Selling PYPL puts for income.

PayPal Holdings (PYPL) has traded sharply lower as investors shy away from anything related to cryptocurrencies or consumer transactions.

However, PYPL’s core business is still very healthy. The company is expected to earn $3.89 this year, followed by 23% profit growth in 2023.

At its current price near $73.60, shares trade at just 15 times next year’s expected earnings – a reasonable price considering the company’s growth.

The stock appears to be finding support. Meanwhile, higher premiums for option prices allow us to collect a lucrative income payment while still giving ourselves an extra buffer in cast the stock continues lower.

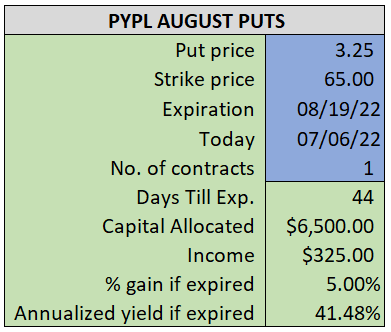

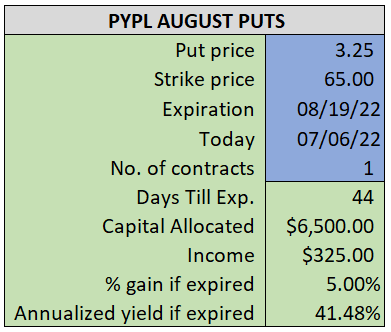

By selling the August $65 puts near $3.25, we’re able to collect an annualized yield near 41%, while also giving us roughly $8.60 per share in cushion between the current market price for PYPL and our strike price.

- Sell (to open) 1 PYPL August 19th $65 put

- Limit: $3.25 or more

- The new position will represent roughly 7.8% of our model.

~~~~~~~~~ - 15:15 Executed

- Sold 1 PYPL Aug 19th $65 Put @ $3.34