Welcome to the Arete Trading Program!

[Quick note… The “Arete Trading Program” — or ATP — is just a placeholder name for now. It may change before offering the program to the public.]

I’m glad you’ve joined us and I look forward to your feedback!

You’re included in this “beta version” because you’re a close friend and/or colleague of mine. I’m grateful that you’re willing to take a look at the program, the education materials, the watch list and live trades. And I’m especially grateful for your feedback!

I’ve been working on creating this program for a while now. It’s taken some trial and error to get it to where I’m comfortable sharing it publicly.

I’ll be in touch with you over the next few weeks to get your candid feedback. Please remember that I’m not licensed to give individual investment advice and the trade ideas are intended for a broad audience and not as an individual recommendation for you personally.

Let’s jump in to the trading program!

The Quick-Start Essentials

I know you’re ready to get started!

So instead of a long, tedious introduction, I’ll give you the essential basics first. Then in the following sections I’ll explain more details.

You can jump to specific areas of the manual using the links below:

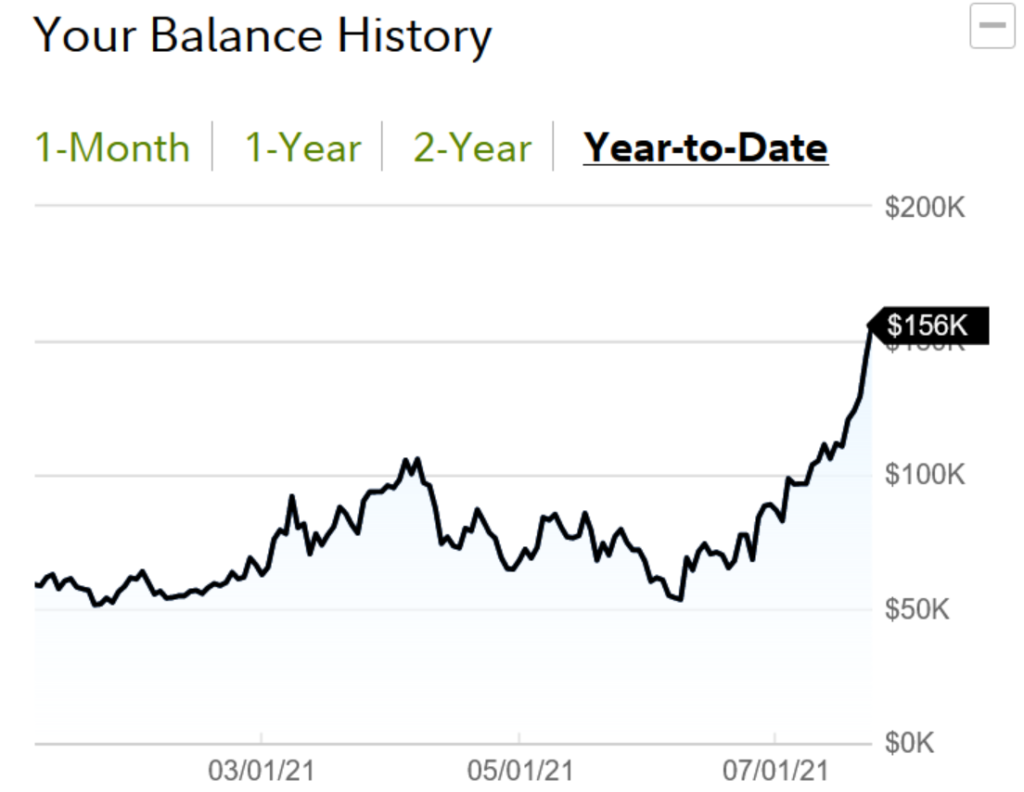

This summer I used the program with one of my own accounts to nearly triple its value in a short time.

Of course past performance is not a guarantee of future returns. This was a live real-money account, using the most aggressive ATP model trades.

All trades and investments involve risk. And there will be some periods where our trades generate profits quickly and some periods of treading water or even losses.

But I wanted to show you the example above to show just how powerful this approach can be when profits start accumulating.

The Arete Trading Program includes two separate modules that have very different characteristics.

- An aggressive (or “speculative”) trading approach. This module takes more risk and shoots for large percentage returns in short periods of time.

- A conservative (income-generating) strategy. This module is designed to minimize risk and capture reliable income payments that accumulate month after month.

Using a “barbell approach” you can combine these two approaches to set up a portfolio of trades that fits best with your risk tolerance and your investment goals over time.

We’ll talk more about different allocations you can consider for your own investments in the sections below. As you get started, consider using a small amount of capital with each of these models so you can become familiar with how they work and what kind of returns to expect.

The Speculative Trading Model

For the Aggressive (or speculative) trading approach, we use in-the-money call and put option contracts to make trades both for stocks we expect to trade higher and for stocks we expect to trade lower.

By choosing in-the-money contracts, our contracts will follow a stock’s price movement closely when the stock is moving in our favor. So for every dollar the stock moves higher (for our call contracts) or lower (for our put contracts) we expect to get almost a full dollar per share of profit.

On the other hand, these call and put contracts move less when stock prices trade against us. So for every dollar the stock moves lower (for our call contracts) or higher (for our put contracts) we expect our option contracts to generate materially LESS than a dollar per share of losses.

So these aggressive positions are designed to accelerate profits when our trades work out, and mute losses for trades that don’t.

Your membership includes access to a model portfolio of these trades along with real-time trade alerts when we make changes to this model.

The model starts with $100,000 each quarter. If you wish, you can use this model as a guide for investing your own capital — or you can pick and choose which trades appeal to you.

We’ll explain more details about this strategy, the specific option contracts we use, stock selection and other variables in the sections below.

The Income Trading Model

For the more conservative income side, we use an actively managed put selling strategy where we collect income from stocks we believe will hold their value or trade higher.

When you sell a put contract, you’re essentially creating an agreement with another trader.

The buyer of a put contract has the right to sell shares of stock to another trader at a specific price.

So when you sell a put contract, you’re taking the other side of that agreement. And you’ll receive an income payment for entering this agreement.

The buyer will have the right to sell shares to you at a specific price.

You should keep cash or margin buying power available in case you’re required to buy these shares.

The model sells put contracts on stocks that we would be willing to buy, and uses price points that we would be willing to pay for the stock.

Our goal with each trade is to have the put contract “expire” without requiring us to buy shares.

We always get to keep the income we receive from entering the agreement and once the contract “expires” or is bought back (to close the trade) we can then use our capital to sell new contracts and collect more income.

We’ll explain more details about this strategy in the section below.

This income approach has been proven to carry less risk than buying shares of the same stocks outright. And it’s a conservative way of generating relatively high levels of income from your investment capital.

Included in Your Membership

Your membership to the Arete Trading Program includes the following:

- Real-time alerts ahead of any buy or sell transactions for both speculative and income trades.

- A model portfolio of speculative trades updated daily and whenever new trades are made.

- A model portfolio of income plays updated daily and whenever new trades are made.

- Our watch list of speculative and income candidates updated weekly and whenever new stocks are added to the list.

- Regular commentary on our portfolios and watch lists, typically through a video alert that includes charts and other visuals.

- Question and Answer sessions so you can get clarification on our strategy, positions in either of the models or questions about allocations. [Please note, no personalized investment advice will be offered.]

Materials will be posted on this site, and you can also sign up to receive real-time email alerts.

Please note this program is private and the trades are proprietary. Do not share the information with any third party.

If you have a friend or colleague you think would be interested in joining the group please let me know. Once this program is offered to the public I would be happy to provide discounts and/or extended membership periods for any of our beta testers who introduce new traders to the group.

That should be enough to get you started.

Again I sincerely appreciate your feedback on this program. Good, bad or indifferent, it helps me to know what your initial reaction is to this material. Send me an email (Zach@ZachScheidt.com) and lets talk about your experience!

Now, let’s jump into the details of these two different modules.

The Speculative Trading Model

Our Speculative Trading Model takes aggressive trades on specific stocks that we expect to move higher or lower.

The trades are designed to have an asymmetric risk profile skewed to give us better returns when we’re right, and less risk when we’re wrong.

You could compare this strategy to a high-rise building where each story above represents more profit.

Our approach is designed to take the elevator up when each specific trade is successful. And for trades that don’t work out as planned, we will take the staircase to lower levels.

So the DNA of this model creates gains that accelerate quickly, and losses that decelerate as a position moves against us.

To create trades with this risk / reward profile, we use option contracts.

Option contracts have a bad reputation in some investment circles. Many believe that these contracts are too risky — and used recklessly they can be too risky.

