Selling CLF puts for income.

Cleveland Cliffs (CLF) is a U.S. steel manufacturer with access to it’s own Iron Ore supplies.

This makes the company more competitive than other steel players who have to import Iron Ore. Plus, CLF is now trading at roughly 6 times next year’s expected earnings.

This makes CLF an important value stock with plenty of room for shares to trade higher.

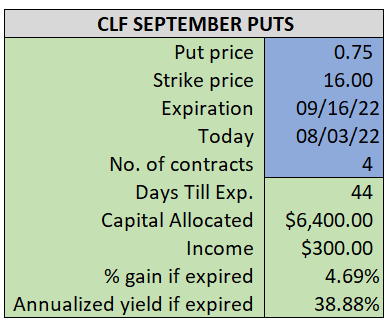

By selling the September $16 puts near $0.75, we’re able to collect an annualized yield near 39%, while also giving us roughly $1.20 per share in cushion between the current market price for CLF and our strike price.

- Sell (to open) 4 CLF September 16th $16 puts

- Limit: $0.75 or more

- The new position will represent roughly 7.3% of our model.

~~~~~~~~ - 13:24 Executed

- Sold 4 CLF September 16th $16 puts @ $0.80