Helping families build wealth so they can focus on what really matters

The Accelerated Income Trading Blueprint

Welcome to Zach Scheidt’s Accelerated Income Model.

I’m excited you’re here and I can’t wait to help you get started generating extra income from this unique trading approach!

I know you’re ready to get started. So let’s jump right in!

First things first… Make sure you’re signed up for our real time trade alerts. Just click on the link below to register for trade alerts in your inbox. That way you always know whenever a new income play is ready.

>>>Click here to enable live trade alerts<<<

In the following sections I’ll explain how our accelerated income put-selling service works. You can jump to specific areas of the manual using the links below:

- Part I: An Overview of My Favorite Income Strategy

- Part II: Finding the Best Income Plays

- Part III: How Much Income Can You Make?

- Part IV: What Happens in a Bear Market?

- Part V: There’s Always A Catch…

I’ll be continually updating this manual based on your feedback. So as you get started with this strategy, please be sure to let me know how you’re doing! You can always email me at Zach@ZachScheidt.com or reply to any of my trade alerts with your comments or questions.

PART I: An Overview of My Favorite Income Strategy

“Consistency Trumps Intensity…. every time!“

I’m not sure who authored this quote. But I’ve kept it posted in my office for years now, reminding me of the importance of consistently doing my best day in and day out.

The concept of consistency applies to so many areas of life. As an endurance athlete, consistent training is the best way to prepare my body for a big race. (Not just a few days of intense distances.)

And when it comes to building your wealth, consistency is just as important!

That’s why consistent investment income is the best foundation for successful wealth building.

When you pull consistent income from the market, you can use the cash flow to cover expenses.

And if you don’t need to spend the income, that cash can then be used to fund new opportunities. This way your investment account is always full of fresh opportunities because you can consistently add cash to new plays.

Today, I wanted to share my favorite strategy for creating investment income in your account. And over the next few days, we’ll cover some of the nuances that can help you grow — and protect — your wealth!

“Put Contracts” for Safety and Speculation

To collect reliable income from the stock market, I use a “put-selling” approach.

While this may sound different from what you’ve done in the past, stick with me. I promise you’ll be glad you did.

A put contract is a specific kind of options contract… And these contracts are simply agreements between traders.

When you buy a put contract, the agreement gives you the right (but not an obligation) to sell 100 shares of stock at a certain price.

Read that again… because it’s important…

Traders buy put contracts to bet on a stock trading lower, or to protect a long-term investment they hold.

If you have a put contract giving you the right to sell shares at $100, and the stock falls to $80, that contract is worth at least $20 per share.

After all, you could buy shares in the open market at $80. And then you could exercise your put agreement which gives you the right to sell the shares at $100. Chalk up a quick $20 profit!

Put contracts trade on the open market just like stocks. And the price you’ll pay to buy or sell these contracts fluctuate. The price for these put contracts depends on the stock price, on investor expectations for how the stock will trade, and a few other factors.

And there are dozens of different put contracts for each actively traded stock. These contracts have different agreement prices (called strike prices), and different expiration dates. (Each put contract has a limited life span and expires on a specific day).

In the next series, we’ll talk a bit more about the market prices for these contracts. For now, I want to explain how these contracts can give YOU income!

Investment Income from Selling Puts

If you own a put, you have the right to sell shares of stock. But for our income strategy we’re going to take the other side of this trade.

You can choose to sell a put contract which simply means that you’re on the other side of the agreement. The buyer of the contract has the right to sell shares of stock. The seller of the contract is obligated to buy those shares if the agreement is exercised.

Important note: You don’t have to own a put contract to sell it. Since this is an agreement between traders, you’re effectively writing a contract and selling it to the other trader. It’s a seamless process in your brokerage account — you simply use the “sell to open” function. (More on this later.)

When you sell a put contract, you receive real cash in your account for taking the other side of this trade.

Now you’re potentially obligated to buy shares of stock. Your broker requires you to keep enough cash or margin buying power on hand in case you are required to buy.

That’s why you should only sell put contracts for stocks that you’re willing to buy. And only use the contracts with an agreement price (or strike price) that you’re willing to pay for your stock.

Here’s What Happens To Your Income Play

If the other trader decides not to sell, your put contract will expire. You’ll get to keep the income you received and you can repeat this process over and over agin.

