Selling OXY puts for income.

Occidental Petroleum (OXY) is an energy company with global operations and oil reserves of $3.5 billion barrels.

Higher oil prices have driven energy stocks up this year, and a short-term pullback now gives us a great entry point for a new income play.

OXY has been in the news lately, thanks to Warren Buffet’s large (and growing) position in the company. Any pullback will likely be met with buying — both by Buffet and by the army of value stock investors who follow Buffet’s investments.

The company is expected to earn $8.03 per share next year, and currently trades for just 7.6 times next year’s earnings. And the longer oil remains near (or above) $100 per barrel, the higher profit estimates will rise.

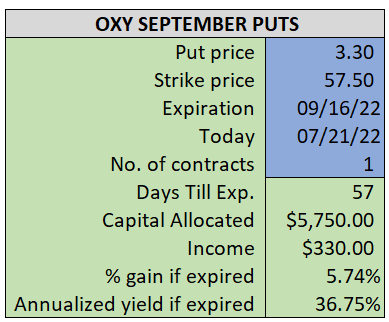

By selling the September $57.50 puts near $3.30, we’re able to collect an annualized yield near 37%, while also giving us roughly $4.10 per share in cushion between the current market price for OXY and our strike price.

- Sell (to open) 1 OXY September 16th $57.50 put

- Limit: $3.30 or more

- The new position will represent roughly 6.8% of our model.

~~~~~~~~ - 10:26 Executed

- Sold 1 OXY September 16th $57.50 put @ $3.90