With all the volatility in today’s market, it’s easy to overlook the fact that we’re entering the heart of earnings season.

Today, I want to share three value stocks to buy in this choppy market. And I’d suggest picking up shares before each company’s earnings announcement.

The market action has been difficult for all investors this past week.

Originally, it was the high-priced growth stocks under pressure. In many cases, those stocks deserved to trade lower.

But as fear spread through the market, even the good stocks started selling off.

That may be frustrating for existing investors. But it’s a great opportunity if you’ve got cash on the sidelines to invest.

(Incidentally, that’s one of the reasons I love income investment strategies. Because you’re always getting extra cash to invest when opportunities arise.)

Now that investors have started throwing out the baby with the bathwater, let’s take a look at three value stocks you can buy at a discount starting next week.

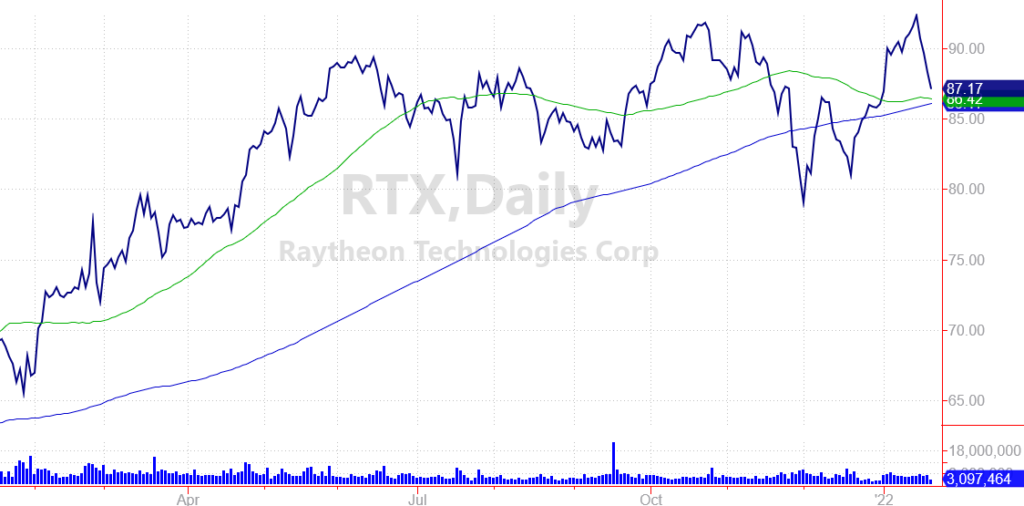

Raytheon’s Pullback is a Buying Opportunity

Our first value stock to buy is Raytheon Technologies Corp. (RTX).

This aerospace and defense company has a broad line of products and services ranging from general aviation to missile defense systems and even space exploration.

Being spread across so many different areas of the economy helps to give the company a more diversified and reliable revenue stream. It also gives RTX exposure to the many growing areas of the economy as the world gets back to normal following the covid pandemic.

Raytheon will report earnings on Tuesday January 25.

Wall Street analysts are expecting earnings of $1.02 per share from $17.3 billion in sales. More importantly, investors expect RTX to generate $4.97 per share in profits this year followed by 20% growth in 2023.

So at a price near $87, shares are trading for 17.5 times next year’s expected earnings. That’s a great value compared to where many other profitable companies are trading right now.

Investors will be interested to hear what management has to say about orders, deliveries and even supply chain issues. All of these factors will affect the company’s future profits.

Prior to this week’s pullback, RTX was trading very near 52-week highs. Even after the market’s selloff, RTX is still within striking distance of its all-time high. A positive earnings report could send this value stock through that level very quickly.

FCX: One of My Favorite Value Stocks to Buy

As the world recovers from the pandemic, governments around the world are kicking off new infrastructure projects.

These projects have proven to be effective ways to restart entire economies because they create better employment opportunities, typically make countries more efficient, and lead to a better long-term business climate.

With demand for construction materials picking up, Freeport McMoRan (FCX) is a natural beneficiary. The company is known for its copper mining operations around the world, and also produces other industrial metals and minerals.

Rising inflation helps to boost the prices FCX can charge, adding another benefit to an already strong and timely business.

The company is slated to report earnings on the morning of Wednesday, January 26. Investors expect profits of $0.91 per share.

FCX should earn $3.52 in 2022. If management tells investors to expect higher profits for the year ahead, shares of FCX could ramp higher.

In the meantime, the stock trades near $41, which means investors are paying about 11.6 times expected earnings for the year ahead. That’s a very reasonable price and helps to shield FCX from some of the selling that has pushed more growth-oriented stocks lower this week.

I expect shares to find support above $40 and for the stock’s bullish trend to continue throughout 2022.

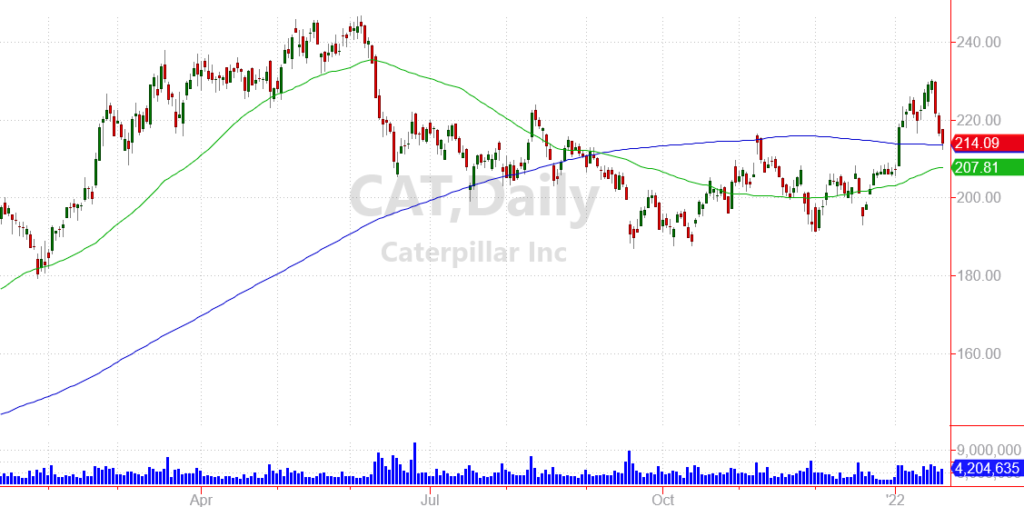

Value Stock Caterpillar Rounds Out the Week

At the end of next week, Caterpillar Inc. (CAT) is set to report results.

Much like FCX, Caterpillar benefits from global trend of spending on infrastructure. With construction projects popping up around the world, CAT’s business is very strong.

Investors need to hear how CAT is dealing with inflation and supply chain challenges. But if the company convinces Wall Street that these factors are under control, we could see shares quickly surge to a new 2022 high.

Prior to this week’s pullback, CAT had been one of the strongest stocks in this young year. Even after this week, the stock is still up on the year which is encouraging given the circumstances.

CAT should earn $12.38 per share in 2022, followed by 23% profit growth in 2023. That’s a tremendous level of growth for a company with a market cap over $115 billion.

Shares are trading for just over 17 times expected profits for this year. That’s a very reasonable price and should make the stock very attractive to value hunters once the current market selloff is over.

Picking up value plays in today’s market is a great way to boost your wealth in 2022. And this week’s selloff creates a perfect buying opportunity for the market’s most profitable companies.