And if the other trader exercises his right and sells you the shares, you’ll be buying shares of stock that you already wanted to own. (And you’ll buy at a price you already agreed on).

Best of all, you’ll still get to keep the income you received when you sold your put contracts. And that income can help to offset any potential pullback in the stock.

A third potential outcome is to buy your put contract back in the market. This is an easy transaction — just use the “buy to close” function in your brokerage account. Make sure that you buy a contract with the same specifications as the one you sold and your brokerage will close the position.

If you’re just learning about this income strategy, it may sound complicated.

But in the next few sections, we’ll cover a bit more on how this income approach works, and how easy it is to use! (Also, you’ll be happy to know you can even use this strategy in an IRA and some 401(k) retirement accounts!)

Selling puts helps me generate investment income for my family. It’s one of my favorite strategies to help build wealth from the stock market. And if you complete one or two trades like this, I’m sure you’ll quickly see why it’s such a powerful tool.

PART II: Finding the Best Income Plays

When searching for the best income plays to use with this strategy, I always start with a watch list of stocks I would like to own. In other words, I only use this strategy for stocks I am confident will trade higher.

It’s a good idea to always have a watch list of companies that you’re following. That way, when it’s time to set up a new income play, you’ve already got a list of great candidates you’ve been researching. (Here’s a link to sign up for a free copy of my current watch list.)

I like to set up income plays when one of my favorite watch list stocks trades with a particular chart pattern. This helps improve the likelihood that the stock will move higher in the near future. Some of these patterns include:

- Cup with handle — I wrote about this pattern here.

- Pullback to support

- Double bottom

- Breakout above resistance

- Oversold rebound

We’ll talk more about these setups in the future. The key is to pick stocks you would want to invest in, and to set up your income play at a time when the stock is most likely to trade higher.

Pay special attention to which industries are in play.

For instance, if the market is facing a high level of inflation, you may want to consider bank stocks, gold miners or producers of tangible items like oil and construction materials.

And when other investors are confident and the market is moving steadily higher, tech stocks can be great candidates for our income plays.

Once you have a stock picked out, the next step is to look at which put contract to sell.

Picking the Right Put Contract

For every active stock traded on U.S. exchanges there are dozens of put contracts to pick from. How do you know which contract to sell?

I have two requirements for my income plays:

- They must be out of the money…

- And they must expire in the near future.

A put contract is “out of the money” if the strike price is below the stock’s current market price.

For example, Schlumberger (SLB) recently closed at $32.24. You could sell a $30 put contract which is “out of the money”

Selling this put contract gives someone the right to sell SLB to you at $30. Since the stock is trading at $32.24, the buyer wouldn’t want to exercise his “right” today. After all, they could get more money by selling at the market price.

So the $30 put contract is considered “out of the money” because $30 is below the current market price for SLB.

Selling a put contract that expires in the near future also works to your advantage. I usually sell put contracts that expire between 3 and 8 weeks in the future.

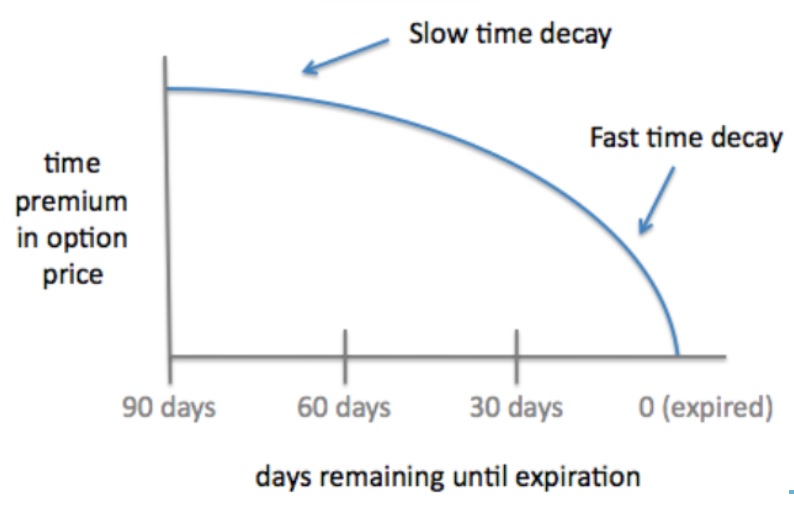

As we get closer to the expiration date, the value of a put contract decreases. This is known as “time decay.”

