Selling MPC puts for income.

Marathon Petroleum Corp. (MPC) is an energy refiner company with 13 different refineries in the U.S. The company can process 2.9 million barrels of oil per day.

MPC had a strong run early this year as higher margins for oil refiners drove profits.

Shares pulled back in June as investors worried about the recession and the potential for slowing energy demand.

The stock found support near $80 — in line with the 200-day moving average. This is likely to be a long-term support level for MPC as the company still remains very profitable and refineries will continue to operate at capacity for the foreseeable future.

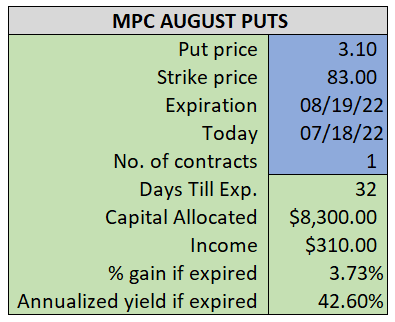

By selling the August $83 puts near $3.10, we’re able to collect an annualized yield near 43%, while also giving us roughly $3.50 per share in cushion between the current market price for MPC and our strike price.

- Sell (to open) 1 MPC August 19th $83 put

- Limit: $3.10 or more

- The new position will represent roughly 9.8% of our model.

~~~~~~~~ - 11:11 Executed

- Sold 1 MPC August 19th $83 Put @ $3.40