But just like any tool, when used properly options can be very effective in growing your wealth.

We’ll start with a quick overview of what option contracts are and how they work.

Next, we’ll cover the specific options we use for our ATP Speculative Model.

If you’re a seasoned trader and already understand the basics of option contracts, you may want to skip ahead to the “Selecting Contracts with Great Reward-to-Risk Qualities” section.

Calls and Puts — the Basics of Option Contracts

At their most basic level, option contracts are exactly what their name implies…

- A contract between two different traders…

- Giving you an option to buy or sell shares of stock.

Option contracts are divided into two main categories. Calls and Puts.

Owning a Call Contract gives you the right to buy shares of stock at a specific price.

Owning a Put Contract gives you the right to sell shares of stock at a specific price.

Both call contracts and put contracts trade on an exchange just like shares of stock. So there is nearly always a listed price for buying or selling one of these contracts. And there are option contracts available for most all widely traded stocks.

For each stock, there can be dozens (or even hundreds) of different option contracts. The difference between these contracts depends on a few key features that are pretty easy to understand once you get used to them.

In addition to the difference between calls (the right to buy shares) and puts (the right to sell shares), there are a few other key factors.

The expiration date tells us how long an option contract is in effect.

When you buy an option contract, there’s a limited amount of time that you have a right to buy or sell your shares. Once the expiration date passes the contract “expires” and you no longer have the right to buy or sell shares.

Traditionally, each stock has had option contracts that expire on different months. And the monthly option contracts expire when the market closes on the third Friday of each month.

More recently, exchanges have listed weekly option contracts that expire on Friday of each week. For the most liquid stocks, there are usually 3-4 different choices for this Friday, the Friday one week from now, the Friday two weeks from now and so forth…

An option contract’s strike price represents the price you’ll be able to pay for your shares of stock if you buy a call contract… or the price you’ll be able to receive for your shares if you own a put contract.

Remember, call options allow you to buy shares of stock for an agreed upon price. That price is the strike price. The same term is used when you buy a put contract (giving you the right to sell shares at the strike price).

For actively traded stocks there are dozens of different strike prices available. So you can pick a contract with a strike price near where the stock is trading today… or one with a strike price that is well above (or well below)where the stock is currently trading.

As you’ll soon see, your choice of which strike price and which expiration date you’ll use can make a very big difference in how much profit you can accumulate, and how reliable your trades will be.

It’s important to note that each option contract represents 100 shares. So when you buy a call contract, you’re buying the right to purchase 100 shares of that stock.

Buying and Selling Option Contracts For Speculative Profits

Option contracts are bought and sold on an exchange very much the way stocks are bought and sold every day.

Typically, traders start by buying a contract to open a new position. For every option contract traded on the market, there’s a market price that you’ll have to pay to buy that contract — and/or a market price for selling the contract when you’re ready to do that.

Market prices are listed on a per share basis. But remember, every contract represents 100 shares of stock.

So you’ll need to multiply the listed price by 100 to calculate the full amount you’ll pay to own this contract.

Let’s assume you want to buy a call option contract for Facebook Inc. (FB).

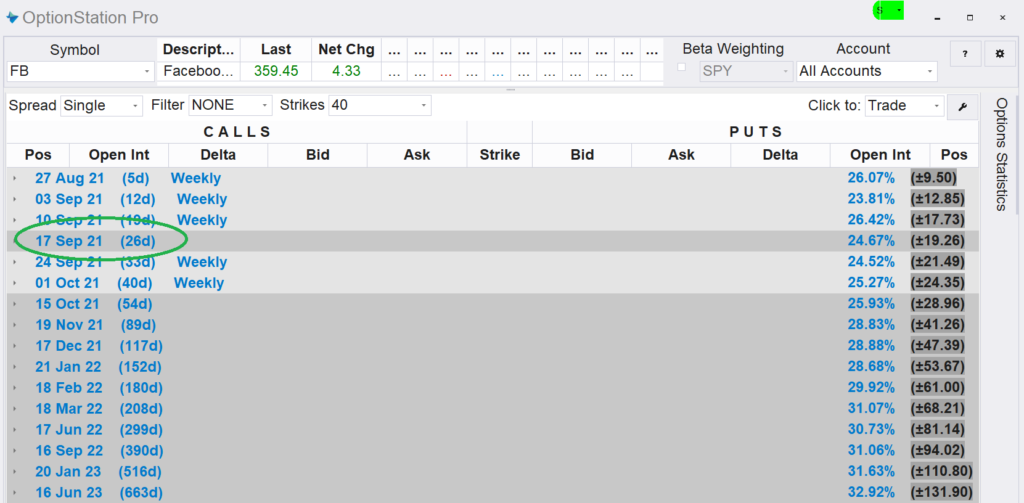

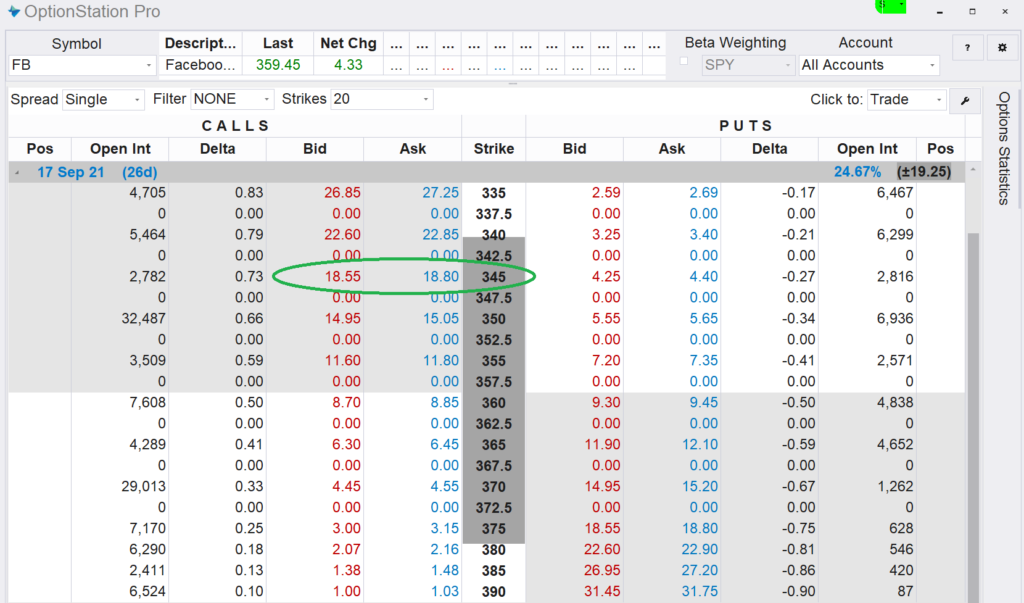

You can use any online brokerage or investing website to pull up an options chain for the stock. Below is a screenshot of a trading platform I use, showing some of the expiration dates available for FB. (We’ll be looking specifically at the September 17th options for this example).

With this platform, I can simply click on any specific date to get more details on which option contracts are available to buy. In other platforms, there may be a dropdown menu to select an expiration date or a similar feature to find the contract you’re looking for.

Once I select the September 17th expiration date, I’m able to see the different contracts that are available for me to buy.

Note in this example that the strike prices are listed in the center of this table, with market prices for call contracts on the left, and market prices for put contracts on the right.

I’ve highlighted the Facebook September 17th $345 call contracts to show you how to select one specific contract.

Notice that there is a “bid price” and an “ask price” for each contract. This tells you what price you can expect both for buying and for selling this contract.

The “bid price” is the price a market maker is “bidding” for the specific contract. So if you’re selling, you know there is a trader willing to take the other side of your transaction at the bid price. In other words, you can sell a FB September 17th $345 call contract at $18.55 per share right now.

The “ask price” is the price a market maker is “asking” for the same contract. So if you’re buying, you know there is a trader willing to take the other side of your transaction at the ask price. In other words, you can buy a FB September 17th $345 call contract at $18.80 per share right now.

Don’t forget, each contract represents 100 shares. So if you buy this contract at $18.80, you’ll be paying $1,880 (plus any fees or commissions) for each contract.

Once you own a contract, it’s easy to sell by selecting the very same contract and choosing the “sell” feature in your brokerage account. Most accounts make it even easier by allowing you to simply click on your position and then hit “sell” to make sure you’re selling the right contract.

One final thing to keep in mind is that some brokerages require you to designate either “to open” or “to close” when placing an option trade.

