Selling BTU puts for income.

Peabody Energy (BTU) is one of the largest coal mining companies helping to supply the world with fuel for electricity and also for steel manufacturing.

While coal has a bad name for its environmental effect, technology advances have helped to reduce emissions and make coal-fired plants much more efficient.

In today’s world where many countries face a crisis shortage of natural gas and other energy alternatives, coal will continue to be an important part of the global energy mix.

BTU has been trading higher alongside other energy investments. But the stock is still extremely cheap compared to expected earnings.

Meanwhile, thanks to uncertainty surrounding the entire energy complex, we’re able to get an attractive amount of income while still leaving plenty of room in case the stock pulls back.

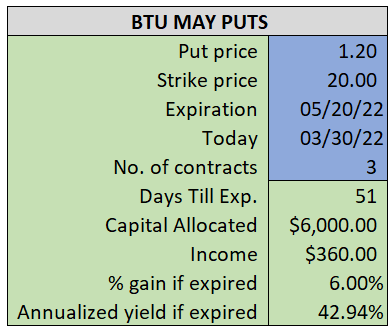

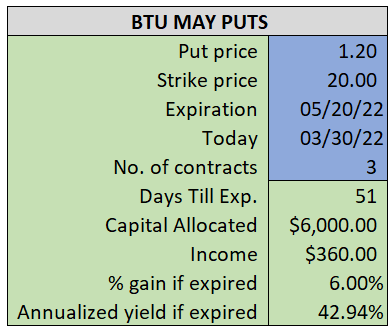

By selling the May $20 puts near $1.20, we’re able to collect an annualized yield near 43%, while also giving us roughly $4.70 per share in cushion between the current market price for BTU and our strike price.

- Sell (to open) 3 BTU May 20th $20 puts

- Limit: $1.20 or more

- The new position will represent roughly 6.1% of our model.

~~~~~~~ - 12:53 Executed

- Sold 3 BTU May 20th $20 Puts @ $1.35