Think about it this way… You would pay less for an insurance policy that only protected you for a couple weeks. The same holds for the price traders will pay for put contracts.

The closer the expiration date, the faster the value for put contracts deteriorate. Since we sell put contracts to collect income, faster time decay works in our favor.

Eventually we want our put contract to expire (and disappear from our account), or we’d like to buy it back at a lower price. Either way, faster the time decay grows our profits more quickly.

Measuring Our Income Play Ahead of the Trade

To pick the best income plays for our put-selling strategy, you need to be able to calculate the annualized rate of return for selling a put contract.

Remember, selling a put contract is the same as agreeing to buy shares of stock. And your broker will set aside the cash (or margin buying power) in case you’re required to buy those shares.

A wise investor will ask “What am I paid for setting this cash aside?“

You should make sure the put contract pays you an attractive amount of income for the money you’re setting aside. And you must also consider the time until expiration.

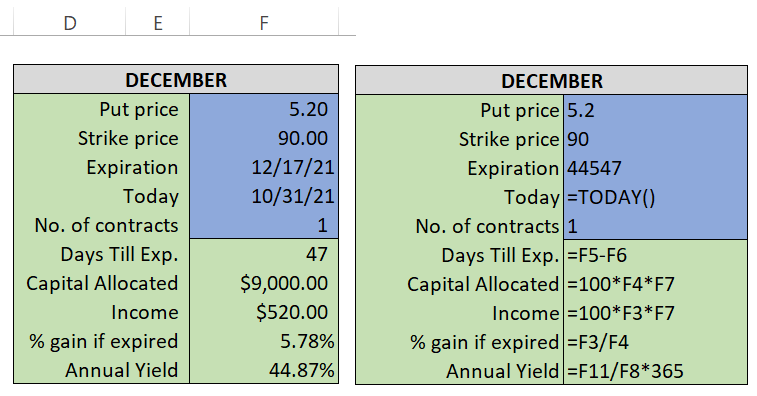

I use a simple spreadsheet to calculate the rate of return for my income plays.

The left side shows the table which calculates a 44.87% annualized rate of return for a specific put contract. And for you excel nerds (like me), I’ve included a table that shows the calculations for each cell. This way you can recreate the table yourself!

(By the way, I give you an income table like this for each new income play that we enter. So you always know our expected return for the income trade that we’re setting up.)

Let’s look at the put contract in the example table above:

- The price is $5.20 for selling the put contract.

- The put contract has a $90 strike price.

- Our contract expires in 47days.

- We must set aside $9,000 for this income play.

- We receive $520 from selling the contracts.

- That $520 represents a 5.78% rate of return.

- The annualized rate of return is 44.87%.

So if we could continually make trades like this with all of our capital throughout the entire year, our account value would grow by 44.87%.

Balancing Risk and Reward

When you calculate the return for different put contracts, you’ll notice some big differences in annualized rates of return. Here are some concepts to help explain (and to help you pick the best contracts).

- The closer the put’s strike price to the actual market price, the more income.

- But keep in mind, this means there’s probably a higher chance the stock could trade below that level.

- The more volatile a stock’s expected price movement, the more income you’ll receive.

- There’s an art to picking plays volatile enough for good income, but plays that are not too risky.

It’s not reasonable to expect every trade to work out perfectly. Some plays lose money. Others may be closed out for smaller gains.

There are also situations where a trade can be closed out early and lock in a higher annualized rate of return.

In the next installment, we’ll discuss putting together a portfolio of income plays. We’ll talk about strategies for getting the max value for each income play. And most importantly, we’ll see how much money you can really make with this strategy.

PART III: How Much Income Can You Make?

So how much income can you REALLY make with this strategy?

Last week I found myself explaining our put-selling income process to Jeff. He’s a new colleague of mine and I was helping him get up to speed on how this strategy works.

After a while, I saw his eyes light up. I love this moment when talking about our put-selling process. There’s always that “aha” expression when it clicks and someone understands how the process works.

Jeff stopped me mid-sentence with an excited look in his eye.

“So how much money can you really make?? Like if I did this one strategy for a full year?”

Of course I explained to Jeff that there are no guarantees… that all investments involve risk… that different seasons in the market can offer different returns (and potential losses).

These are important considerations to cover any time you make an investment. And its especially important to set realistic expectations any time you start thinking about how much income you can make.

