Selling CHK puts for income.

Chesapeake Energy (CHK) produces oil and natural gas and is particularly well known for its shale nat gas properties.

The stock has been trading higher this year as the world scrambles to supply Europe with natural gas ahead of winter.

CHK should continue to benefit from this trend for many months (if not years) to come.

A short-term pullback for CHK sets up an attractive entry point for a new income play.

Thanks to heightened volatility in the market, we’re able to set up a trade with a lucrative payout and plenty of buffer between our agreement price and the current stock price for CHK.

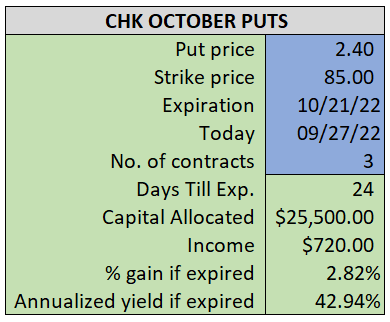

By selling the October $85 puts near $2.40, we’re able to collect an annualized yield near 43%, while also giving us roughly $7.00 per share in cushion between the current market price for CHK and our strike price.

- Sell (to open) 1 CHK October 21st $85 put

- Limit: $2.40 or more

- The new position will represent roughly 9.9% of our model.

~~~~~~

- Executed 13:34

- SOLD 1 CHK Oct 21 $85 Put @ $2.57