American’s energy crisis is getting scary… It hasn’t been this bad since Harry Truman was president!

And as we head into the holiday season, things could quickly get worse!

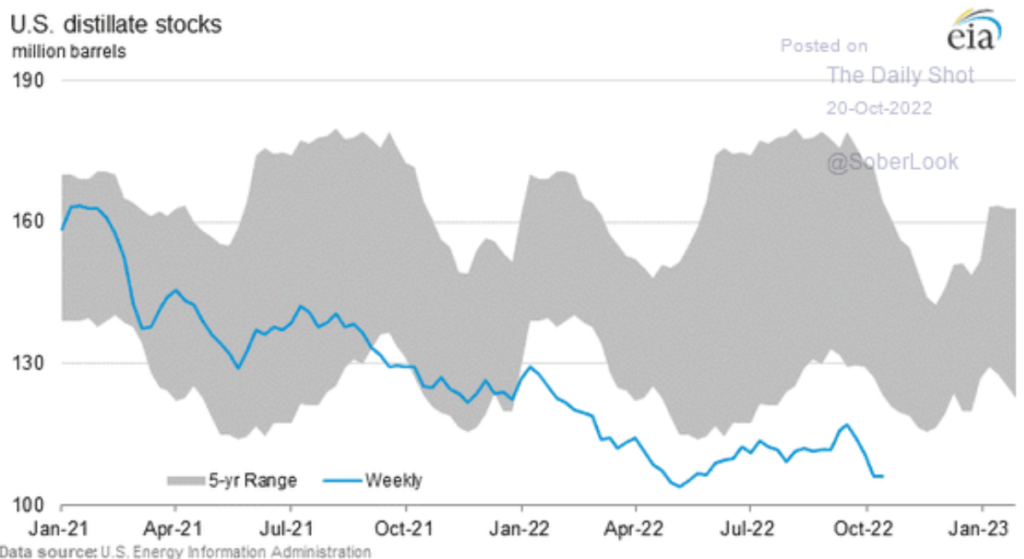

Just take a look at the chart below — courtesy of the U.S. Energy Information administration (or EIA):

The blue line shows our inventory of distillate stocks (mostly diesel fuel). And the grey shaded area shows the “range” over the last 5 years.

Our diesel inventories are exceptionally low. And they’re headed in the wrong direction!

Higher Fuel Costs > Higher EVERYTHING Costs

Maybe your vehicle doesn’t use diesel. But that doesn’t mean your family is out of harm’s way.

You see, dangerously low levels of diesel will affect all of us. Because this traditional source of fuel affects many other areas of our economy.

Almost every physical thing that you buy is at least partially tied to diesel fuel.

Trucks and trains use diesel fuel to transport merchandise across the country.

Farm equipment uses diesel fuel to harvest the food we eat.

Even manufacturing plants use diesel to power equipment and machinery.

So as diesel supplies fall, America’s energy crisis is heating up!

Economics 101 tells us that when supplies of an important resource are low, the price will naturally trend higher.

And that’s exactly what’s happening to the price of diesel.

Spot prices have risen to over $200 per barrel. And higher diesel costs drive prices higher for just about everything we eat, wear, or even buy from Amazon.

Think inflation is cooling off? Think again!

Energy Crisis Drives Energy Stock Outperformance

Dwindling diesel reserves are driving costs higher. They’re also driving huge risks for our domestic (and international) supply chain.

But there is a silver lining for investors.

Energy stocks have actually done well for investors!

Back in January, I told you to focus on energy stocks this year. And even through the brutal bear market, these stocks have given us profits.

Today, I expect energy stocks to continue to outperform.

Fuel shortages, stringent regulations, and a high-profile supply cut from OPEC+ should continue to support this area of the market.

In particular, oil refining stocks look very attractive.

That’s because refineries can buy crude oil at relatively stable prices. And they can then sell refined fuel (like diesel) at exceptionally high prices.

Profit margins are expanding and the stocks are beginning to surge higher.

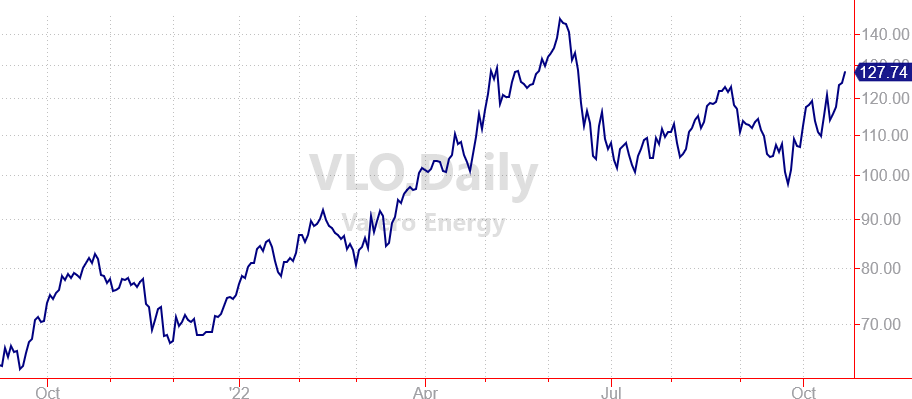

One name to consider in this area is Valero Energy (VLO). The stock pulled back throughout the summer, but is now moving higher as diesel prices surge.

Hedge Your Exposure to America’s Energy Crisis

Buying energy stocks like VLO can be a great “hedge” for your personal budget.

That’s because as energy costs drive inflation in other areas of the economy, you can lock in gains from energy stocks.

Depending on how you invest, your profits could even exceed the higher costs!

I’ve been using energy stocks to help grow my own family’s investment accounts this year.

And given the low levels of diesel inventories and rising energy costs, I expect our profits to continue to grow.

Make sure you’re invested too!

If you’d like to see the aggressive positions I’m taking on energy stocks and other areas the market, be sure to check out my Speculative Trading Program.

It’s a real-money portfolio of trades I’m putting in my own account.

And members of the Speculative Trading Program receive live trade alerts before I enter (or exit) a position in my own account.

That way you can set up your own position ahead of mine. And you’ll also get a chance to lock in profits before I close out my personal position.

>>More on The Speculative Trading Program Here<<

America’s energy crisis will certainly have an affect on U.S. inflation.

But you can fight back by making smart energy investments.

Here’s to growing and protecting your wealth!

Zach