So today, I wanted us to take a look at how this strategy could play out in a real portfolio — and help to set some realistic expectations on how much income you can make.

How Much Income Depends…

The amount of income you can make from this strategy really depends on a lot of factors.

Some of these are under your control:

- You can pick more volatile stocks to get more income…

- But selling puts on these stocks also increases your risk.

- You might be a great stock picker with a higher win rate…

- Or you might pick stocks that are more likely to trade lower.

- You could use leverage (borrowed funds) to enter more trades…

- This approach increases both your income AND your risk…

And there are variables out of your control that also affect how much income you can make:

- Sometimes stock prices and the entire market can swing wildly…

- These periods, give you more income from every put contract…

- But there’s also more risk your position will trade lower.

- Interest rates can adjust higher or drop lower…

- These rates affect how much you get from selling puts.

- Unexpected events like fraud, acts of god, and sabotage can hurt your returns.

So it’s clear that I can’t give you a definitive rate of return you can expect from selling puts to collect income. But we can look at some statistics that can help shed some light on how much income you can make.

Rate of Return versus Batting Average

There are two very important factors that affect how much income you can make from our put-selling strategy:

- The potential rate of return for each income trade.

- And your batting average (or win rate) over time.

In our last installment, I showed you one of the tables that I use to calculate the annualized rate of return for each income play I’m considering.

This table gives us the annualized rate of return we can expect if the put contract expires and we are not required to buy shares of stock.

The example I showed included a put contract that carried a potential 44.87% annualized rate of return. And in our current market environment I typically look for trades with annualized rates in the 35% to 55% range.

Yes, that sounds like a very high rate of return for a strategy that is generally very safe. But that’s where the other important factor comes into play.

Not every put contract that we sell will expire. In fact, sometimes the stock we’re selling a put against will trade lower. You must then decide whether to buy the put contract back or let it be exercised.

If the put contract is exercised, that means we’ll be required to buy shares of stock at the agreed upon price.

And if we buy back the put contract, we may have to pay more to close the trade than we received when we initially set up the income play.

Your win rate — or the percentage of plays that expire or are closed out for a profit — can be anywhere from 50% or below, to a win rate above 90%. It depends on which put contracts you sell and how quickly you close a trade out if it starts to move against you.

Active Management to Enhance Your Income

If you decide to use this strategy to generate your own investment income, consider “paper trading” (or simulating trades on paper) to start with.

This will give you a better feeling for how likely different plays are to be winners. You’ll also see how often you will need to close out trades early to cut potential losses (or how often you wind up being required to buy shares of stock).

One way to enhance your overall returns from our put-selling strategy is to close out positions that have already captured most of the potential profit from the income play.

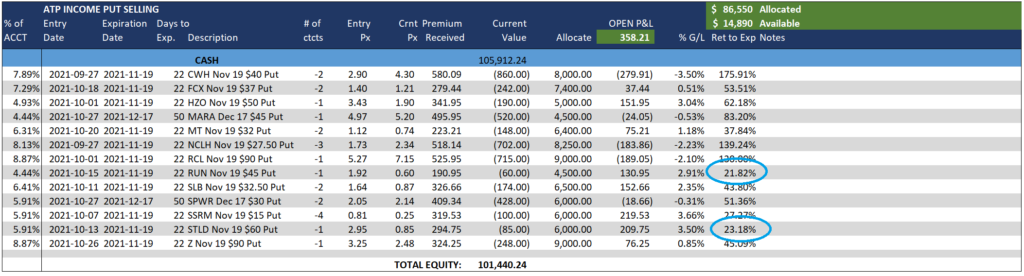

For example, take a look at table of some historical income plays from the beta version of our Accelerated Income Model.

The column on the far right shows the annualized return remaining for each position. I’ve circled two specific plays that have a very low rate of potential rate of return compared to the others.

Both of these positions were set up with much higher rates of return. But the stock moved higher, helping the trades to become profitable very quickly. At the time this screenshot was taken, there wasn’t much potential profit left for either of these positions.

Paying to buy these put contracts and close the position early frees up capital for new plays.

You can then use the capital for new income plays with a higher rate of return. So if you carefully manage your income plays and continually rotate into new plays with higher annualized rates of return, you can increase how much income you can make from this strategy.

More Income Using Leverage

Some traders also accelerate their returns by using margin. Here’s how it works…

When you sell a put contract, your broker sets cash aside. This cash is in case you are required to buy shares of stock. The cash sits in your brokerage account. But your broker uses the cash as collateral for your put agreement.

