Selling YETI puts for income.

Yeti Holdings (YETI) sells specialty outdoor consumer goods like coolers and beverage insulators. We’ve used the stock with our income model previously.

Consumer spending remains strong. And even though consumers are spending more on experiences than merchandise, YETI still benefits as their products go hand-in-hand with outdoor and travel spending.

The stock trades for a reasonable valuation and should move higher as the overall market finds support.

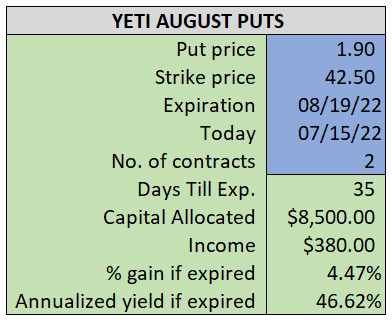

By selling the August $42.50 puts near $1.90, we’re able to collect an annualized yield near 47%, while also giving us roughly $3.20 per share in cushion between the current market price for YETI and our strike price.

- Sell (to open) 2 YETI August 19th $42.50 puts

- Limit: $1.90 or more

- The new position will represent roughly 10.1% of our model.

~~~~~~~~ - 15:03 Execution

- Sold 2 YETI August 19th $42.50 Puts @ $2.05