Selling OXY puts for income.

Occidental Petro (OXY) is a oil & gas company that benefits from rising energy prices.

Shares have pulled back over the last couple of days. But this pullback is within the context of an overall bull market for energy stocks in an inflationary environment.

I expect energy stocks to continue to trade higher.

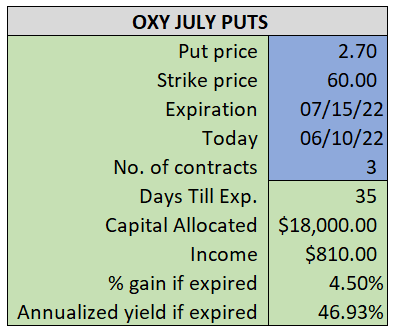

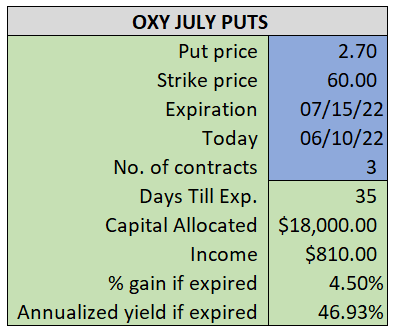

By selling the July $60 puts near $2.70, we’re able to collect an annualized yield near 47%, while also giving us roughly $$4.20 per share in cushion between the current market price for OXY and our strike price.

- Sell (to open) 1 OXY July 15th $60 put

- Limit: $2.70 or more

- The new position will represent roughly 6.8% of our model.

~~~~~~ - 15:18 Update

- Adjusting our limit price to $2.55

~~~~~~~ - 15:22 Executed

- Sold 1 OXY July 15th $60 Put @ $2.70