Selling NCLH puts for income.

Norwegian Cruise Lines (NCLH) is the world’s third-largest cruise company.

The stock has been under pressure during the pandemic period as cruise ships were originally shut down and since then have faced challenges getting their businesses back up and running.

But in today’s market, affluent consumers are spending more on travel and leisure. Cruises are being booked, and revenue is picking up.

Shares traded lower this week after the company announced results for the second quarter. The company doesn’t expect to reach pre-pandemic occupancy levels until Q2 of next year.

NCLH is also facing higher labor and fuel costs.

But some of these inflation factors are starting to ease which should help NCLH get back to profitability sooner rather than later. The stock is now rebounding following its drop and should benefit from strong consumer spending on travel.

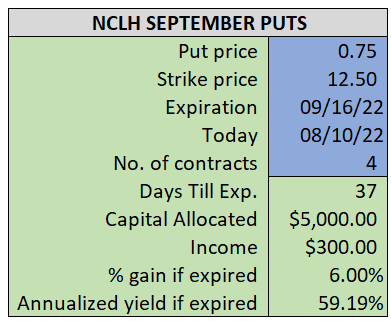

By selling the September $12.50 puts near $0.75, we’re able to collect an annualized yield near 59%, while also giving us roughly $0.75 per share in cushion between the current market price for NCLH and our strike price.

- Sell (to open) 4 NCLH September 16th $12.50 puts

- Limit: $0.75 or more

- The new position will represent roughly 5.7% of our model.

~~~~~~~~ - 10:44 Executed

- Sold 4 NCLH September 16th $12.50 puts @ $0.75