For margin accounts, brokers are willing to loan you more cash to use for selling additional put contracts. So if you had $50,000 in your account, you may be able to sell put contracts that cover $100,000 or more of stock you’re agreeing to buy.

Please realize that you’re still on the hook for ALL potential losses from these contracts. And your broker may also charge you interest for the margin loan.

Generating extra income from a margin loan can still make sense if you understand the risks and you’re willing to be more aggressive with your income plays. In fact, since our income strategy carries less risk than traditional buy and hold investments (more on that in the next installment) it can be the perfect strategy for using this type of financial leverage.

Just please make sure you understand both the potential rewards — and the potential risks — before using this more aggressive approach.

During healthy market periods, this strategy can generate reliable annualized returns well above 20%. And by enhancing your returns with active management and/or margin loans your returns may be significantly higher.

But even with this reliable income, I believe the true value of this approach lies in how well it can withstand a more challenging market period.

PART IV: What Happens in a Bear Market?

“Never confuse a bull market for brains.”

That’s one of the many phrases my boss and mentor Bill would use when I worked at the hedge fund.

In a bull market, everyone looks like a genius. Especially the speculative (AKA risky) investors. In certain periods, the more you risk, the more money you make!

When markets are surging higher, it’s the careful investors who look like idiots. Because they typically don’t keep up with the market averages — and certainly don’t bet heavily on speculative stocks that are surging higher. Which brings up another Wall Street axiom:

“There are bold traders, and there are old traders… But there are very few old, bold traders.” ~Ed Seykota

We can debate the merits of that statement another day. The key takeaway is that you need a strategy that can survive both bull market environments and bear markets as well.

Because if you give up all of your gains — or all of your capital during a bear market, it really doesn’t matter how much you make when times are good.

That’s why I like our put-selling income strategy so much. It actually has a built-in buffer system that helps protect you from a bear market.

Today, I’m going to show you three ways this strategy can protect your wealth when stocks are trading lower.

Bear Market Advantage #1: A Discount Stock Price

In Part II of this series we talked about selling out-of-the-money put contracts. When you sell these put contracts, you’re entering an agreement to buy shares at a specific price.

And out-of-the-money put contracts have an agreement price (or a “strike price”) below where the market is trading.

Suppose you decide to use our put selling income strategy on a stock that currently trades for $55. You might decide to sell the $50 put contracts that expire in six weeks. And let’s say you receive $3.00 per share for selling this contract.

By selling the put contract, you’re agreeing to buy shares of the stock at $50. And that’s were our first advantage comes in.

If we enter a bear market and the stock could possibly trade 20% lower.

Anyone who bought the stock at $55 and held it through the 20% decline would lose $11 per share. (A 20% decline would push the stock from $55 to $44)

But selling the put contracts obligated you to buy shares at $50. So you missed the first $5.00 of the stock’s slide!

That’s a big reason why I always sell out of the money put contracts. Because this approach gives us some extra buffer even if a bear market causes our stocks to trade lower!

Advantage #2: Offsetting Income

The second advantage for our income approach is tied to the cash you receive every time you sell a put contract.

In the example above, you received $3.00 per share for selling your put contract. So even though you were required to buy shares at $50, you still had an extra $3.00 of income already in your account.

That income add even more of a buffer during bear market periods.

For this particular example, your “breakeven” stock price is actually $47. That’s because you agreed to only buy shares at $50. And you received $3 per share for your agreement.

So a 20% pullback would cause the stock to fall from $55 to $44. That means a normal “buy and hold” investor would lose $11 per share.

But since our income approach gives you a “breakeven” price near $47, you’ll only lose $3 per share with this trade.

Of course this is just a hypothetical example. And a bear market may hit some stocks harder than others.

Still, the basic concept stands. When stocks trade lower, our put-selling strategy holds up much better than a typical buy and hold approach.

Advantage #3: More Income for the NEXT Play

One final advantage kicks in as you continue to use our income strategy throughout a bear market period.

When stocks trade lower, investors naturally look for ways to protect their positions. And that means they’re willing to pay more for option contracts.

Statistically, the “premium price” of option contracts tends to increase significantly during volatile bear market periods. This simply means that an option with the same metrics will be more expensive during a bear market than a similar contract during a more peaceful market period.