“To Open” simply means you’re buying a new contract that isn’t currently in your account. So you’re opening a new position. (Select this even if you’re buying an additional contract to go along with other identical contracts you may already own in your account.)

“To Close” means that you’re closing out one or more of the contracts you already hold in your account.

This designation helps the exchanges keep track of how many contracts are actually held between different traders.

Option Prices and How They Change

[Quick Note: In this section we’re going to get into some academic details of how options are priced. You don’t NEED to understand these details to follow along with our Speculative Trading Model. So it’s fine to skip this section if you’re not interested. I’m including the information to help you understand how we select our call and put contracts to get higher profits and lower risk.]

Market prices for buying and selling your option contracts depends on a few different variables. Option prices are tied to the price of the underlying stock. But there are some important nuances for how these prices are connected.

“In the Money” Option Contracts

The first thing to note is whether an option contract is “in the money” or “out of the money.”

An option contract is considered “in the money” if there is value in exercising your option to buy or sell shares at the agreed upon price.

Remember, call contracts give you the right to buy shares of stock at a certain price.

If you have the right to buy shares at $50 and the market price is $60, you can use your right to buy 100 shares at $50 and then sell those shares in the open market at $60. You’ll pocket $10 per share (or $1,000 per 100-share contract) for this transaction.

So with call contracts, an option is “in the money” if the stock’s market price is above the options strike price.

For put contracts, an option is “in the money” if the stock’s market price is below the options price.

That’s because if you have the right to sell shares at $50, but the market price for that stock is $40, you could buy shares today at the market and immediately sell them at $50. Again, you’d pocket $10 per share or $1,000 per 100-share contract.

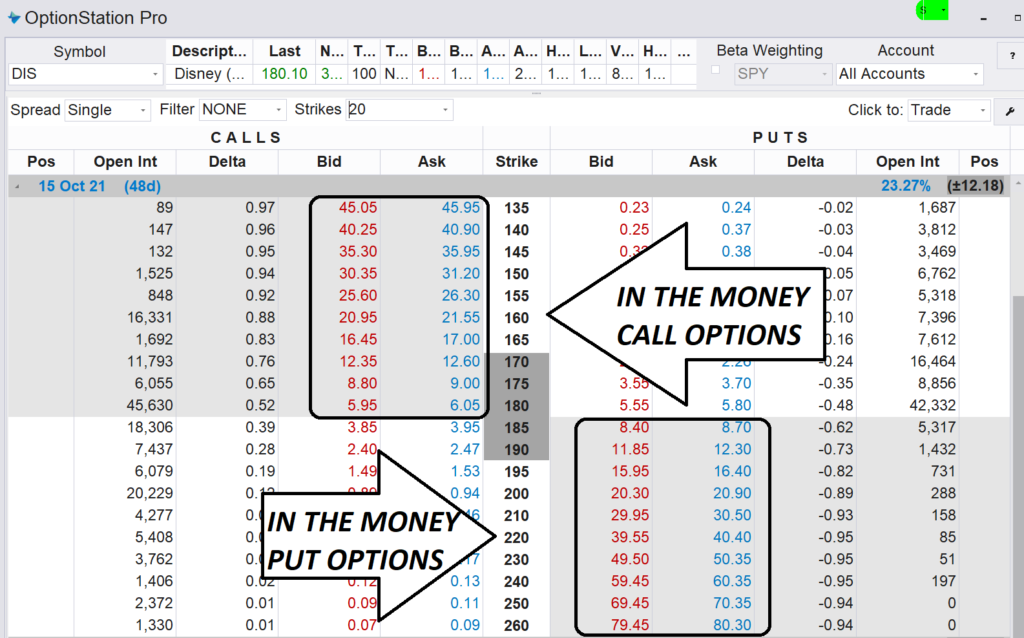

In the table below, you can see a series of Disney (DIS) option contracts for the October 15th expiration date. Disney is currently trading just above $80 per share.

Notice that call options with a strike price below the current $180.10 market price for DIS are “in the money.” And put contracts with a strike price above the $180.10 market price for DIS are also “in the money.”

Option contracts not “in the money” are considered “out of the money.” We’ll discuss some of these contracts when we talk more about our conservative income approach.

For our more aggressive Speculative Trading Model positions, we will focus on “in the money” option contracts because of the unique way that option prices react to movements in the underlying stock price.

Two Values in an Option Price

The market price you’ll pay to buy a call contract or a put contract can be divided into two categories:

- Intrinsic Value — The value of a contract if it were to be exercised right now.

- Extrinsic (or Premium) Value — The additional cost of a contract above its intrinsic value.

Let’s look at an example to see both of these values in play.

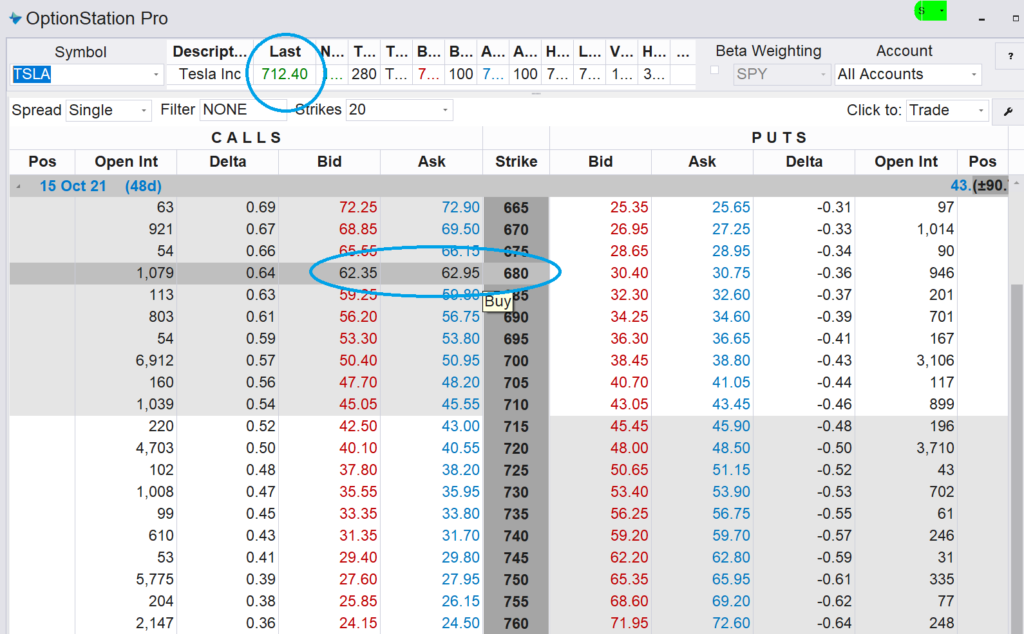

Here is a screen shot of Tesla Inc. (TSLA) option contracts set to expire on October 15th. At the time of writing there are 48 days left until expiration.

Notice the market price for TSLA stock is $712.40. I’ve highlighted the $680 call contracts which can be bought for $62.95.

First, let’s calculate the intrinsic value for the TSLA $680 call contract.

- These calls give you the right to buy shares of TSLA at $680.

- You can sell those same shares at the market price of $712.40.

- Your profit on this transaction would be $32.40 — this is the intrinsic value for the call contracts.

If the intrinsic value is $32.40 and the market price to buy these call contracts is $62.95, that means the extrinsic value — or premium is $30.55 per share.

This is the extra amount you have to pay on top of the underlying value of your option to buy at $680 and sell at $712.40. Traders are willing to pay this higher premium because there’s a chance that shares of TSLA could trade higher between now and when the October calls expire.

So at some point in the future, the intrinsic value could be much higher. And that’s the reason traders are willing to pay a market price above the intrinsic value to buy a contract.

The amount of premium varies depending on how volatile traders expect a stock price to be, how much time is left until the option contract expires, and a few other variables.

For put contracts we can use a similar calculation.

