Rolling our PYPL puts to a higher strike price.

Shares of PYPL are breaking above the stock’s downtrend line, as investors start to realize the value PYPL offers customers and investors.

I continue to be bullish on this stock. The most recent rally gives us a chance to close out our August $65 put contracts while locking in a large portion of the income we received from entering this trade.

We’ll then use that cash to set up a new income play by selling put contracts with a higher “strike price” (or agreement price). This way we can continue to generate income from shares of PYPL.

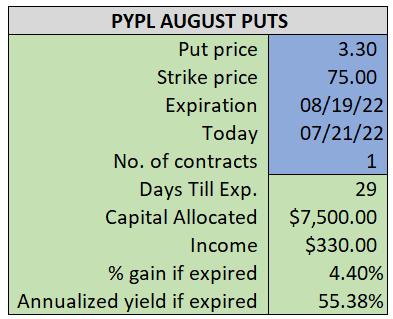

By selling the PYPL August $75 puts near $3.30, we’re able to collect an annualized yield near 55%, while also giving us roughly $7.40 per share in cushion between the current market price for PYPL and our strike price.

- Buy (to close) our PYPL August 19th $65 put

- Limit: $1.25 or less

~~~~~~~~ - 13:51 Executed

- Bot PYPL August 19th $65 Put @ $1.23

ALSO

- Sell (to open) one PYPL August 19th $75 put

- Limit: $3.40 or more

- The new position will represent roughly 8.8% of our model.

~~~~~~~~ - 13:51 Executed

- Sold 1 PYPL August 19th $75 put @ $3.62