Selling GM puts for income.

General Motors (GM) is a deep value play with shares trading near 5.6 times expected profits for next year.

Investors have become too pessimistic on this name.

Supply chain, labor and inflation challenges have all been well documented.

And these concerns have driven the stock sharply lower this year.

But GM will continue to generate profits.

And as the company works through these challenges, investors will be attracted to the stock’s value.

Shares have begun moving higher as the bear market rally picks up momentum.

And thanks to GM’s recent volatility, there is plenty of premium in the price of option contracts.

That gives us a chance to set up a lucrative income play with a wide safety buffer between today’s stock price and our agreement price.

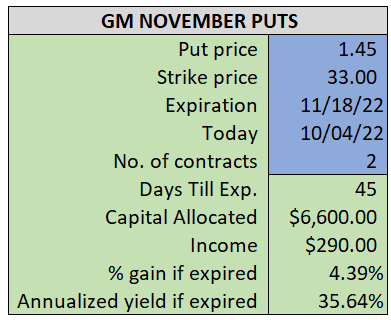

By selling the November $33 puts near $1.45, we’re able to collect an annualized yield near 36%, while also giving us roughly $2.10 per share in cushion between the current market price for GM and our strike price.

- Sell (to open) 2 GM November 18th $33 puts

- Limit: $1.45 or more

- The new position will represent roughly 7.6% of our model.

~~~~~~~~

- Executed 12:00

- SOLD 2 GM Nov 18 $33 Puts @ $1.48