Selling CPRI puts for income.

Capri Holdings (CPRI) is a luxury retailer stock trading near a key support level.

Wealthy consumers continue to spend, and CPRI’s business continues to be strong compared to other retailers.

Meanwhile, investors have abandoned this area of the market, sending stocks sharply lower.

CPRI now represents a significant value, trading for roughly 5.5 times next year’s expected earnings.

The stock is beginning to move higher as the broad market rebounds.

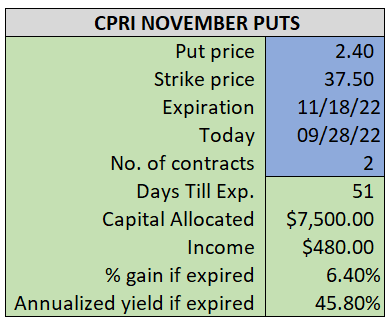

By selling the November $37.50 puts near $2.40, we’re able to collect an annualized yield near 46%, while also giving us roughly $2.50 per share in cushion between the current market price for CPRI and our strike price.

- Sell (to open) 2 CPRI November 18th $37.50 puts

- Limit: $2.40 or more

- The new position will represent roughly 8.7% of our model.

~~~~~~~

- Executed 12:13

- SOLD 2 CPRI Nov 18th $37.50 Puts @ $2.50