Selling APA puts and AU puts for income.

As inflation continues, we’re in a bull market for commodities. This inflation benefits companies that produce natural resources like oil and also precious metals.

APA Corp (APA) produces oil and natural gas. The stock has been trending higher, but pulled back slightly over the last few trading sessions. We’ll use this pullback as an opportunity to set up a new income play for APA.

Similarly, gold miner Anglogold Ashanti (AU) also benefits from higher inflation and strong gold prices. After a February breakout, shares of AU have pulled back to a level where the stock was trading in late 2021. This level should provide support for the stock, giving us a chance to set up a new income play for AU.

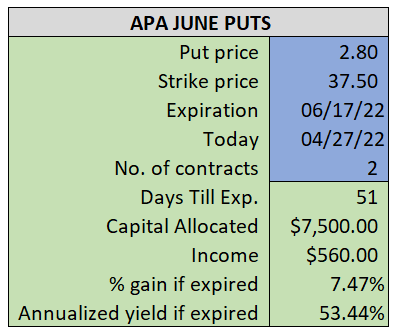

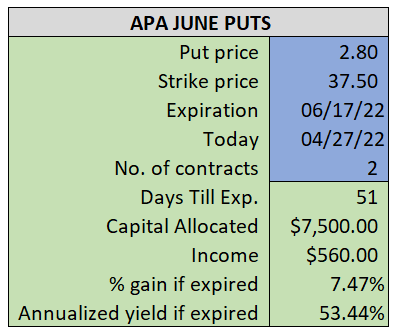

By selling the APA June $37.50 puts near $2.80, we’re able to collect an annualized yield near 53%, while also giving us roughly $2.50 per share in cushion between the current market price for APA and our strike price.

- Sell (to open) 2 APA June 17th $37.50 puts

- Limit: $2.80 or more

- The new position will represent roughly 8.1% of our model.

~~~~~~~ - 13:49 Executed

- Sold 2 APA June 17th $37.50 Puts @ $2.82

.

.

ALSO

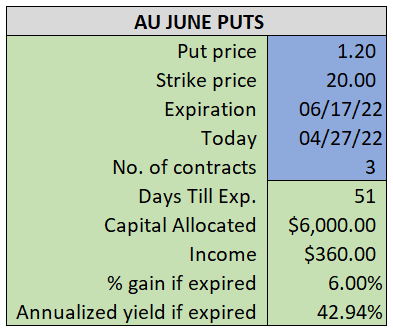

By selling the AU June $20 puts near $1.20, we’re able to collect an annualized yield near 43%, while also giving us roughly $0.50 per share in cushion between the current market price for AU and our strike price.

- Sell (to open) 3 AU June 17th $20 puts

- Limit: $1.20 or more

- The new position will represent roughly 6.5% of our model.

~~~~~~~ - 13:50 Executed

- Sold 3 AU June 17th $20 Puts @ $1.25