Selling BROS puts for income.

Dutch Bros (BROS) is a coffee chain growing in popularity in the Pacific Northwest.

U.S. consumers have strong balance sheets and “meeting for coffee” is becoming much more popular as the economy reopens from the pandemic.

BROS is growing quickly and catching the attention of investors. And while the stock is expensive compared to near-term profits, that growth could continue for a long time.

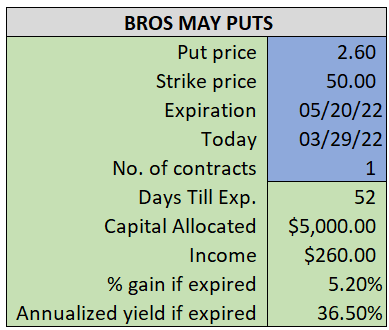

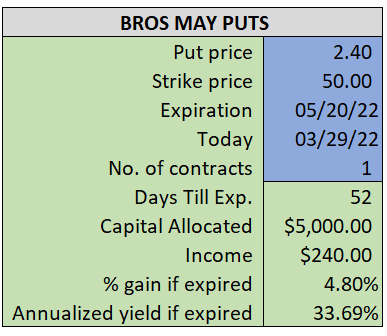

By selling the May $50 puts near $2.40, we’re able to collect an annualized yield near 34%, while also giving us roughly $13 per share in cushion between the current market price for BROS and our strike price.

- Sell (to open) 1 BROS May 20th $50 puts

- Limit: $2.40 or more

- The new position will represent roughly 5.1% of our model.

~~~~~~~ - 15:14 Executed

- Sold 1 BROS May 20th $50 Put @ $2.50