Selling CF puts for income.

CF Industries (CF) is a global fertilizer manufacturer.

There continues to be a supply / demand imbalance for grain thanks to Russia’s invasion of Ukraine which is impacting global food supplies.

CF is a deep value play as the company is expected to earn $13.02 per share next year, and the stock is trading near $92.50. In other words, investors are paying just over 7 times expected earnings for this stock.

Shares are moving higher this week after a pullback to support. This move will likely send the stock back to previous highs which sets up a good opportunity for us to collect an extra income payment.

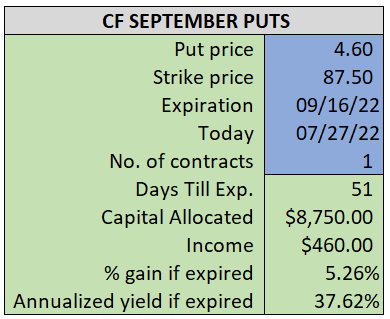

By selling the September $87.50 puts near $4.60, we’re able to collect an annualized yield near 38%, while also giving us roughly $5.00 per share in cushion between the current market price for CF and our strike price.

- Sell (to open) 1 CF September 16th $87.50 put

- Limit: $4.60 or more

- The new position will represent roughly 10.3% of our model.

~~~~~~~~ - 11:28 Executed

- Sold 1 CF September 16th $87.50 put @ $4.60