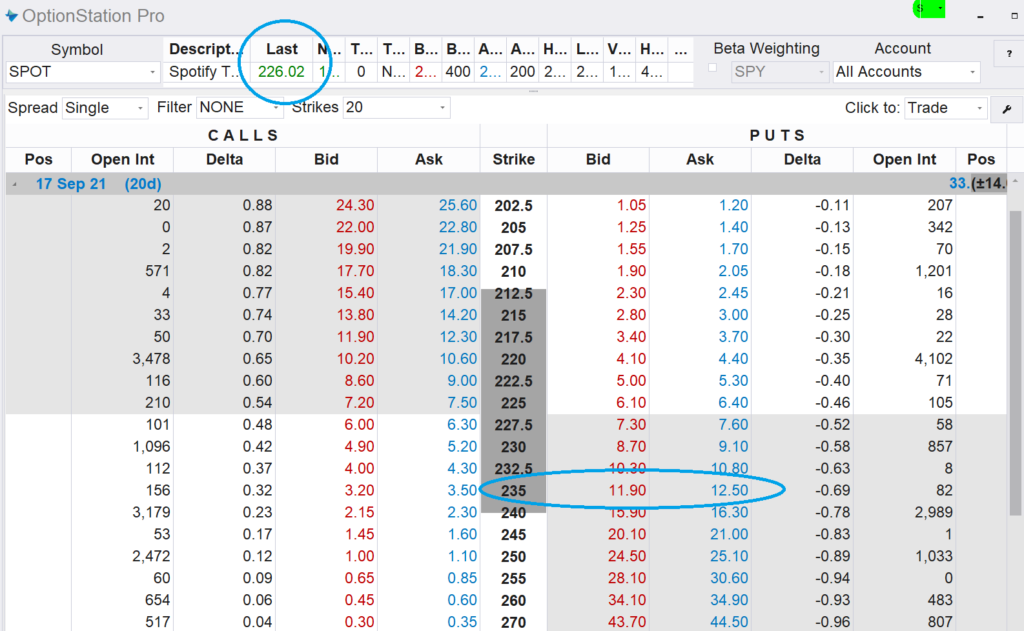

Here is a screen shot of Spotify Tech (SPOT) option contracts set to expire on September 17th. At the time of writing there are 20 days left until expiration.

Notice the market price for SPOT stock is $226.02. I’ve highlighted the $235 put contracts which can be bought for $12.50.

First, let’s calculate the intrinsic value for SPOT $235 put contract.

- These calls give you the right to sell shares of SPOT at $235.

- You can buy those same shares at a market price of $226.02.

- Your profit on this transaction would be $8.98 — this is the intrinsic value for the put contracts.

If the intrinsic value is $8.98 and the market price to buy these put contracts is $12.50, that means the extrinsic value — or premium is $3.52 per share.

These different values are important for selecting which contracts to use for our aggressive trades.

Now that we’ve covered some of the basics for how option contracts are priced, let’s look at the best plays for our ATP Speculative Model trades!

Selecting Contracts with Great Reward-to-Risk Qualities

Remember how we talked about positions that “take the elevator higher” when they’re profitable, and “take the staircase lower” when they don’t work out?

The way we set up these favorable reward-to-risk trades is by choosing in the money option contracts that will give us the most benefit, and at the same time will help to buffer our potential risk.

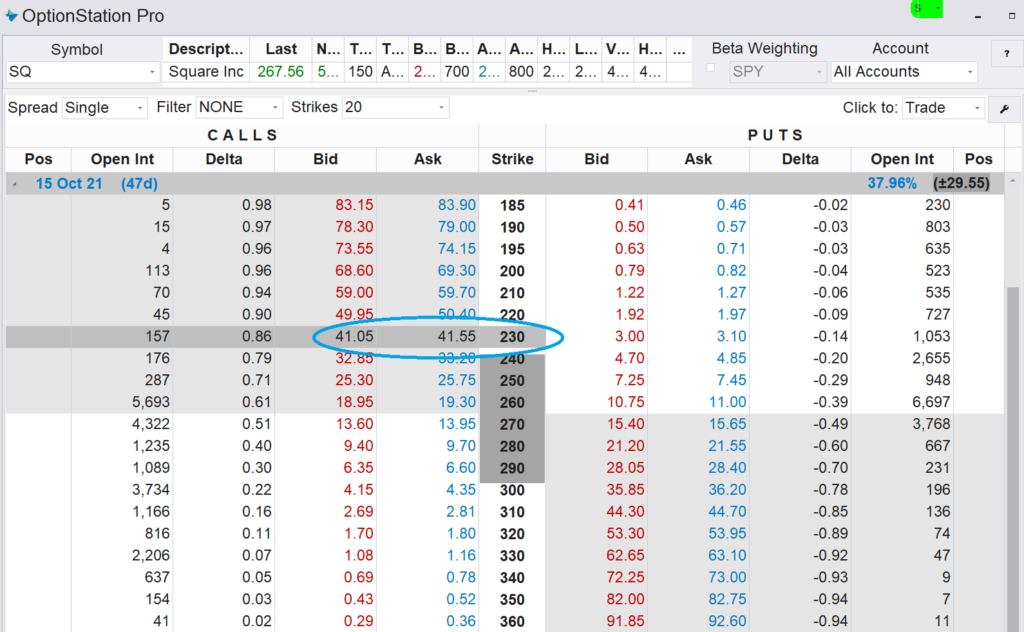

Let’s take a look at some call contracts for Square Inc. (SQ) to see how these trades work.

Assume we expect shares of SQ to trade higher.

We could buy call contracts for SQ today and if the stock trades higher our call contracts should increase in value. You can see in the option chain below, we can buy the October $15th $230 call contracts at $41.55 per share (or $4,155 per call contract).

Since the stock is currently trading near $267.56 we know that these $230 call contracts have an intrinsic value of $37.56. That’s because SQ is $37.56 in the money (or $37.56 above the strike price) for this call option.

Which also means that we’re paying an extra premium of $3.99. The two values add up to the market price of $41.55.

Let’s assume we’re expecting the stock to move about $30 in our favor. But there’s also a risk that SQ could decline by $30 per share as well.

The current option chain gives us some good clues for what to expect if either one of these scenarios were to happen.

First, let’s start with the positive scenario.

If SQ were to trade $30 higher, we know that our call contract would go from $37.56 in the money right now — to $67.56 in the money after the stock’s rally.

So what would the price be for an option that is $67.56 in the money? We can look at the current option chain to get a good idea of what that price would be!

Notice the SQ October 15th $200 call contract circled in green. That’s the contract that is currently $67.56 in the money. And we could sell that contract near the bid price of $68.60.

Of course there could be other factors involved (such as time decay, a change in the stock’s volatility and trader expectations). But a rough calculation shows us that if the stock were to move $30 in our favor, we should be able to sell our option contract close to $68.60 per share.

That would give us a profit of $27.05 per share — or $2,750 per contract.

So you can see that on a dollar-for-dollar basis, this trade could capture about 90% of the price move that shares of SQ made. We only had to invest $41.55 per share (instead of the $267.56 per share that buying the stock outright would have required). And in total, the trade would have resulted in a 65% gain on our investment.

Now that we’ve seen what a successful trade could look like, let’s consider what a decline in the stock would do to our position.

If SQ were to trade $30 lower, we know that our call contract would go from $37.56 in the money right now — to just $7.56 in the money after the stock’s slide.

Once again, we can look at the current option chain to get a good idea of how a call contract that is only $7.56 in-the-money would be priced.

Notice the SQ October 15th $260 call contract circled in green. That’s the contract that is currently $7.56 in the money. And we could currently sell that contract near the bid price of $18.95.

Once again, there could be other factors involved. When a stock drops, traders are often willing to pay a higher premium for call contracts because volatility is expected to be higher. But let’s use the current $260 call price of $18.95 as a reasonable level for selling our SQ call contract that is just $7.56 in the money.

Selling our calls at $18.95 would leave us with a loss of $22.60 per share — or $2,260 per contract.

You can see that on a dollar-for-dollar basis, this contract would lose about 75% of the negative price move for shares of SQ.

That’s because the closer the strike price is to the market price, the more premium is included in the price.

So even when shares move in the opposite direction from what we expect, we’re still insulated from some of the losses which helps to reduce our overall risk.

If you flipped a coin and I paid you $90 for every time the coin landed on heads — and charged you $75 for every time it landed on tails, you’d take as many flips as possible!

That’s the type of reward-to-risk scenario we try to set up with each of our ATP Speculative Model trades.

Except instead of a coin flip for which stocks to play, I’m using more than two decades of trading experience along with data from many different research services to pick out the stocks I believe have the highest probability of trading in our favor.

The Same Reward-to-Risk From FALLING Stocks

Keep in mind, we can use the mirror approach with put contracts to profit from stocks we expect to trade lower.

This is an extremely important tool because too many investors lose a large portion of their wealth during bear markets.

But using our ATP Speculative Model trades to profit from falling stocks can help to minimize your risk when markets are weak – and even lead to overall profits when most other investors are playing defense.

