Selling CTRA puts for income.

Coterra Energy (CTRA) is an independent energy producer with a focus on natural gas.

Demand for natural gas as a clean burning fuel for power plants has been rising. Plus, the U.S. is working to build more LNG terminals to export gas to Europe and other areas of the world.

This demand has pushed nat gas prices higher which works to CTRA’s benefit. And this trend should continue for many years to come.

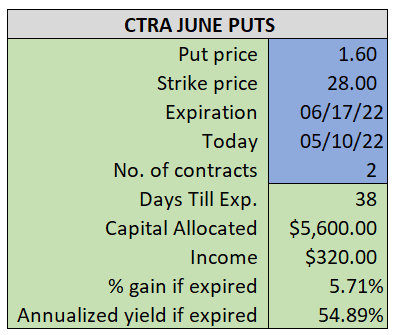

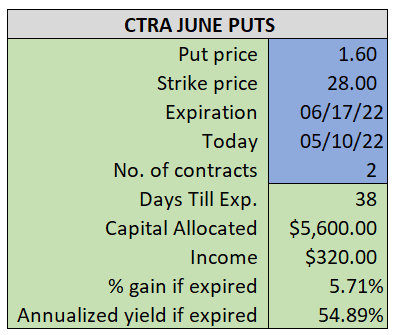

By selling the June $28 puts near $1.60, we’re able to collect an annualized yield near 55%, while also giving us roughly $1.60 per share in cushion between the current market price for CTRA and our strike price.

- Sell (to open) 2 CTRA June 17th $28 puts

- Limit: $1.60 or more

- The new position will represent roughly 6.4% of our model.

~~~~~~ - 14:11 Executed

- Sold 2 CTRA Jun 17th $28 Puts @ $1.70