Selling ANF puts for income.

Abercrombie & Fitch (ANF) is trading higher as supply chain concerns start to alleviate and the global economy reopens.

Consumers are flush with cash after stimulus payments and thanks to rising housing and financial markets.

The company is expected to earn $4.00 per share this year. So at a current price near $41.75, shares trade for roughly 10.5 times expected earnings. That’s an attractive value which makes ANF a stock institutional investors will likely gravitate towards.

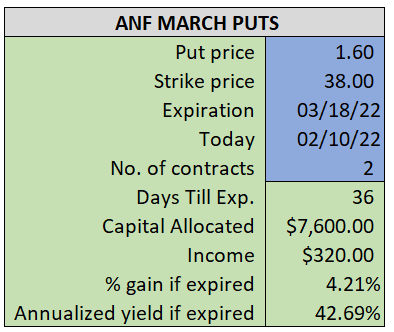

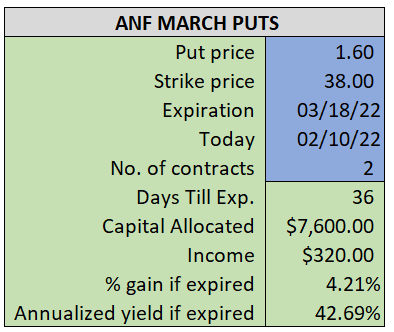

By selling the March $38 puts near $1.60, we’re able to collect an annualized yield near 43%, while also giving us roughly $3.75 per share in cushion between the current market price for ANF and our strike price.

- Sell (to open) 2 ANF March 18th $38 puts

- Limit: $1.60 or more

- The new position will represent roughly 7.7% of our model.

~~~~~~~ - 11:42 Executed

- Sold 2 ANF March 18th $38 Puts @ $1.65