Selling BTU puts for income.

Peabody Energy Corp. (BTU) produces coal from mines in the U.S. and Australia.

Thermal coal is used to generate electricity and also for smelting furnaces necessary for forging steel and other industrial metals.

Europe’s energy crisis is driving demand for all kinds of energy, including coal. And with today’s advanced technology, coal-fired power plants are able to produce more energy with much lower emissions.

With the U.S. exporting as much natural gas as possible to Europe, demand for other sources of electricity continue to rise here at home. This is good news for BTU.

The stock trades at a very low price compared to expected earnings. And thanks to uncertainty and volatility, BTU’s option contracts are very expensive. This gives us a chance to set up a lucrative income play with a wide risk-management buffer.

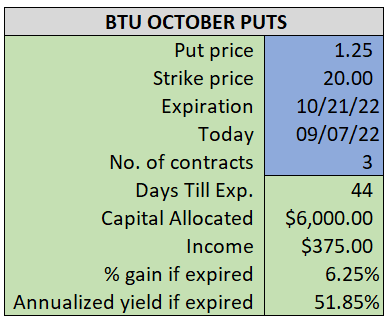

By selling the October $20 puts near $1.25, we’re able to collect an annualized yield near 52%, while also giving us roughly $3.50 per share in cushion between the current market price for BTU and our strike price.

- Sell (to open) 3 BTU October 21st $20 puts

- Limit: $1.25 or more

- The new position will represent roughly 6.9% of our model.

~~~~~~~~~ - 10:26 Executed

- Sold 3 BTU Oct 21st $20 Puts @ $1.30