Selling PINS puts for income.

Pinterest Inc. (PINS) is a mix between a social media platform and an e-commerce business.

Users can share ideas on travel destinations, home decor, recipes and many other topics. And Pinterest profits from selling ads and through it’s growing e-commerce platform.

Shares surged during the pandemic. And like many speculative tech stocks, PINS has traded back down to a much more reasonable level.

The company generates a reliable profit (as opposed to many of the speculative tech stocks that are still losing money). And after going through a basing period, PINS appears poised to trade higher.

Thanks to it’s dramatic pullback option prices for PINS are very high. This gives us a chance to create a new income play with a very attractive risk-to-reward ratio.

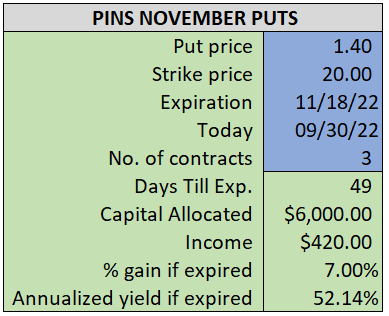

By selling the November $20 puts near $1.40, we’re able to collect an annualized yield near 52%, while also giving us roughly $3.75 per share in cushion between the current market price for PINS and our strike price.

- Sell (to open) 3 PINS November 18th $20 puts

- Limit: $1.40 or more

- The new position will represent roughly 7.0% of our model.

~~~~~~~

- Executed 13:48

- SOLD 3 PINS Nov 18th $20 Puts @ $1.49