[Editor’s Note: This is part III of our series on investment income plays selling put contracts. In Part I I explained put contracts and how to sell them for income. And in Part II, I explained how to find the best income plays.

Today, we’ll discuss how much income you can expect to generate using this strategy in your own account.]

So how much income can you REALLY make with this strategy?

Last week I found myself explaining our put-selling income process to Jeff. He’s a new colleague of mine and I was helping him get up to speed on how this strategy works.

After a while, I saw his eyes light up. I love this moment when talking about our put-selling process. There’s always that “aha” expression when it clicks and someone understands how the process works.

Jeff stopped me mid-sentence with an excited look in his eye.

“So how much money can you really make?? Like if I did this one strategy for a full year?”

Of course I explained to Jeff that there are no guarantees… that all investments involve risk… that different seasons in the market can offer different returns (and potential losses).

These are important considerations to cover any time you make an investment. And its especially important to set realistic expectations any time you start thinking about how much income you can make.

So today, I wanted us to take a look at how this strategy could play out in a real portfolio — and help to set some realistic expectations on how much income you can make.

How Much Income Depends…

The amount of income you can make from this strategy really depends on a lot of factors.

Some of these are under your control:

- You can pick more volatile stocks to get more income…

- But selling puts on these stocks also increases your risk.

- You might be a great stock picker with a higher win rate…

- Or you might pick stocks that are more likely to trade lower.

- You could use leverage (borrowed funds) to enter more trades…

- This approach increases both your income AND your risk…

And there are variables out of your control that also affect how much income you can make:

- Sometimes stock prices and the entire market can swing wildly…

- These periods, give you more income from every put contract…

- But there’s also more risk your position will trade lower.

- Interest rates can adjust higher or drop lower…

- These rates affect how much you get from selling puts.

- Unexpected events like fraud, acts of god, and sabotage can hurt your returns.

So it’s clear that I can’t give you a definitive rate of return you can expect from selling puts to collect income. But we can look at some statistics that can help shed some light on how much income you can make.

Rate of Return versus Batting Average

There are two very important factors that affect how much income you can make from our put-selling strategy:

- The potential rate of return for each income trade.

- And your batting average (or win rate) over time.

In our last installment, I showed you one of the tables that I use to calculate the annualized rate of return for each income play I’m considering.

This table gives us the annualized rate of return we can expect if the put contract expires and we are not required to buy shares of stock.

The example I showed included a put contract that carried a potential 44.87% annualized rate of return. And in our current market environment I typically look for trades with annualized rates in the 35% to 55% range.

Yes, that sounds like a very high rate of return for a strategy that is generally very safe. But that’s where the other important factor comes into play.

Not every put contract that we sell will expire. In fact, sometimes the stock we’re selling a put against will trade lower. You must then decide whether to buy the put contract back or let it be exercised.

If the put contract is exercised, that means we’ll be required to buy shares of stock at the agreed upon price.

And if we buy back the put contract, we may have to pay more to close the trade than we received when we initially set up the income play.

Your win rate — or the percentage of plays that expire or are closed out for a profit — can be anywhere from 50% or below, to a win rate above 90%. It depends on which put contracts you sell and how quickly you close a trade out if it starts to move against you.

Active Management to Enhance Your Income

If you decide to use this strategy to generate your own investment income, consider “paper trading” (or simulating trades on paper) to start with.

This will give you a better feeling for how likely different plays are to be winners. You’ll also see how often you will need to close out trades early to cut potential losses (or how often you wind up being required to buy shares of stock).

One way to enhance your overall returns from our put-selling strategy is to close out positions that have already captured most of the potential profit from the income play.

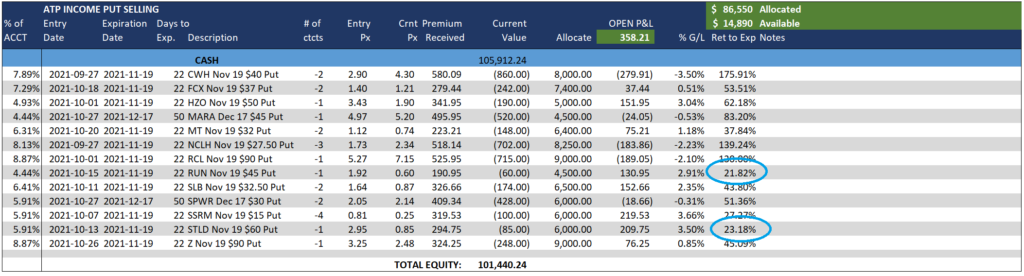

For example, take a look at table of some income plays from a model account I have been analyzing.

The column on the far right shows the annualized return remaining for each position. I’ve circled two specific plays that have a very low rate of potential rate of return compared to the others.

Both of these positions were set up with much higher rates of return. But the stock moved higher, helping the trades to become profitable very quickly. At the time this screenshot was taken, there wasn’t much potential profit left for either of these positions.

Paying to buy these put contracts and close the position early frees up capital for new plays.

You can then use the capital for new income plays with a higher rate of return. So if you carefully manage your income plays and continually rotate into new plays with higher annualized rates of return, you can increase how much income you can make from this strategy.

More Income Using Leverage

Some traders also accelerate their returns by using margin. Here’s how it works…

When you sell a put contract, your broker sets cash aside. This cash is in case you are required to buy shares of stock. The cash sits in your brokerage account. But your broker uses the cash as collateral for your put agreement.

For margin accounts, brokers are willing to loan you more cash to use for selling additional put contracts. So if you had $50,000 in your account, you may be able to sell put contracts that cover $100,000 or more of stock you’re agreeing to buy.

Please realize that you’re still on the hook for ALL potential losses from these contracts. And your broker may also charge you interest for the margin loan.

Generating extra income from a margin loan can still make sense if you understand the risks and you’re willing to be more aggressive with your income plays. In fact, since our income strategy carries less risk than traditional buy and hold investments (more on that in the next installment) it can be the perfect strategy for using this type of financial leverage.

Just please make sure you understand both the potential rewards — and the potential risks — before using this more aggressive approach.

During healthy market periods, this strategy can generate reliable annualized returns well above 20%. And by enhancing your returns with active management and/or margin loans your returns may be significantly higher.

But even with this reliable income, I believe the true value of this approach lies in how well it can withstand a more challenging market period.

We’ll cover that in the next installment. So stay tuned!