Selling DAL puts and MU puts for income.

Delta Airlines (DAL) will benefit from a pickup in airline traffic. In particular, the resumption of international and business travel has the potential to drive shares sharply higher.

Micron Tech (MU) is a computer chip stock we’ve used in the past for our income plays. The stock is trading at a deep value compared to expected earnings, and shares have been holding up well despite weakness in the overall tech industry.

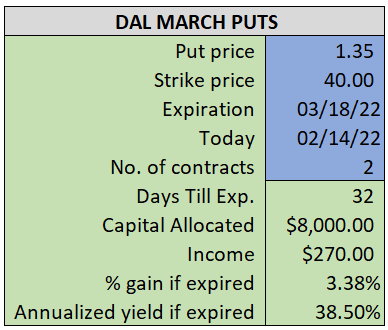

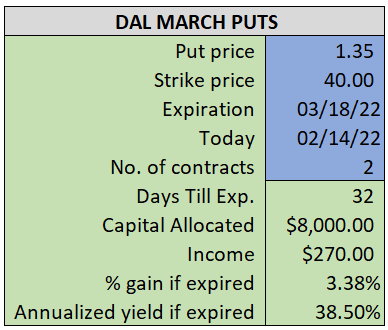

By selling the DAL March $40 puts near $1.35, we’re able to collect an annualized yield near 38%, while also giving us roughly $2.00 per share in cushion between the current market price for DAL and our strike price.

- Sell (to open) 2 DAL March 18th $40 puts

- Limit: $1.35 or more

- The new position will represent roughly 8.2% of our model.

~~~~~~~~ - 14:59 Executed

- Sold 2 DAL March 18th $40 Puts @ $1.35

.

ALSO

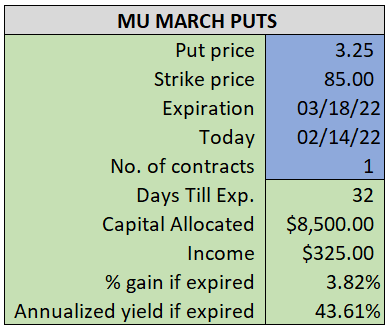

By selling the MU March $85 puts near $3.25, we’re able to collect an annualized yield near 44%, while also giving us roughly $4.00 per share in cushion between the current market price for MU and our strike price.

- Sell (to open) 1 MU March 18th $85 put

- Limit: $3.25 or more

- The new position will represent roughly 8.6% of our model.

~~~~~~~~ - 15:00 Executed

- Sold 1 MU March $18th $85 put @ $3.32