Do you have the patience to be a successful investor?

Over the past few days I’ve had a handful of conversations with friends and family members who ran out of trading patience.

It’s understandable — and even reasonable to lose patience with this market.

But as I replay the conversations in my head, I can’t help but remember the famous Jesse Livermore quote:

“It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I’ve known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine–that is, they made no real money out of it. Men who can both be right and sit tight are uncommon.” ~Jesse Livermore

Trading patience is one of the hardest things for any ambitious investor to learn. After all, we get into this business because we want to grow our wealth.

Maybe it’s a financial goal that you’ve created for yourself. Maybe it’s a sense of being a good steward of your capital. Or maybe you’re creating a new source of income.

Whatever brought you to the market, it certainly wasn’t a desire to sit on your hands and watch the action unfold.

But in many cases, that’s what successful trading requires!

To quote another favorite trader of mine — my boss and mentor at the hedge fund where I first started investing — “Don’t just do something, STAND THERE!“

Today, I wanted to take a look at three different market scenarios that require patience. And all three of these setups can lead to big profits (if you’ve got the patience to let them come to you).

Trading Patience Through Normal Pullbacks

One of my favorite areas of the market right now is the travel and leisure industry.

As the economy recovers from the coronavirus crisis, more people are planning trips and making up for lost vacation time.

That’s great news for travel and leisure stocks. And I think there’s a lot of room for cruise stocks to move higher as the industry gets back on its feet.

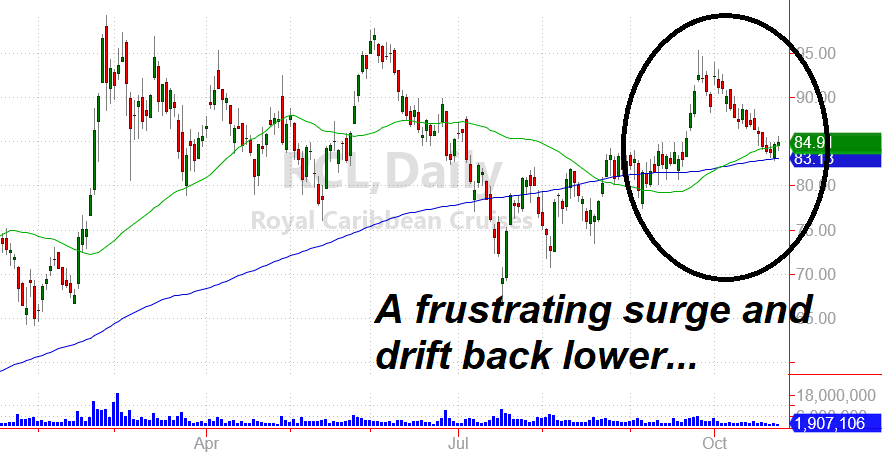

One of the stocks I’ve been watching closely is Royal Caribbean Cruises (RCL). While the company will lose money this year, profitability is expected to return in 2022. RCL should have plenty of pricing power thanks to strong demand. And by raising prices I’m expecting RCL’s profits to rebound quickly.

Take a look at the RCL chart below.

Last month, RCL broke higher and looked like it was off to the races! The delta variant appeared to be under control and investors were optimistic. I expected the stock to surge towards its 2019 peak above $130.

I took a personal position in the stock, and as you can see, RCL didn’t continue higher.

And every day this month, I’ve resisted the urge to close the position because RCL isn’t heading where I want it to.

But if you look more carefully, RCL is still in good shape. The stock pulled back to the 50-day and 200-day averages which is a natural spot for it to find support.

Logically, I know this is a situation where I need to exercise trading patience. But even after years of trading, my urge to “do something” has made it hard to sit on my hands and wait.

