“Dad, can you please come get me? I’m stranded on the side of the highway and I don’t know what to do…”

And so began our overnight family trip this week.

Thankfully, while our plans had to adjust along the way, everyone got through the adventure safely. And my daughter learned a thing or two about paying attention to the warning lights on her dashboard.

I also picked up on some clues that could help your family (and mine) book some investment profits in the year ahead. So let’s unpack this situation and I’ll fill you in on what I learned.

Thank Goodness for Spare Tires

Our family trip became complicated just after I arrived at my sister’s house.

As I gave hugs to my nieces and nephews, my phone rang. It was my teenage daughter who was on her way to meet us after finishing her shift at work.

Unfortunately, her car had a flat tire. And the flat could have been avoided if she had checked the pressure in her tires when the hazard light lit up on her dashboard.

Since she was stranded on the side of a busy highway, I asked her to stay in the relative safety of her car. That’s when I jumped back in my car and drove 90 minutes to meet up with her.

We got the spare tire on her car and eventually met back up with the rest of the family. I’m sure for years to come, we’ll look back on this holiday trip and laugh about the chaos and extra hours driving back and forth.

After the trip, we took her car in to replace the tire.

And while we were waiting, I had a chat with the general manager of the auto repair shop.

He told me that business has been good — REALLY GOOD!

Which lines up perfectly with my research on this area of our economy.

An Era of High-Mileage Autos

Over the past few years, I’ve read several reports about the age of cars on the road.

Americans are driving vehicles far longer than in past decades. And now there are many more “high-mileage” cars on the road that need to be maintained.

Part of this trend is due to supply chain issues caused by the pandemic.

Many auto assembly lines were shut down. And others had a difficult time sourcing the necessary parts.

You’ve probably heard me talk about low inventories for both new and used cars. And this low supply has led to inflation for both new and used vehicles.

It’s also led to more demand for auto parts and for the auto servicing industry.

Because high mileage cars and trucks need more work done to keep them running.

This trend is great news for my local auto repair shop. And it’s also great news for one particular stock on my watch list.

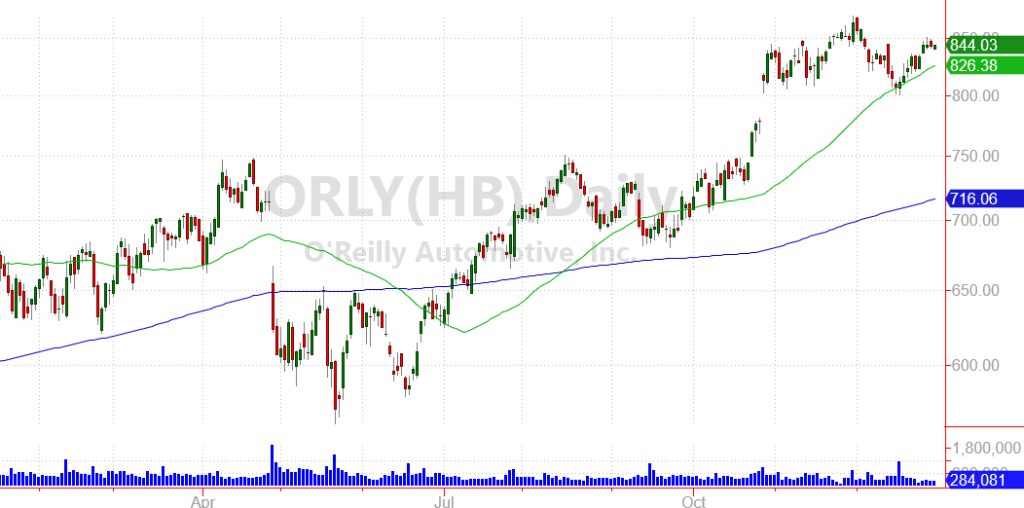

Shares of O’Reilly Automotive (ORLY) have been trending higher this year. The company sells auto parts, tools and accessories through its 5,784 stores spread across the United States.

Take a look at the chart:

As Americans maintain fleets of aging cars, ORLY should continue to grow profits. And that’s why I’ve got ORLY on my bullish watch list as we head into 2023.

The Importance of Being Prepared

After getting everything settled, my daughter and I had a talk about “being prepared.”

I’m not upset that she had a flat tire — or even that she ignored the warning lights.

But I DO want to make sure that she’s prepared for next time something like this happens. It’s important to have some warm clothes in the car, to know how to change a flat tire, and to keep her phone charged in case she needs to get in touch with me.

It’s also important for us to be prepared for unexpected investment situations.

That’s exactly why I keep a series of watch lists with stocks like ORLY on deck.

This way, when dynamics in the market shift — or when new opportunities arise — I’m already prepared to take advantage of the situation.

If you aren’t familiar with my Profit Watch service, it’s a multi-part watch list full of stocks I’ve vetted for specific situations.

The list includes:

- 20 Bullish Plays (stocks I expect to trade higher)

- 20 Bearish Plays (stocks I expect to trade lower)

- 20 Income Plays (stocks I use to collect income payments)

Each week, I update the information for each of these stocks — often adding new names to each list. Members of my Profit Watch service get an email detailing any changes to the lists — along with a few important notes on what is happening in the market.

If you don’t already have real-time access to this watch list tool, I encourage you to sign up! This is a great way to prepare your investments heading into the new year.

>> Sign up for Profit Watch here <<

And if you ARE a member of Profit Watch, be sure to check in on all three watch lists. I updated the lists just this morning so you’ve got some fresh information to look over.

I can’t tell you how excited I am about the year ahead.

After navigating the bear market of 2022, there are a number of great opportunities — like ORLY — that I’m closely tracking.

Here’s to a healthy and profitable new year!

Zach