Selling RCL puts for income.

Royal Caribbean Cruises (RCL) is trading sharply higher today from an oversold position.

Investors have bailed out of travel and leisure stocks over the last few weeks as inflation concerns rise.

But RCL is still a good rebound candidate that should profit from strong demand for travel over the next several years.

The low price point for RCL gives us a chance to sell put contracts with a lower strike price. Meanwhile, higher volatility in this area of the market has pushed the price for put contracts higher — which means we get more income for each of our plays.

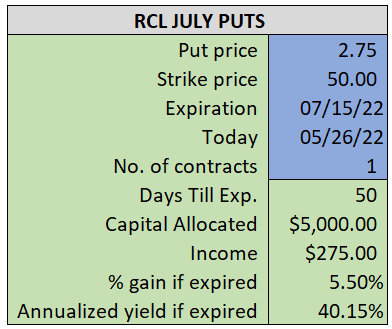

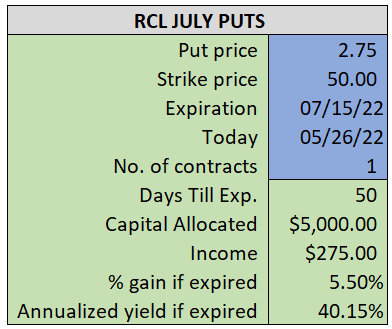

By selling the July $50 puts near $2.75, we’re able to collect an annualized yield near 40%, while also giving us roughly $5.50 per share in cushion between the current market price for RCL and our strike price.

- Sell (to open) 1 RCL July 15th $50 put

- Limit: $2.75 or more

- The new position will represent roughly 5.6% of our model.

~~~~~~~~ - 11:50 Executed

- Sold 1 RCL July 15th $50 Put @ $2.85