Selling CLF puts for income.

Shares of Cleveland-Cliffs Inc. (CLF) have moved well off the July lows as supply chain problems are being resolved.

The steel company has a unique advantage. It has access to its own iron ore supplies here in the U.S., so it does not have to import raw materials from other parts of the world.

This allows CLF to keep costs low while still selling steel to customers at market prices.

The stock is a deep value play, currently trading near 6.5 times next year’s expected earnings.

While recessionary pressures may lead to lower prices, this risk appears to already be priced in for CLF shares. So any positive news could lead to another surge higher.

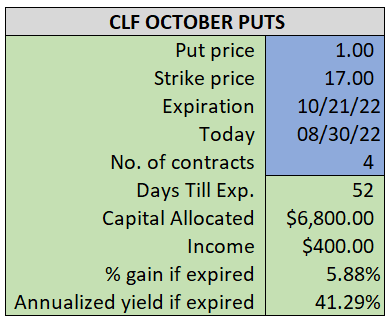

By selling the October $17 puts near $1.00, we’re able to collect an annualized yield near 41%, while also giving us roughly $1.10 per share in cushion between the current market price for CLF and our strike price.

- Sell (to open) 4 CLF October 21st $17 puts

- Limit: $1.00 or more

- The new position will represent roughly 7.8% of our model.

~~~~~~~~ - 10:20 Executed

- Sold 4 CLF October 21st $17 puts @ $1.18