for COHU and our strike price.

- Sell (to open) 2 COHU February 18th $35 puts

- Limit $1.90 or more

- The new position will represent roughly 7.4% of our model.

~~~~~~~ - 14:43 still no fill. We’ll leave the order in for the day.

- I’d rather not “chase” this income play and change our price.

- If no fill today, we can circle back to the trade next week.

~~~~~~~ - 15:03 Executed

- Sold 2 COHU Feb 18th $35 puts @ $1.90