Selling DHI puts for income.

Homebuilder stocks like D.R. Horton (DHI) have been holding up well after bottoming earlier this summer.

Strong demand for homes continues to help support prices. And an easing of supply chain problems — along with an improving labor market is helping homebuilders like DHI to complete more units.

DHI offers investors extreme value. The stock is trading for less than 5 times next year’s expected profits. This leaves plenty of room for shares to trade higher, and should attract buyers to keep the stock from moving much lower.

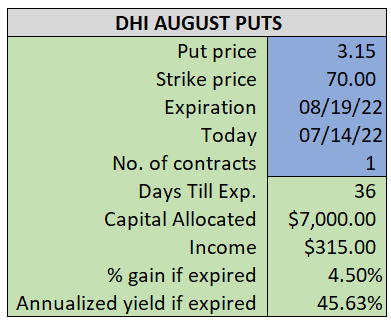

By selling the August $70 puts near $3.15, we’re able to collect an annualized yield near 46%, while also giving us roughly $2.60 per share in cushion between the current market price for DHI and our strike price.

- Sell (to open) 1 DHI August 19th $70 put

- Limit: $3.15 or more

- The new position will represent roughly 8.3% of our model.

~~~~~~~~ - 14:38 Adjusting our limit price to $3.10

~~~~~~~~ - 14:46 Executed

- Sold DHI August 19th $70 Put @ $3.29