Rolling our APA puts to a lower strike price.

Shares of APA Corp. (APA) benefit from higher energy prices. Oil and natural gas continues to trade at inflated levels – driving higher profits for this energy company.

Still, the stock is trading lower as investors cut back on risk in just about every area of the market right now.

The stock has fallen below our $45 strike price. But I still like APA as an income play.

Today, we’ll use our parachute protection play to buy back our put contracts with a $45 strike price. We’ll also sell a new set of put contracts with a lower strike price to add extra income.

This way, we’ve got more of a buffer if APA trades lower, but still an attractive amount of income from this stock.

We’re buying back our original APA put contracts at a loss. But our second position should help to offset that loss and put us back on the road to growing your profits.

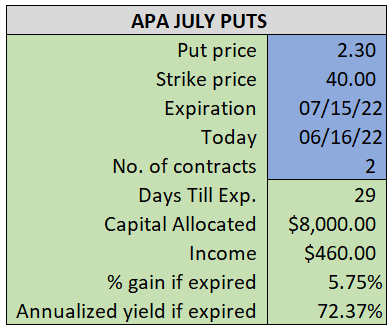

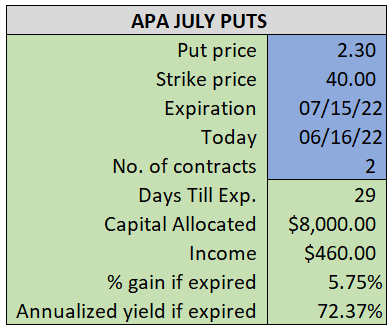

By selling the APA July $40 puts near $2.30, we’re able to collect an annualized yield near 72%, while also giving us roughly $1.75 per share in cushion between the current market price for APA and our strike price.

- Buy (to close) our APA July 15th $45 put

- Limit: $5.20 or less

~~~~~~~ - 15:19 Adjusting our limit price to $5.35

~~~~~~~ - 15:25 Executed

- Bot APA July 15th $45 Put @ $5.25

ALSO

- Sell (to open) two APA July 15th $40 puts

- Limit: $2.30 or more

- The new position will represent roughly 9.4% of our model.

~~~~~~~ - 15:25 Executed

- Sold 2 APA July 15th $40 Puts @ $2.54