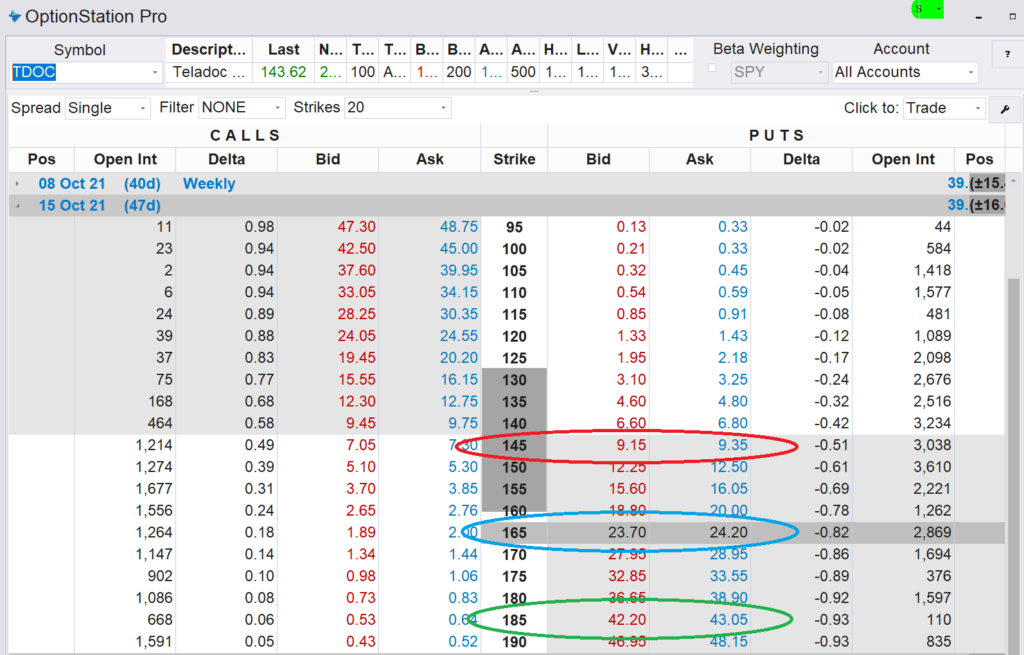

Take a brief look at the option chain below to see how put contracts can offer the same reward-to-risk benefits that we saw with our Square Inc. (SQ) example above.

The option chain above is for shares of Teladoc Health (TDOC). Let’s assume that we expect TDOC to trade $20 lower. We’ll buy the October $165 puts at $24.20 to profit from this move.

Since shares of TDOC are trading at $143.62 (see the header portion of the screenshot), our $165 put contracts are $21.38 in-the-money. That means the contracts have $21.38 of intrinsic value and an additional $2.82 of premium value.

If our research pans out and TDOC trades lower by $20 the put contracts will be $41.38 in-the-money.

Looking at the table above, we can see that put contracts $41.38 in-the-money can be sold for $42.20. Assuming we could sell our put contracts for a similar price, our profit per share would be $18. Once again, we’re expecting to capture about 90% of the stock’s move in our favor.

On the other hand, if TDOC shares moved $20 higher, the put contracts would only be $1.38 in-the-money. And looking at our table above we can see that put contracts that are currently $1.38 in the money can be sold for $9.15.

Assuming we could sell our put contracts for a similar price, our loss per share would be $15.05. This represents a 62% loss from our $24.20 entry price.

While no one wants to see a trade move against them like this, it’s encouraging to see that we would lose significantly less from a losing position than we would gain from our wins.

Another word of caution here… As you can see in the examples above, the percentage gains and percentage losses for any individual positions can be relatively big.

It’s not out of the ordinary for positions like this to gain 50% or more in a short period of time. Some of these option trades will even double or triple over a few days or a few weeks.

At the same time, it’s also not unusual for any one trade to decline by 50% or more. Which is why you should always use caution when investing in these trades and not risk more than you can afford to lose.

Investing a small amount into many different aggressive trades will help to reduce the amount of risk you’re taking with your wealth, while also giving you more shots at booking larger profits from some of the more exceptional wins that occur.

Using our Speculative Trade Model With Your Account

As a member of the Arete Trading Program, you have real-time access to our model of aggressive trades.

This model begins each quarter with a base of $100,000 and typically holds 8-10 aggressive option trades at any one time.

The account is a real-money live brokerage account that I have set up to keep track of our speculative trades.

[Important Note: The live trading account creates benefits and risks to you as a member of this group. On the positive side, trading a live account gives us a chance to report trade results that are executed in a live market. So the information on entry and exit prices can be more in-line with what you can expect to receive in your own trading account.

On the negative side, suggesting a trade idea to you and then buying that same position in my own account creates a conflict of interest. I may have more of a bias with my communication due to the fact that I have my own money invested in trades we’re discussing.

My process is to send out trade alerts to members five minutes before entering the trades in my own account. This is an attempt to give our members first access to trade opportunities while still executing our own trades in a timely manner so as to provide accurate and timely pricing for our model portfolio.

You should always do your own due diligence on any trade you execute in your own account and you are ultimately responsible for determining appropriateness for your own financial situation.]

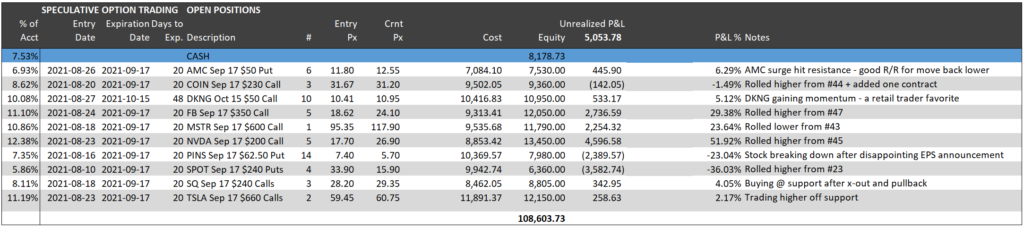

Below is a sample screenshot of open positions for our Speculative Trade Model.

Each position is listed with important details that can be helpful for you when considering adding these trades to your own brokerage account.

On the left, we list the size of the position calculated as a percentage of the overall ATP Speculative Trading Model. You can choose to mimic the sizing in your own speculative account, or go with position sizes that are larger or smaller. Do what makes sense for your own financial picture.

Whenever a new position is taken — or an existing position is closed — we post a trade alert on our website. If enabled, you can also .

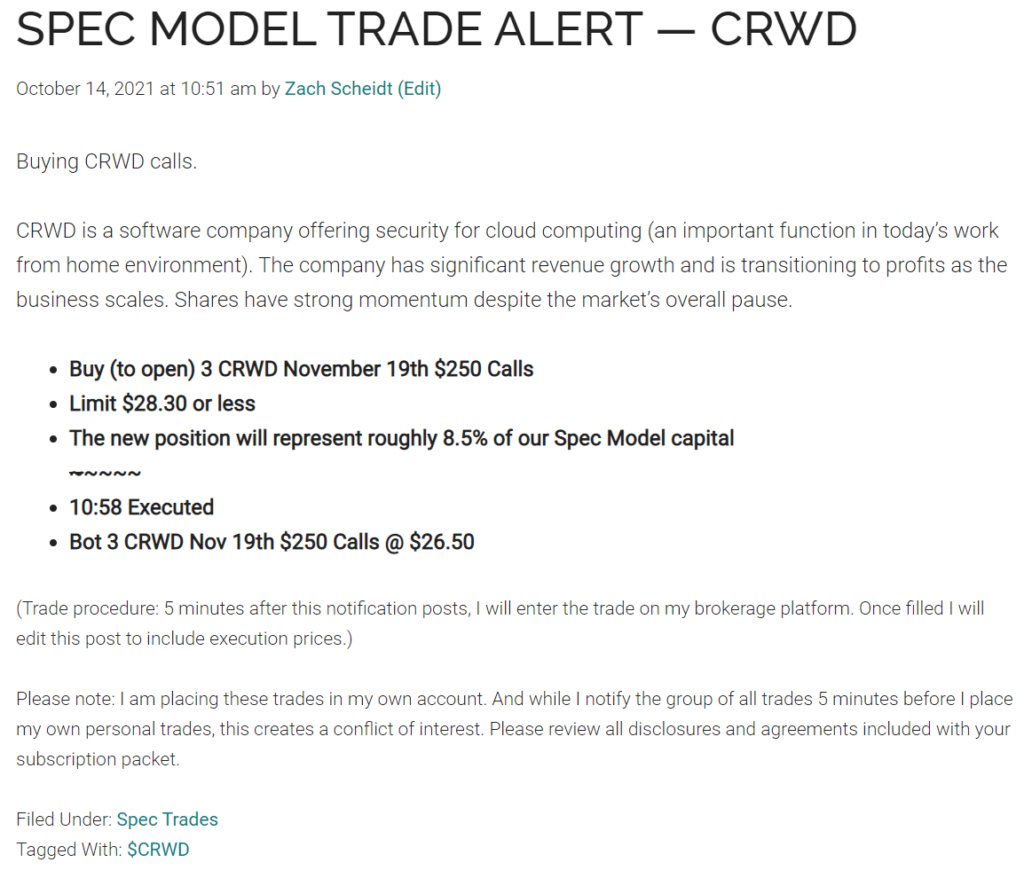

Here’s an example of what a typical trade alert looks like:

Note that the trade alert is sent out before the actual trade is executed for our model portfolio giving ATP members priority on executing their trades first.

