Greetings from rainy Baltimore Maryland… (Do you know the “Raining in Baltimore” Counting Crows song?)

I’m in “Charm City” for a couple of days to meet up with colleagues and chat about trade ideas and long-term investment opportunities. It’s always nice to get in-person time with my coworkers!

Yesterday I had a middle seat in the back of the plane, which wasn’t bad for a short flight. But I have to say I was surprised at how full the flight was — especially for an off-peak time slot!

It’s an anecdotal observation for sure. But it still adds a little first-person evidence of what I’ve been seeing in my research for some time now.

Travel is hot!

People are willing to spend big bucks to go places. And this is true for both personal AND business travel!

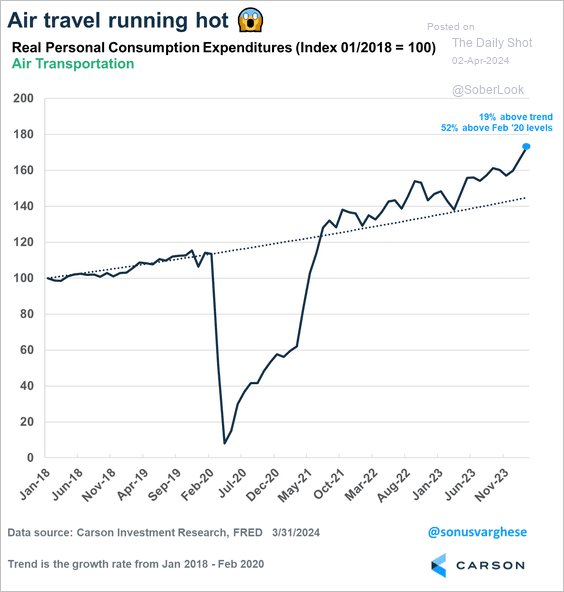

Here’s a chart I came across this morning showing how much Americans are spending on airfare.

It’s clear that after the pandemic, travelers started paying big bucks to get where they want to go.

And this is creating some great trade opportunities across the travel industry.

Let’s take a look at three of my favorite travel stocks in today’s market. Perhaps they can help you book some trading profits to use for your next trip!

Destinations In Focus

While airlines are near capacity and have plenty of pricing power, I’m a little hesitant to invest too much in these stocks. There are too many other variables that are tough to handicap. (Thanks Boeing – ugh!!)

But all the passengers filling up these flights are going somewhere. And many of the companies behind these destinations are reaping the benefits.

One of the names I’m most excited about right now is Wynn Resorts (WYNN).

The luxury casino and resort operator should benefit from a resurgence in conferences, trade shows and other “on-premise” business meetings.

It’s tempting for those of us in the U.S. to think of Wynn’s business as largely tied to the Las Vegas market. But Wynn also has a significant presence in Macau, which has the potential to drive much more profit growth in the year ahead.

Macau is an “Offshore China” location, and was hurt badly by Chinese lockdown policies. But now that China is working hard to resurrect its economy, Wynn’s Macau locations are in great shape!

Both domestic and international profits are helping to boost WYNN’s stock price. And there’s still plenty of room for WYNN to trade higher as investors gain confidence in the Macau rebound.

Full Disclosure: I have a personal position in WYNN as part of my Speculative Trading Program. This is a high-risk / high-potential-reward trading system that taps into trends like the one we’re seeing in the travel industry right now. I’d love for you to follow along with my personal trades with this service!

>> More Info on the Trading Program here <<

Hotels For the Corporate Traveler…

Hotel stocks are also looking very strong right now…

It makes sense as occupancy levels rise and hotel companies have more pricing power.

Higher room rates naturally lead to wider profit margins. But there are other factors in play as well!

Following the pandemic, the labor market was extremely tight. Which meant hotel companies had to compete for workers in what is a generally human-capital intensive industry.

Higher labor costs (and the challenge of training new employees when many were skipping from job to job) cut into profits. But now, wage inflation is less of a problem for hotels, and is offset by higher gains in room rates.

Meanwhile, the potential for a decline in interest rates later this year should also benefit many of these companies.

Lower interest rates help to reduce risk of refinancing hotel buildings. And can also drive more investors into hotel stocks that pay reasonable dividends. (Because these investors are no longer receiving high rates from bonds or savings accounts).

One of the strongest hotel operators right now is Marriott International (MAR). The company operates 1.6 million rooms across 30 different hotel brands. Profits have been growing and Wall Street continues to adjust expectations higher.

Marriott should benefit particularly from business travel — building loyalty with road warriors and offering perks through the company’s rewards program.

Leisure travelers are also booking hotel rooms with Marriott. But I’ve got a better idea to profit from these travelers.

…And Vacation Rentals For Fun!

If you’re taking a trip with your family or a loved one, it can be refreshing to get AWAY from the corporate hotel world and experience a destination in a more personal location.

Airbnb (ABNB) is a great option for this kind of travel, and the stock is certainly benefiting as vacations are booked.

- A wisteria arbor in the back yard…

- That antique mirror on the brick fireplace…

- The quaint porch to enjoy your morning coffee…

Every Airbnb location has its own unique features and personality. Which makes the process of booking a trip all the more adventurous and special.

Airbnb has done a good job of building a reliable business from what has historically been a niche industry for local travelers. And while the stock is a bit expensive compared to profits, Wall Street estimates may prove to be too conservative.

Last month, the stock broke above last year’s resistance levels. The breakout could have a long way to go, and today’s moderate pullback actually looks like a good buying opportunity! (I’ve got my finger on the trigger, and may be setting up a new trade for ABNB soon).

I hope you’re able to book some enjoyable trips with loved ones this year. And I hope some of these travel stock ideas wind up paying for your trip!

Here’s to growing and protecting your wealth,

Zach