Selling CLR puts for income.

A slight pullback for energy stocks gives us an opportunity to collect income from a profitable U.S. oil and gas company Continental Resources (CLR).

The broad economic recovery is driving demand for oil and gas. And political tensions surrounding Russia’s potential invasion of Ukraine could drive oil prices well over $100 per barrel.

Higher prices allow companies like CLR to generate more profit selling the oil and gas they produce.

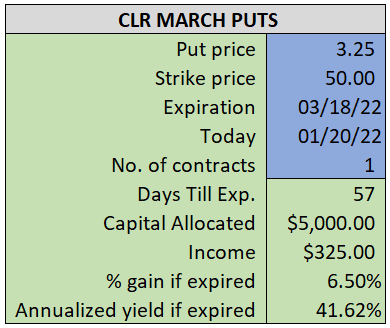

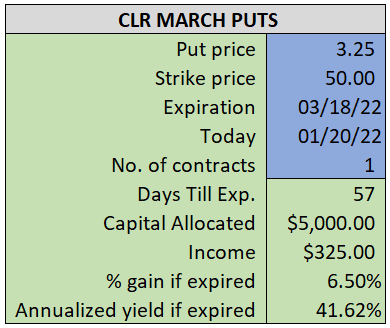

By selling the March $50 puts near $3.25, we’re able to collect an annualized yield near 42%, while also giving us roughly $2.00 per share in cushion between the current market price for CLR and our strike price.

- Sell (to open) 1 CLR March 18th $50 put*

- Limit: $3.25 or more

- The new position will represent roughly 5.0% of our model.

~~~~~~~~~ - 10:09 Executed

- Sold 1 CLR March 18th $50 Put* @ $3.50

*An earlier version of this alert had the wrong strike price (the income table pictured had the correct strike price).