Waiting for a Trade to Set Up

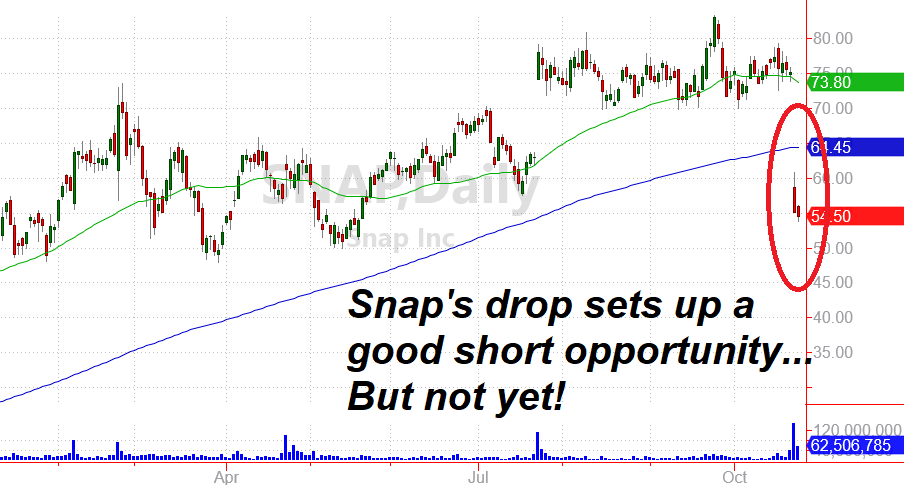

Here’s another situation that I’ve been watching closely.

You may have seen news reports about Snap Inc. (SNAP) and the company’s weak results. Apple’s changes to how user data is tracked and used for advertising is a challenge for social media companies. And weak supply chain issues have caused advertisers to cut budgets.

The news sent shares of SNAP plummeting. And quite frankly, I’m licking my chops at a chance to buy puts on this stock and profit from a further decline.

But whenever a popular stock like SNAP drops, there’s almost always a group of loyal investors ready to buy the dip. So making a bearish bet on the stock too early can just lead to quick losses when dip buyers show up.

The better play is to show patience (there’s that word again) and wait for a better setup.

Trading Patience in Holding a Winner

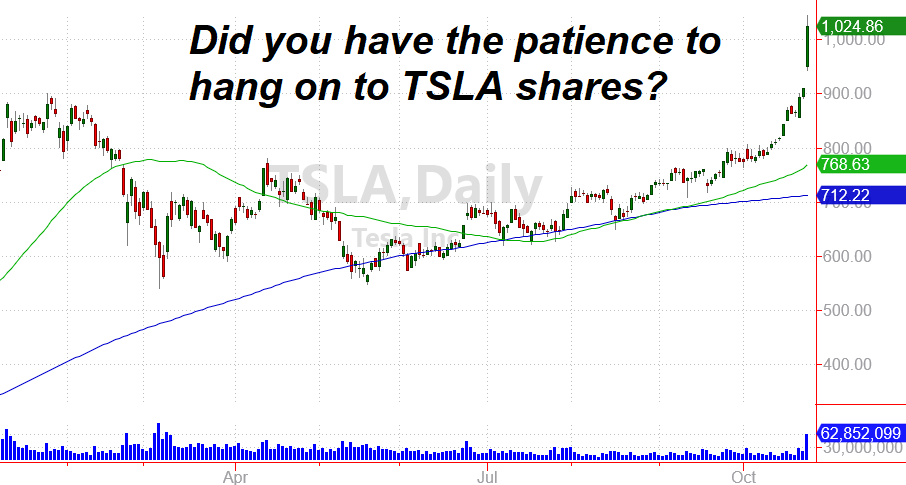

Here’s one that made some big headlines today!

Tesla Inc. (TSLA) joined an elite group of stocks with a market cap above $1 trillion today. Shares surged higher after Hertz announced the rental company is buying 100,000 of Tesla’s electric vehicles.

Shares were up more than 13% today alone, helping the overall market notch another new high.

To be quite frank, TSLA has not been an easy stock to hold. Despite the admiration I have for the company and it’s cars, the stock is expensive and it’s pullback earlier this year shook a number of “true believers” out of their positions.

However those investors who had a plan and stuck to that plan — sitting on their hands patiently — were rewarded when the stock finally broke to a new high.

The takeaway from all three situations?

Having a plan — and then patiently waiting for that plan to work out — is the best way to successfully build your wealth. Impatience, trading on impulse, and following human nature simply lead us all in the wrong direction.

Just a few thoughts this evening as I’m catching up on the market action and setting my plans for the weeks ahead!