Once the trade is executed, the trade alert is edited to report the actual trade execution, and the model portfolio open positions screenshot is also updated.

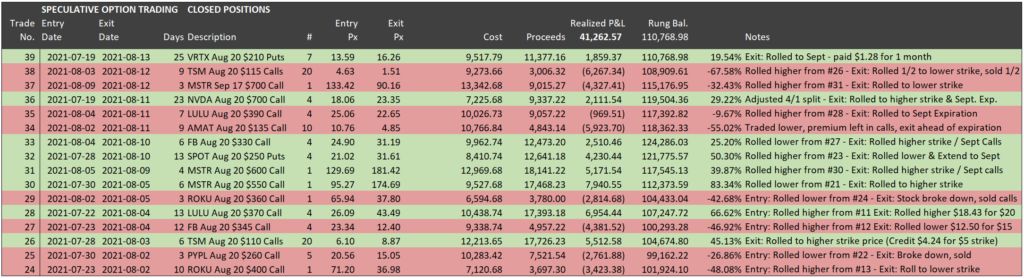

A table of recently closed trades is also included and updated whenever a trade is closed.

Managing Trades as Profits Accumulate

One of the biggest challenges with an active trading approach is knowing when to lock in profits and when to let your winning positions continue to run.

Locking in profits is important because it allows you to reduce your risk and keeps winning trades from giving up gains when shares pull back.

But selling out of long-term trends too early can leave big potential gains untapped. And it’s incredibly frustrating to be on the sidelines when a position you used to own surges higher.

Our ATP Speculative Trading approach has a unique solution to this problem.

We simply roll our position to a higher strike price! (Or for our put positions, we can roll to a lower strike price.)

Here’s how the process works.

Let’s assume you bought the SQ calls from our previous example at $41.55, and the stock moved higher by $30.

Remember, we expect our call contracts to rise by roughly $27 in this scenario giving us a nice profit on our position!

It’s possible to lock in some of our profits while still keeping the position in play. That way we’re still able to profit if shares of SQ continue to move higher. And at the same time, we’ve got less capital at risk and can free up cash to invest in new opportunities that are developing.

The way we typically do this is by making two simultaneous transactions:

- Sell the current (profitable) call contract.

- Buy a NEW call contract with a higher strike price.

Most brokerages offer a “roll” or “spread trading” function that allow you to place both orders at the same time, and designate a “net price” for the two trades.

For instance, we might tell our broker to:

- Sell (to close) the SQ October 15th $230 call contracts

- Buy (to open) the SQ October 15th $260 call contracts

- For a net CREDIT of $27.00

In this scenario, we would be moving our call contracts to a strike price that is $30 higher. And we would be receiving $27 per share from this transaction.

This essentially “resets” the trade so that once again we have a favorable reward-to-risk profile. And at the same time, we’re able to pull cash out of the trade that is no longer at risk if SQ were to pull back.

One way to look at this situation is that we’re “giving up” $30 of intrinsic value by rolling to a higher strike price. And we’re getting paid $27 for that intrinsic value. So while we’re not getting the full price change for the new strike price, we’re setting up a trade that has more favorable reward-to-risk statistics.

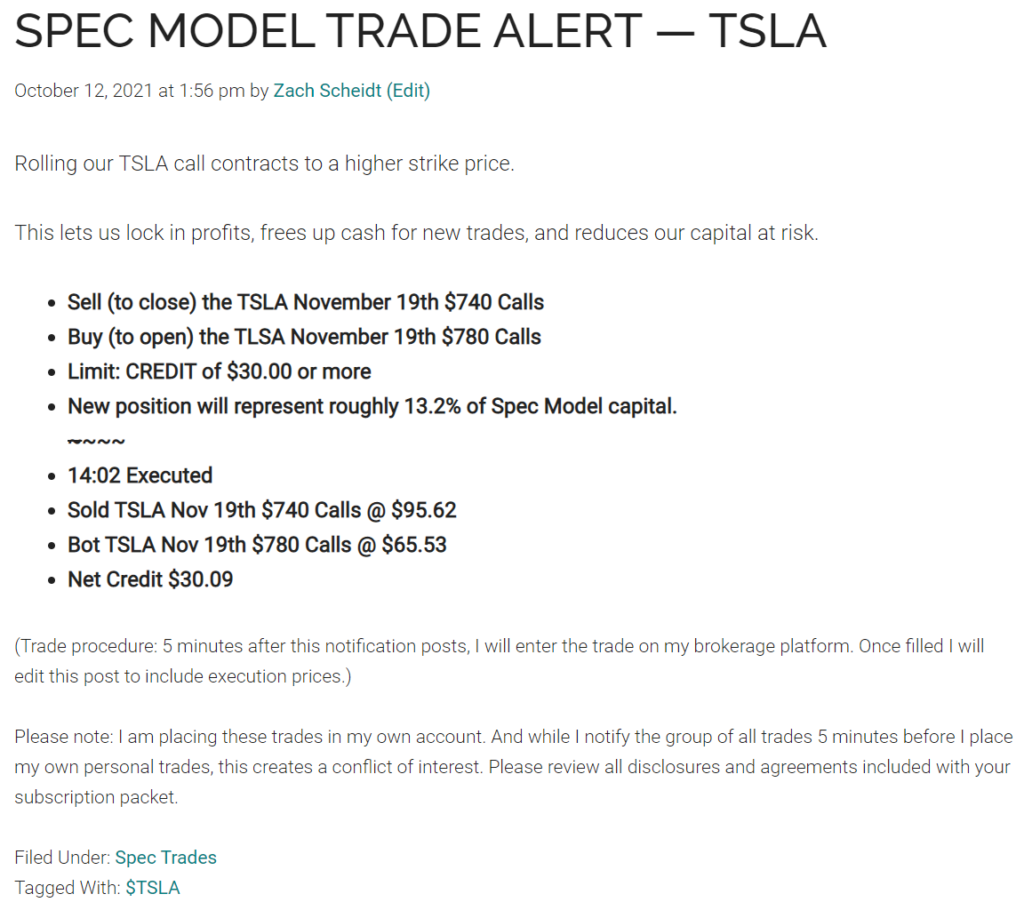

Here’s a historical example of a Speculative Trading Model alert for rolling call contracts to a higher strike price:

While it is possible to place each side of a trade like this individually, I highly recommend using your broker’s “spread trade” or “roll contract” function. This will let you set a specific amount you expect to receive, and will ensure that both trades are executed simultaneously.

That way, you’ll avoid unfortunate situations where you accidentally have two positions on at the same time (which creates more risk). Another risk is selling one side of the position before buying your new contracts (which could leave you without a position as the stock moves in your favor).

A similar process can be taken in reverse for our bearish put positions.

- Sell (to close) your existing put position.

- Buy (to open) a new position with a lower strike price.

- Set a limit price (a net credit) to make sure you get a fair transaction price.

Just like our call positions, this transaction sells your current put contract and buys a new put contract with a lower strike price. The contract you sell will be more expensive than the one you buy, generating extra cash that can be used for new opportunities.

How to “Reset” Trades that Pull Back

Not every trade we enter will work right off the bat. In fact, it’s not unusual to go through a season where only about 50% of individual transactions are profitable.

But just because a stock doesn’t move in the right direction immediately doesn’t mean the trade is a bust. And thanks to the way our option prices are priced, we can actually “reset” trades that initially move against us — or trades that pull back within the context of an overall trend — to give us a bigger shot at future profits.

The best way to do this is by rolling our call contracts to a lower strike price — or by rolling our put contracts to a higher strike price.