Since our approach sells option contracts, higher option prices actually give us more income.

You’ll notice that during a bear market, you’ll get more income for most of the put contracts you sell. And this gives you more of a safety buffer. And of course it’s great to have more income flowing into your account as well.

Now this doesn’t mean that our strategy doesn’t carry risk. You saw in our example that a stock pullback can still lead to losses with your income play.

But with three distinct bear market advantages, this income approach can help insulate your investment account, allow you to keep more of your wealth, and even accelerate your profits thanks to higher income payments.

It all sounds pretty good right?

In the next installment, we’ll talk about the “catch” — or what you’re giving up when you use this income strategy.

PART V: There’s Always a Catch

“There’s no such thing as a free lunch…“

At least that’s what my mom told us as kids. (Typically the statement came right before she pulled out her list of chores for us.)

The statement is usually true with your investments as well. There’s no “free money” in the market. And for the most part, when you hear about strategy or approach that has a special advantage, there’s always a catch.

Even our income strategy that I love so much comes with a price.

Once you understand what you have to give up to collect our income payments, you might decide this strategy isn’t for you.

Or you may agree with me… (I think the income we get from this approach is well worth the price of admission.)

Either way, I want to make sure you’re fully informed before you decide to use this income approach in your own account.

Playing “A-B-C” Baseball

To understand the “catch” behind this income strategy, it helps to use a baseball analogy.

There are baseball teams known for their power hitters. And fans love to go to the ballpark and watch these hitters knock the long-ball out of the park.

On the other end of the spectrum, teams that play “A-B-C” baseball start by getting a runner on base. Then, the next hitter may sacrifice to move him over to second or third base. These teams “manufacture” runs by doing small things right and putting probabilities in their favor.

Power teams win huge games in dramatic fashion when the big hitters connect.

But fundamental teams consistently score runs and usually wind up with a chance to make the playoffs at the end of a season.

As you might have guessed, our income strategy is a lot like the fundamental baseball team.

When you sell a put contract, you’re stepping up to the plate and trying to hit a single or a double. The most you can possibly make is the income you receive from selling your put contract.

So you’re never going to shoot the lights out with any single trade.

Let’s take a look at a recent example.

Always a Catch: MARA Example

Last month I used our income strategy to collect a payment from shares of Marathon Digital (MARA). The company is a cryptocurrency miner and with Bitcoin moving back towards all-time highs, the company’s outlook was strong. Plus, the stock bounced off a key support line (see chart below).

The chart above shows what MARA looked like on October 6th. On that day I sold two MARA put contracts. These contracts had a November 19th expiration date and a $35 strike price. So by selling these shares, I was agreeing to buy MARA at $35 — and my agreement was set to last until November 19th.

I received $3.43 per share for entering this agreement. So with two contracts (each representing 100 shares) my total income was $686 (less commissions).

Given the strong backdrop for the company (with Bitcoin prices rising) I would have been happy to buy shares of MARA at $35. And I was pleased with the $686 of income I received from this trade.

Now, let’s take a look at where MARA stands today…

As you can see, shares of MARA surged higher. Anyone who bought shares of MARA on the day I sold my put contracts could have ultimately made about $25 per share.

I ultimately closed out my trade, buying the puts back at $0.70 and locking in a gain of $2.73 per share — or about $545 for the two contracts. And while I was happy with the income, I didn’t hit a “home run” with MARA.

Balancing Reliability And Big Wins

So is this income approach the BEST way to invest? Or is it better to swing for the fences and lock in bigger profits?

I don’t think there’s necessarily a right or a wrong answer here. And you don’t necessarily have to choose between the two!

(I actually keep an account that I use for aggressive / speculative trades, and another account that I use for generating income with my favorite put-selling approach).

The important take-away from today’s message is that there’s always a catch when it comes to different strategies. You have to give up one thing in order to get something else.

In this case, our income strategy is reliable and can cut down on your investment risk. But it also gives up the potential for much bigger profits if your stock shoots higher.

Understanding the whole picture — including both the advantages and disadvantages — gives you a chance to make an informed decision about whether this approach is right for you.

We’ll keep covering more details about this approach and how to use it in your own brokerage account.

In the meantime, please let me know if you have questions! You can send me an email (Zach@ZachScheidt.com) or reply to any of my trade alerts. I look forward to your feedback!

Here’s to generating reliable income from your favorite stocks,

Zach