Selling PYPL puts for income.

Shares of PayPal (PYPL) rallied sharply after the company’s last earnings report.

Consumer payments continue to generate profits for PYPL and the stock trades at a reasonable valuation compared to growth prospects.

Shares pulled back Friday as the overall market weakened. But the stock is still holding up well above it’s pre-earnings levels and key technical support.

This pullback gives us a great opportunity to set up a new income play with our put-selling strategy.

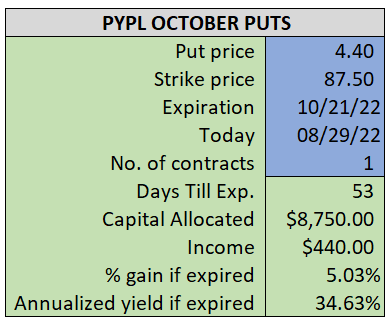

By selling the October $87.50 puts near $4.40, we’re able to collect an annualized yield near 35%, while also giving us roughly $5.00 per share in cushion between the current market price for PYPL and our strike price.

- Sell (to open) 1 PYPL October 21st $87.50 put

- Limit: $4.40 or more

- The new position will represent roughly 10.1% of our model.

~~~~~~~ - 10:17 Updating limit price to $4.10

~~~~~~~ - 10:23 Executed

- Sold 1 PYPL October 21st $87.50 put @ $4.22