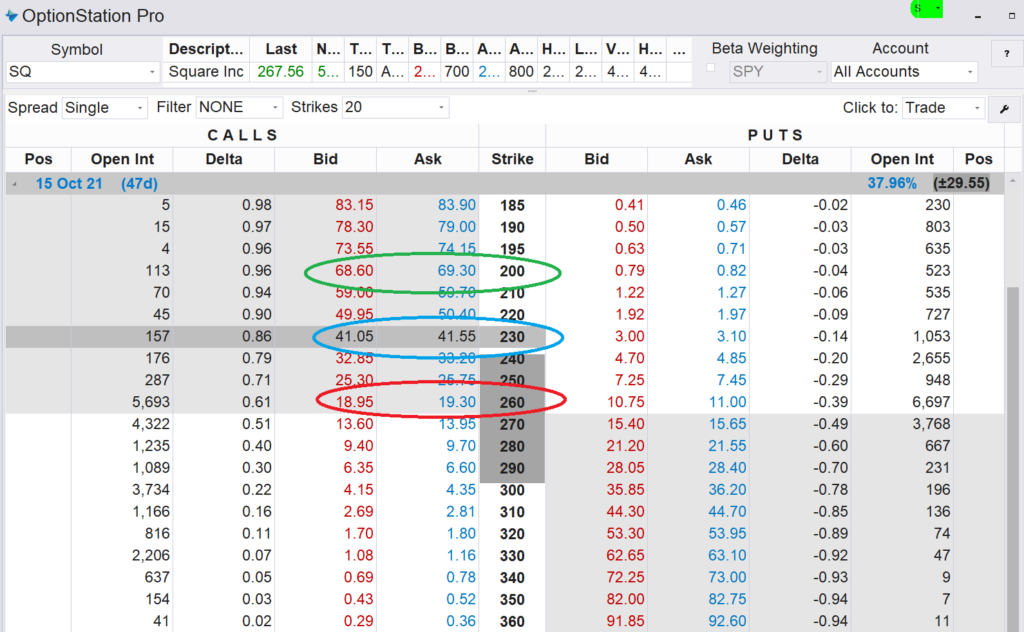

To see how this process works, let’s once again use our SQ call example and assume you bought the SQ $230 calls at $41.55.

Remember, these calls are $37.56 “in-the-money”

If the stock were to move against us and drop by $30 we can expect our call contracts to be worth about $18.95. (That’s where the $260 call contracts are currently trading and those calls are currently $7.56 “in-the-money.”)

In other words, we can expect to lose only about $22.60 from a $30 decline in the stock price.

Assuming SQ still looks like a good play and we still expect the stock to trade higher, we could roll our calls to a lower strike price like the SQ $230 calls.

Once again, we could do this by making two simultaneous transactions:

- Sell the current (unprofitable) call contract.

- Buy a NEW call contract with a lower strike price.

For instance, we might tell our broker to:

- Sell (to close) the SQ October 15th $230 Call contracts

- Buy (to open) the SQ October 15th $200 Call contracts

- For a net DEBIT of $22.60

In this scenario, we would be moving our call contracts to a strike price that is $30 lower, and we would only be paying $22.60 to execute this transaction.

The benefit of this move is that we can reset our position so that we can once again expect to get most of the benefit when the stock moves in our favor, and less of the risk from this new point where the stock is trading.

And while the new option contract we buy will have $30 more in “intrinsic value” — we won’t have to pay nearly that much to roll to the new contract.

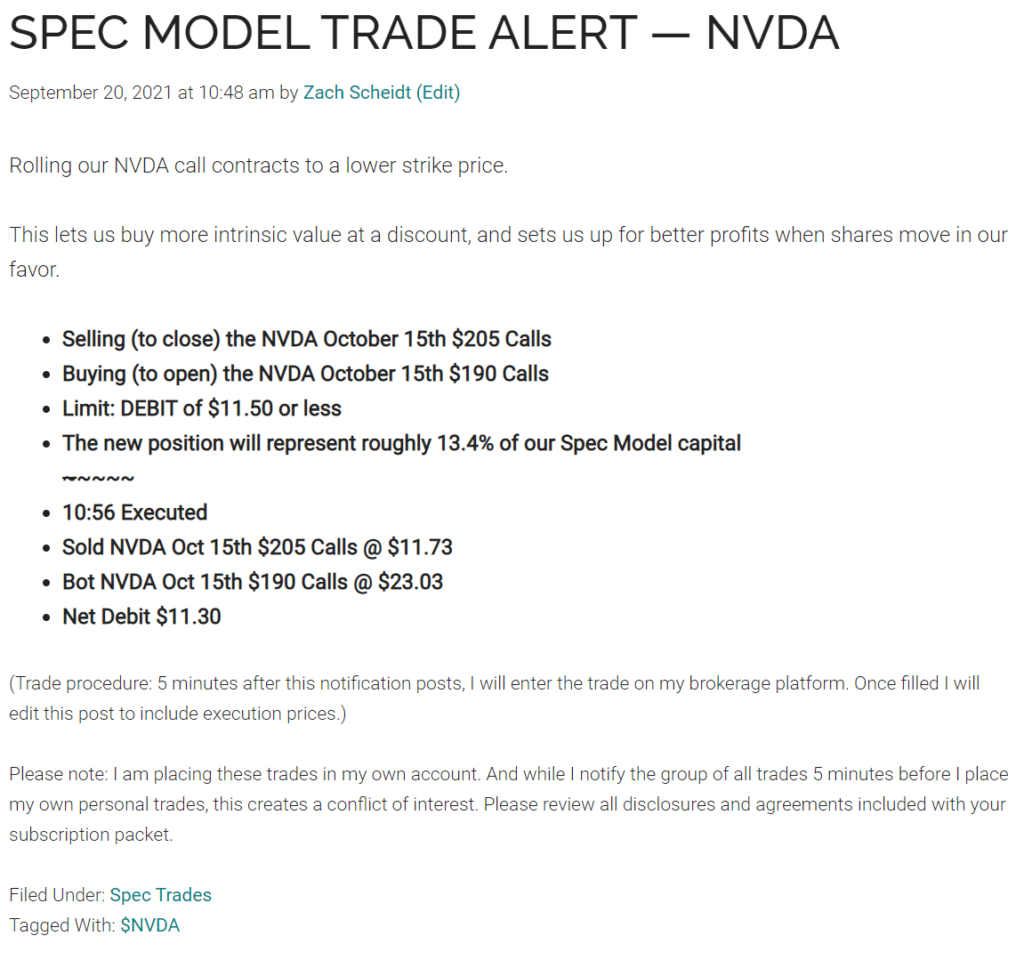

Here’s a historical example of a Speculative Trading Model alert for rolling call contracts to a lower strike price.

Once again, it’s best to use your broker’s “spread trade” or “roll contract” feature to execute both trades simultaneously. This lets you set a limit price for the both trades together and makes sure that you don’t end up with one side of the trade executed and the other side still pending.

A similar process can be taken in reverse for our bearish put positions.

If shares move higher (against our position) you can roll to a higher strike price. This lets you “reset” the trade with a more favorable reward-to-risk scenario if the stock then moves back lower as we expect.

To roll your put contracts to a higher strike price:

- Sell (to close) your existing put contracts.

- Buy (to open) new put contracts with a higher strike price.

- Set a limit price (a net debit) to make sure you get a fair transaction price.

Once we’ve reset our call or put contracts, the position should once again have a more favorable reward-to-risk profile. And that gives us a chance to make larger profits when the stock moves in our favor — while limiting our risk if the stock moves farther against us.

Over time, our Speculative Trading Model uses these statistical advantages to set up aggressive positions designed to accelerate profits while muting losses.

By itself, this trading approach can be volatile, locking in big gains during positive trading periods, but also accumulating material losses whenever we have a series of losing trades.

But when you combine this aggressive trading approach with our consistent income model, the end results can be much more stable!

Let’s take a look at this very different approach to trading. And then we’ll circle back and discuss some ways that you can combine the two trading styles to take advantage of the best features of both strategies.

The Income Trading Model

While our Speculative Trading Model profits from buying option contracts first and then selling them at a higher price, our income strategy takes a different approach.

We start by selling put option contracts to collect an up-front payment.

It may sound backwards to sell something that you don’t actually “own.” But remember, options are contracts — or agreements — between two traders.

So when you sell an option contract, you’re technically just taking the other side of an agreement. And you’ll receive a payment from the buyer of this contract who is essentially purchasing a “right” or an “option” to make a trade with you.

These payments you receive from selling a put option contract (or entering an agreement with another trader) add up over time. This is how our trading strategy generates reliable income.

Selling Put Contracts on Attractive Stocks

There are actively traded put contracts for most popular stocks, and these put contracts trade on an exchange. So it’s just as easy to buy and sell a put contract as it is to trade shares of an individual stock.

