-Down 550 points Thursday morning…

-Up 828 points by the close…

-Down 404 points the following session…

-Up 551 points today…

The market has been extremely turbulent over the last few sessions.

Investors are trying to figure out if inflation is under control or not…

If the U.S. will enter a recession…

Whether the Fed will back off its aggressive interest rate policy…

How the Ukraine war — or rising tension with China will turn out…

And at the same time, we’re kicking off one of the most important earnings seasons in recent memory!

No wonder investors are skittish and the market is trading up and down like a yo-yo.

At times like this, it can be helpful to look past the day-to-day swings, and focus on the relative strength of specific stocks or areas of the market.

That way, you can pick out the strongest investments — which will likely give you the best returns once the broad market finds its footing.

Energy Stocks Post Relative Strength

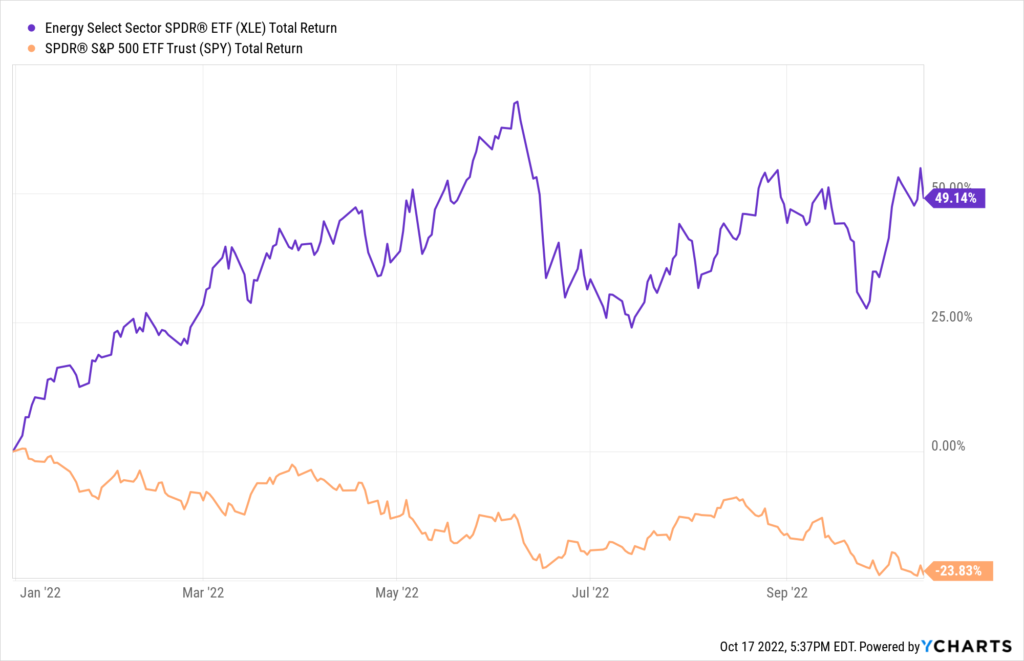

Most U.S. stocks have been trending lower since the beginning of the year. The S&P 500 index is clearly in a bear market, after losing nearly 24% of its value for investors.

Meanwhile, energy stocks continue to be one of the strongest areas for investors.

Below, you can see the relative strength of energy stocks, which are up nearly 50% this year.

The Energy Select Sector SPDR (XLE) gives you diversified exposure to many stocks in the energy sector.

Picking out specific names with reliable profits and generous dividends can help grow your wealth even in this challenging bear market.

Since many energy plays are still extremely cheap (relative to earnings), I expect the energy sector to continue its relative strength well into next year.

Make sure you’re investing in this area — even with the choppy market action!

Apple Stands Out Versus Peers

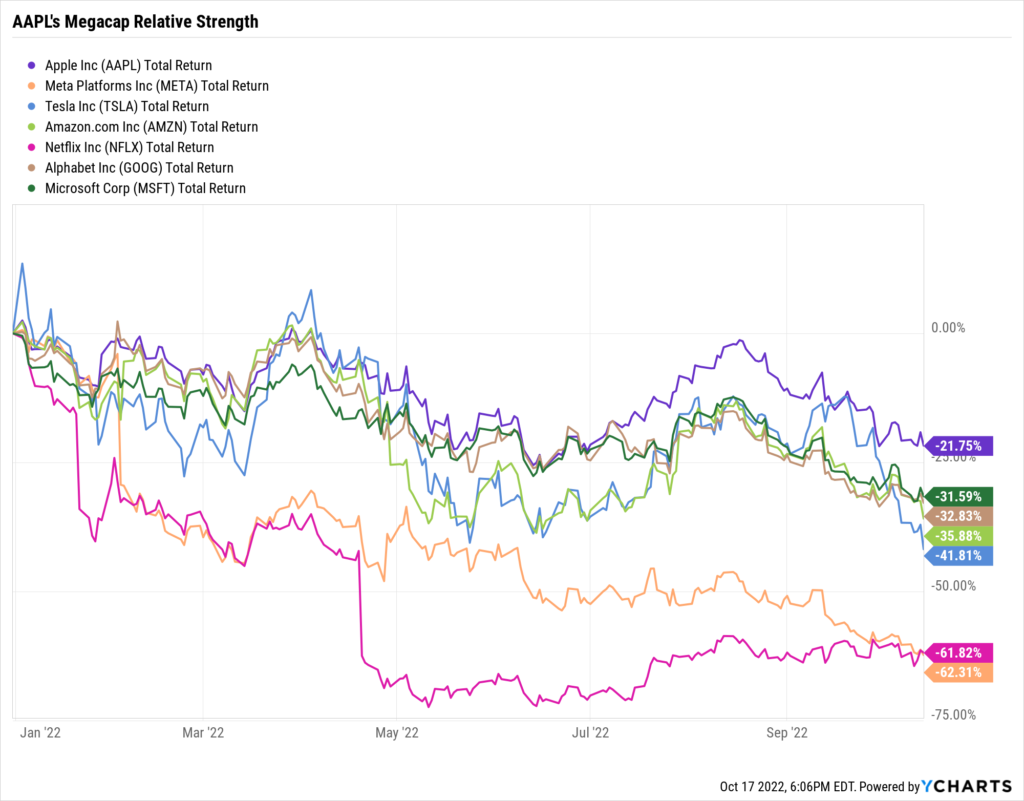

Another relative strength winner I’m watching is Apple Inc. (AAPL).

While the stock may be down nearly 22% this year, shares are actually holding up far better than other mega-cap tech stocks.

Since AAPL is holding its value better than most peers, it will be much easier for the stock to re-take all-time highs once the market regains its footing.

(On the other hand, Netflix will need to rise by 162% just to get back to where it started the year!)

Investors tend to have more confidence in stocks showing relative strength. Which means once the market eventually starts moving higher, these names can offer some of the best returns.

So instead of focusing on the turbulent day-to-day swings (which can make you dizzy), consider accumulating stocks that are holding up better than their peers.

You’ll sleep easier if you’re less worried about the daily price action. And your investments have already proved they can hold value even in a challenging bear market.

Here’s to growing and protecting your wealth!

Zach

P.S. Investing for income is one of the best strategies for a bear market. Not only does the income help with day-to-day expenses, you can also use the cash to buy new shares at a discount!

Here’s my favorite income strategy for bear markets… It’s how I invest most of my own family’s money!