Dividend stocks can be incredible wealth-building investments. Not only do the dividend payments give you investment income, the stock prices can also trade higher — leading to capital gains.

That’s why I’ve focused on dividend stocks as a great starting point for new investors.

But so far this year, dividend stocks haven’t kept up with the rest of the market. The chart below shows a basket of the most popular dividend stocks actually down 6% this year compared to the market’s 12.4% gain.

If you’re a dividend stock investor, you may be discouraged by this underperformance.

But the truth is, this pullback can actually work in your favor over time. Especially if you take advantage of the investment income tool I’m about to show you.

An Easy Hack for Boosting Investment Income

Most dividend stocks send quarterly dividends. The dividends show up as cash in your brokerage account and you can then use that cash for expenses, or for a new investment.

But if you don’t need the cash right away, there’s a better option that will help you grow wealth (and your future income) more quickly.

It’s called a Dividend Reinvestment Plan (or DRIP for short).

When you enroll in a DRIP, your dividends are automatically used to buy new shares of the same dividend stock.

And once those new shares are in your account, your next dividend payment will be even larger (because you’ll own more shares).

Over time, this small hack can add a lot of wealth to your account, because you’re constantly boosting the number of shares — and also the amount of investment income — in your account.

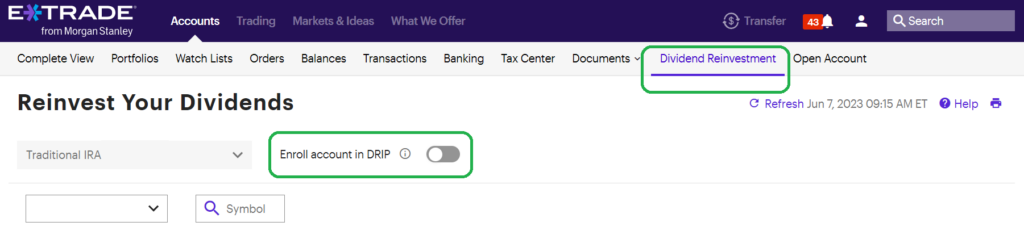

Setting up a DRIP is very easy to do. In fact, most brokerages have a single option you can click that ensures all dividend payments will be reinvested. Here’s a screenshot I took from my E*Trade account.

Once you start to reinvest your dividends automatically, you’ll see why a short-term pullback for dividend stocks can actually help you build more wealth over time…

DRIP Into More Shares

Even though dividend stocks have pulled back this year, most companies are still sending the same investment income payments to shareholders.

In fact, many high-quality dividend companies have actually increased their quarterly payments already this year.

Let’s think about how this works for your DRIP program:

- You receive the same income payment from the company’s dividend.

- You reinvest the cash buying shares at a lower price.

- So you actually get more shares for your reinvestment when the stocks trade lower.

So when dividend stocks pull back, your DRIP program actually accumulates more shares (automatically). This way, once the stock eventually rebounds, you’ll have more shares to grow your wealth more quickly.

And as an added benefit, whenever your company announces a dividend hike, you’ll have more shares that EACH get a larger dividend payment for years to come.

So if you’re looking for long-term investment income, here’s my advice…

- Buy high-quality dividend stocks.

- Enroll in your brokerage’s dividend reinvestment plan (DRIP).

- Be patient and watch your share count — and your investment income – grow.

Here’s to growing and protecting your wealth!

Zach

P.S. Each week I update my watch list of top stocks, along with a review of the best opportunities in today’s market. Members of my “Profit Watch” service have access to notes on EACH of the 60 stocks on the list, along with weekly updates, notifications when positions change, and my best stock market research.

Make sure you subscribe to my watch list for just $27 a year. That’s 52 weeks of investment ideas for less than the cost of a tank of gas!