Selling another batch of YETI puts for income.

Our August YETI put contracts are set to expire on Friday.

Shares are moving higher today after positive earnings reports from high-profile retail stocks.

Affluent consumers continue to spend on travel and entertainment. And YETI products are often purchased alongside these travel and entertainment splurges.

Today, we’ll go ahead and collect more income from this profitable retailer. We’ll sell September put contracts while allowing our August put contracts to expire in two more trading days.

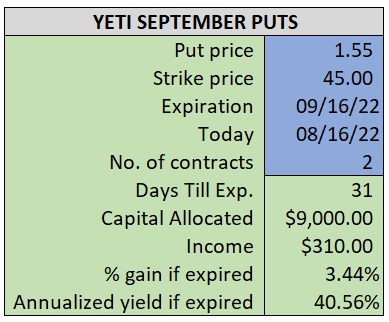

By selling the September $45 puts near $1.55, we’re able to collect an annualized yield near 41%, while also giving us roughly $2.50 per share in cushion between the current market price for YETI and our strike price.

- Sell (to open) 2 YETI September 16th $45 puts

- Limit: $1.55 or more

- The new position will represent roughly 10.0% of our model.

~~~~~~~~ - 14:20 Executed

- Sold 2 YETI September 16th $45 puts @ $1.61