Selling CHK puts for income.

Chesapeake Energy Corp. (CHK) is a U.S. energy producer with a focus on natural gas.

As Europe braces for a winter without Russian gas supplies, Liquid Natural Gas (LNG) exports from the U.S. are hitting record levels. This drives demand (and price) for domestic natural gas higher, helping to boost CHK profits.

CHK is pulling back a bit today. But the pullback is within the context of an overall bull market for energy stocks. This gives us a good opportunity to set up a new income play before the stock continues higher.

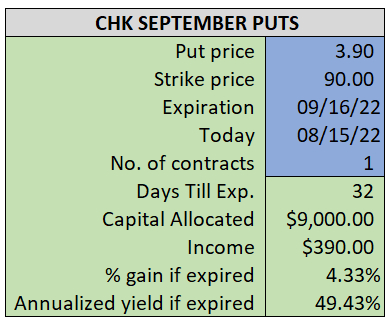

By selling the September $90 puts near $3.90, we’re able to collect an annualized yield near 49%, while also giving us roughly $3.50 per share in cushion between the current market price for CHK and our strike price.

- Sell (to open) 1 CHK September 16th $90 put

- Limit: $3.90 or more

- The new position will represent roughly 10.1% of our model.

~~~~~~~~ - 10:09 Executed

- Sold 1 CHK September 16th $90 put @ $4.10