Selling RUN puts for income.

Sunrun Inc. (RUN) designs, develops, and installs solar power systems.

Solar energy is one of the few areas that has held up really well this year. And recent industry reports show strong global demand for solar energy, driving prices higher.

RUN is a bit more of a speculative name for our income strategy. The company is not expected to turn a profit until 2024. But strong growth in the area and a pullback from last year’s peak stock price make RUN much more attractive.

An overall bear market rally should push the stock higher. Meanwhile, we’re getting an attractive income payment while still keeping a reasonable buffer of safety in case the stock pulls back.

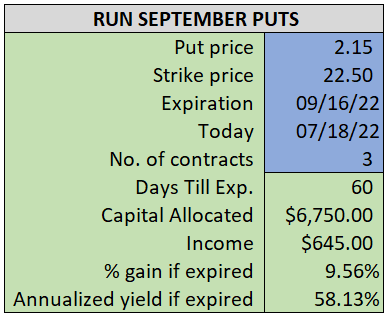

By selling the September $22.50 puts near 2.15, we’re able to collect an annualized yield near 58%, while also giving us roughly $3.20 per share in cushion between the current market price for RUN and our strike price.

- Sell (to open) 3 RUN September 16th $22.50 puts

- Limit: $2.15 or more

- The new position will represent roughly 7.9% of our model.

~~~~~~~~ - 10:21 Executed

- Sold 3 RUN September 16th $22.50 Puts @ $2.32