For our income trades we’ll primarily be selling out-of-the-money put contracts.

This means we’ll be selling put contracts with a strike price that is below the current market price for a specific stock.

Remember, the buyer of a put contract has the right to SELL 100 shares of stock at a specific price (the strike price) any time between now and when the put contract expires.

So if you’re selling this put contract you’re giving someone else that right.

In other words, you’re getting paid to accept the obligation of buying shares from this trader at the strike price.

But you’ll only be required to do this if the stock drops below that strike price. (After all, why would the trader sell you shares at one price, if he or she could get a higher price from the market?)

Let’s take a look at a real-world example of a put-selling income trade.

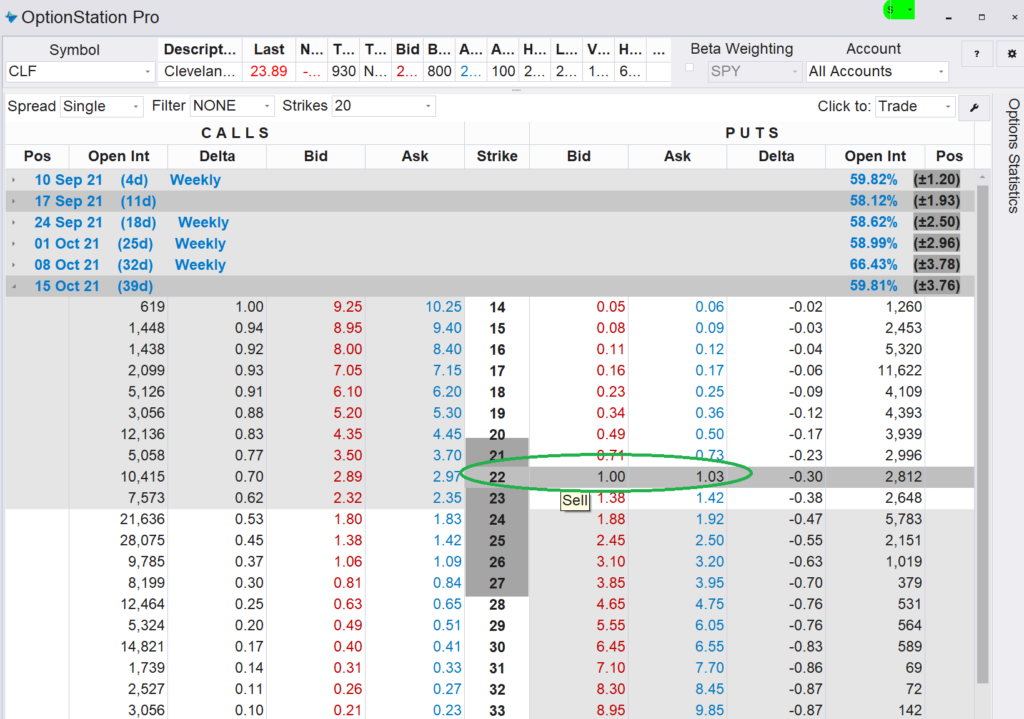

The put contract highlighted is the Cleveland Cliffs (CLF) October 15th $22 put contract. If you buy one of these put contracts, you’ll have the right to sell 100 shares of CLF at $22.

Shares of CLF are trading at $23.89 at the time of this writing. So the put contracts are out-of-the-money since the put strike price ($22) is below the current market price.

If you sell one of these put contracts you’ll be entering an agreement to buy 100 shares of CLF at $22 per share. And you’re getting paid $1.00 per share — or $100 per contract — to enter this agreement.

Your broker will set aside $2,200 of your capital for cash accounts — or $2,200 of your margin buying power for margin accounts — in case you’re required to buy shares of CLF at $22.

That’s it!

By selling this put contract, you could have generated an instant $100 of income in your account. (And keep in mind, this income is in exchange for your agreement to potentially buy shares of stock.)

Now, let’s take a look at what can happen to your position after selling these put contracts.

Three Potential Outcomes…

Once you’ve collected your income from selling a put contract, the position will show up in your brokerage account as a negative number of contracts. The position will carry a negative value that ties to the current market price for your put contract.

This negative position will remain in your account until one of three things happens.

- The put option contract expires.

- The put option contract is exercised.

- You buy (to close) the contract.

Here’s what to expect with each of the three outcomes:

First, if the stock price is above your strike price on the put contract’s expiration date, your put contract will expire and automatically disappear from your account.

Remember, every option contract has an expiration date. So if that date passes without the buyer of the put contract exercising his or her right to sell shares to you, the put contract will no longer be valid.

This is a very good outcome for our income play.

You get to keep the income you received from selling your put contract. And once the put contract expires, you no longer have to keep any capital set aside to potentially buy shares of stock.

From this point, you’re free to find a new income play and start the process all over again!

The second potential outcome is for your put contract to be exercised. This means the owner of the put contract requires you to buy shares of stock at the agreed upon price.

When this happens, your broker will automatically buy shares of stock in your account. You don’t have to do anything for this transaction to occur.

But you will need to decide what to do with your shares of stock.

Typically put contracts are only exercised on the contract’s expiration date. There may be a few exceptions, but this is what happens for the majority of put if you continue to hold them in your account.

Since our income strategy is more focused on generating income from selling put contracts (and not from holding shares of stock), we typically try to avoid situations where our put contracts are exercised.

That brings us to the third possible outcome.

Instead of holding a put contract until it expires (or is exercised), you may choose to buy your put contract back and close out your position.

It’s easy to close out an option position even if you sold it first. Simply use your brokerage platform to buy the same contract that you originally sold.

Make sure you select the “buy to close” option in your trading platform.

Since option contracts trade on an exchange and fluctuate in price, you may wind up buying the contracts back at a higher or lower price from where you originally sold.

Just like any other transaction, your profit will come from buying low and selling high. Or in this case, starting by selling at a high price, and then profiting from buying your option contracts back at a lower price.

If you sold a CLF October 15th $22 put contract from the example above at $1.00 — and then bought that same put contract back at $0.25 — you will book a profit of $0.75 per share — or $75 per contract.

Not bad!

If the underlying stock trades sharply lower, the market price for our put contracts could rise. You may have to buy back your put contract at a higher price.

For the CLF example, if you had to pay $2.00 to buy back your contract, you would lose $1.00 per share (or $100 per contract).

This is why it is important to sell put contracts for shares that we expect to hold their value or trade higher. And while not every income play will be profitable, our goal is to enter trades with a high probability of success so we can continue to accumulate reliable income from this strategy.

Picking Out the Best Income Plays

For our income model to be successful, we need to sell put contracts on stocks that we expect to trade higher — or at the very least remain stable.

After all, we’re getting paid to agree to buy shares at a certain price. So if shares remain above that agreed upon price, we’ll get to keep the income and ultimately won’t be required to buy shares.

When picking out which put contracts to sell, it’s helpful to look at the rate of return we can expect.

Remember, when you sell a put contract, your broker will set aside some of your cash (or some of your margin buying power)

So how do you know if you’re getting enough income to justify the amount of cash that you set aside?

To do this, we’ll look at a few important variables:

- The amount of income you expect to receive.

- The amount of cash you’re required to set aside.

- The amount of time left until expiration.

For our income plays, we start by working with the assumption that the put contracts will eventually expire. This is our best case scenario and we want to measure our profitability if this occurs.

Using the CLF October 15th $22 example from above, we know that we can sell these put contracts for $1.00. We also know that our broker will set aside $2,200 for each contract we sell.

That means our rate of return for this trade (assuming the puts eventually expire) is 4.55%. To get this, we simply divide our $100 in income by the $2,200 in capital we’re committing for each contract.

To get an annualized rate of return, we can then take the 4.55% and divide it by the number of days until expiration — and then multiply that number by 365.

In this example, there are 39 days left until expiration. And crunching the numbers leaves us with a 42.54% annualized rate of return.

This basically tells us that if we were to put identical trades on throughout the year — replacing our put contract each time it expires — we could expect to generate a gain of 42.54% on our capital over the course of a year.

Of course, not all trades will work out perfectly. And there’s no guarantee a new put contract will have the same metrics.

But this measurement does help us to evaluate each new income play we include in our model.

Included in your subscription tools is a spreadsheet table to help you easily come up with these measurements.

In the example below, you can fill the data in for the blue cells and get the results for any specific trade in the green cells.

The example below shows the rate of return and the amount of capital needed to sell three CLF put contracts like the ones we’ve been discussing in our example.