Selling XPO puts for income.

XPO Logistics. (XPO) is a trucking and logistics company serving companies in the U.S. and Europe.

As supply chain issues ease, XPOs business is picking up.

The company generates reliable profits that are set to grow over the next two years. And shares of XPO trade at a very reasonable 10.5 times this year’s expected profits.

Shares moved sharply higher in July, allowing us to lock in a profit on our previous XPO income play.

Today, the stock is pulling back a bit, giving us a chance to set up an attractive new income play.

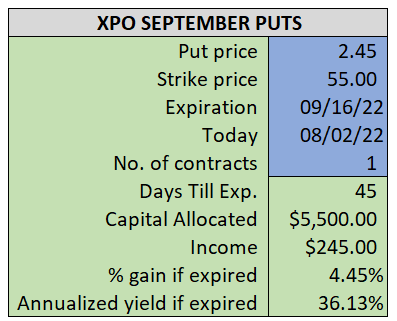

By selling the September $55 puts near $2.45, we’re able to collect an annualized yield near 36%, while also giving us roughly $3.30 per share in cushion between the current market price for XPO and our strike price.

- Sell (to open) 1 XPO September 16th $55 put

- Limit: $2.45 or more

- The new position will represent roughly 6.4% of our model.

~~~~~~~~ - 10:20 Executed

- Sold 1 XPO September 16th $55 put @ $2.60