Rolling our MU puts to a higher strike price and July contract.

Shares of MU have found support and now appear ready to move higher.

The computer chip supplier is a high-quality and profitable company in the industry and should benefit from inflation in computer chip prices. Plus, as Chinese lockdowns begin to ease, supply chain issues should improve.

Now that the stock is trading higher, our June $67.50 puts are much cheaper. So we can buy out of our agreement at a very low price. This allows us to lock in profits and free up cash.

We’ll then use that cash to set up a new income play by selling put contracts with a higher “strike price” (or agreement price). This way we can continue to generate income from shares of MU.

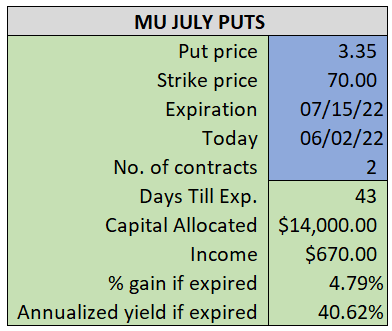

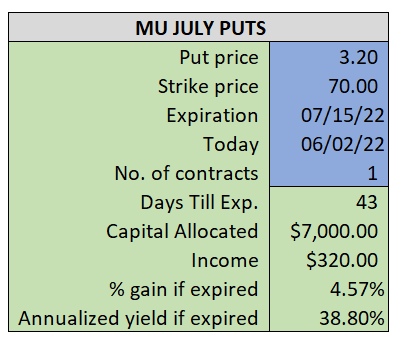

By selling the MU July $70 puts near $3.20, we’re able to collect an annualized yield near 39%, while also giving us roughly $3.30 per share in cushion between the current market price for MU and our strike price.

- Buy (to close) our MU June 17th $67.50 put

- Limit: $1.00 or less

~~~~~~ - 9:52 Executed

- Bot MU Jun 17th $67.50 Put @ $0.75

ALSO

- Sell (to open) one MU July 15th $70 put

- Limit: $3.20 or more

- The new position will represent roughly 7.8% of our model.

~~~~~~~~~ - 9:53 Executed

- Sold 1 MU Jul 15th $70 Put @ $3.20