Forget the “most popular” toy this Christmas… Supply chain bottlenecks have us wondering if there will be a Christmas at all this year!

Of course, the holiday season is about much more than just gifts. That’s an important concept I try to make sure my kids understand each year.

Still, it’s fun to give gifts to loved ones. And I truly believe in the old concept “it is more blessed to give than to receive.”

But I’m not sure how those gifts will wind up under our tree if they’re stuck on a ship waiting to offload at the Port of Los Angeles.

I’m sure you’ve seen the satellite pictures of the dozens of cargo ships sitting off the coast of California. The number of ships in the queue has been as high as 73.

Meanwhile, the port is struggling to find truck drivers and trailer chassis to haul containers away once they’re unloaded from the ships.

Now that the holidays are just weeks away, retailers are scrambling to figure out how they’ll fill their shelves in time for the shopping rush!

Top Retailers Take Supply Chain Matters Head On

The current environment is a true test of the reliability of each retailer’s supply chain.

Some retailers will pass the test with flying colors. And others won’t have inventory and will miss out on the most important shopping season of the year. That’s how capitalism works!

Keep in mind, many retailers operate at a loss throughout the year, and make their profits between Thanksgiving and Christmas. So if supply chain challenges won’t allow them to get merchandise on the shelves, they may go a full year without making money.

(And this, after 2020 — a holiday season challenged by the coronavirus crisis.)

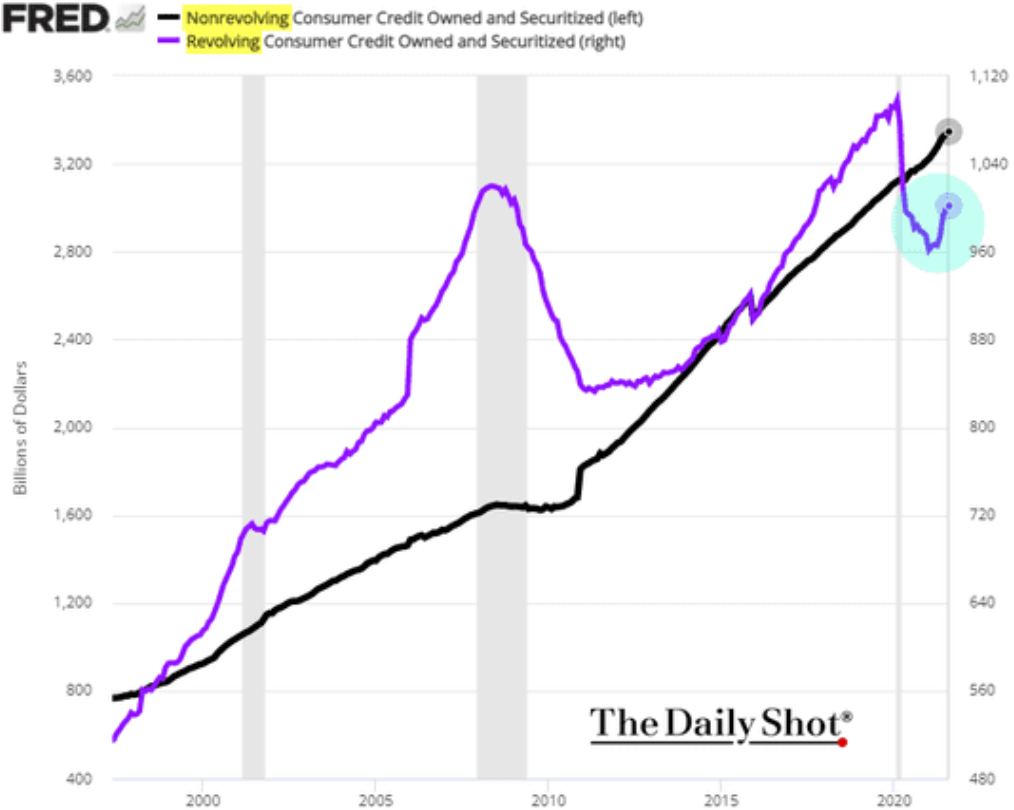

The good news is that consumers have cash and credit available to spend. Household wealth has been tracking higher thanks to stimulus payments, rising home prices, and a strong stock market.

And U.S. credit card balances have also pulled back, leaving plenty of room for consumers to spend!

This week, Levi Strauss & Co. (LEVI) planted its flag in the “winners camp,” reporting earnings that beat investor expectations and raising guidance for the fourth quarter

As I wrote in The Rich Retirement Letter on Thursday, LEVI has a very diversified supply chain, sourcing its merchandise from 24 different countries.

The company has also locked in shipping costs through mid-2022. This helps LEVI avoid paying sky-high transportation costs which are pressuring other retailers’ profits.

Other retailers have resorted to chartering their own ships so they can have more say in where the ships will dock and how soon they can receive the merchandise.

Obviously not every retailer can afford to charter entire container ships. So in today’s market, the retailers with the best contacts and resources are the ones who will fare best!

A Retail Winner For Holiday Investing

One holiday retail play I’m watching is Target Corp. (TGT).

Target is one of the companies mentioned as chartering their own ships to keep their supply chain intact. And the company is a favorite of middle class families across the country.

Shares have pulled back as investors worry about the supply chain constraints.

But if Target is able to charter its own ships and get products on the shelves for Christmas, those fears may turn out to be unfounded.

Meanwhile, shares are trading for just 18 times this year’s expected earnings.

The stock recently pulled back to its 200-day average (blue line). This line often acts as a support, as institutional investors step in to buy near this level.

As a quality retailer with the financial base to protect its supply chain, TGT looks like a good bet for the next several months. A rally back towards its previous highs could hand you a quick 15% profit!

Just because U.S. supply chains are gummed up doesn’t mean all retailers will fail this holiday season. But it’s important to be selective about which companies you invest in.

Here’s to growing and protecting your wealth!