Happy Fed Day!!

This afternoon at 2:00 EST, the Federal Reserve will release it’s scheduled statement on interest rate policy. And then at 2:30, Chairman Jerome Powell will answer questions as part of his normal press conference.

Investors aren’t expecting a change in the Fed’s target interest rate this meeting. In fact, it’s almost certain that the Fed will keep interest rates steady at its next meeting as well.

The real question is what will happen in the second half of this year…

Will the Fed cut rates three times? Maybe just twice? Some even believe the Fed will keep rates steady through the end of the year!

Today’s announcement will shed more light on the Fed’s plans for the rest of the year. And one exhibit in particular will be under close scrutiny.

The Dots Tell an Important Story

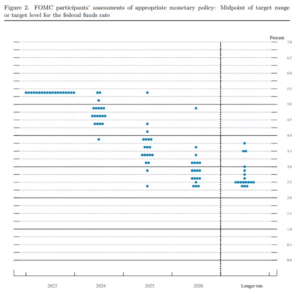

The Fed’s “dot plot” table will be the primary focus of traders today. Here’s a quick snapshot of the current dot plot (ahead of this afternoon’s meeting).

Each dot represents an individual Fed member’s projection for where the Fed’s target interest rate will be at the end of each calendar year.

As you can see, Fed members expect rates to fall a bit in 2024, and then subsequently lower rates through 2025, 2026 and 2027.

Each time the Fed updates its dot plot, investors have to reassess their view on the overall economy, and how the Fed’s policy will affect things.

The current dot plot tells us that on average, Fed members expect to cut rates three times before the end of the year.

But after some hotter than expected inflation readings earlier this month, investors are worried that Fed members will keep rate at their current level for a longer period of time — possibly reducing expectations to just two rate cuts later this year.

So this afternoon, be on the lookout for a shift in the Fed’s dot plot — and also pay close attention to the market’s reaction!

It’s the REACTION That Matters

As an analytical person, I find myself looking carefully at statistics, earnings reports, financial ratios, and other “hard data” pieces of information. And those can certainly be helpful as we make an investment case for various stocks.

But often, the market’s reaction to important information is more telling than the information itself.

If the Fed’s dot plot shows fewer rate cuts are expected this year — but the market rallies following the news, it could tell us something very interesting about other investors’ perceptions.

We could be in a spot where investors are already expecting a delay in rate cuts, and they’ve already built that assumption into their investment decisions.

So once that information is clarified by the Fed, it could give these investors more of an incentive to buy stocks instead of selling them.

On the other hand, if the Fed’s dot plot does not show a delay in interest rate cuts — and the market responds by trading lower — it could signal that investors are worried about a weakening economy.

Bottom line, keep a close eye on the data from today’s meeting (the dot plot specifically). But also be keenly aware of how the market reaction matches (or doesn’t match) the data from the Fed.

I’ll be in touch later this week!

Here’s to growing and protecting your wealth,

Zach