Selling AMD puts for income.

Advanced Micro Devices Inc. (AMD) designs processors for computers and consumer electronics.

As supply chains improve, AMD’s overall business should pick up. Shares bounced sharply from their summer lows and could have a good bit farther to run.

AMD’s profits are much more stable than other companies in the industry. Earnings are expected to hit $4.36 per share this year and grow substantially in 2023 and 2024.

The stock trades at a fair valuation compared to expected profits. So I expect any pullback from this level to be shallow and short-lived.

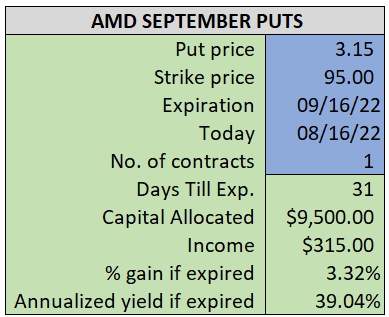

By selling the September $95 puts near $2.90, we’re able to collect an annualized yield near 36%, while also giving us roughly $4.75 per share in cushion between the current market price for AMD and our strike price.

- Sell (to open) 1 AMD September 16th $95 put

- Limit: $2.90 or more

- The new position will represent roughly 10.6% of our model.

~~~~~~~~ - 11:58 Executed

- Sold 1 AMD September 16th $95 put @ $2.93